Patrice Motsepe’s TymeBank has attracted foreign investment of more than R1.6 billion from investors in the UK and Philippines.

The digital bank said the new investors are UK-based Apis Growth Fund II, a private equity fund managed by Apis Partners, and the JG Summit, which is one of the largest and renowned conglomerates in the Philippines and owned by the Gokongwei family.

The company said both these investors are experienced in financial services in emerging markets.

African Rainbow Capital (ARC) has made an additional investment to ensure it maintains its position as anchor shareholder in Tyme. Following the completion of the transaction, ARC will hold a c.59% interest in Tyme. Both Apis and JG Summit will become minority shareholders in Tyme, with Apis having a 14.9% shareholding and JG Summit having a 5.13%.

The bank said the investment, which it described as one of the largest foreign investments any FinTech company has secured in South Africa, will be deployed to bolster Tyme’s growth and secure its path to commercial success.

In addition, it will be used to fund Tyme’s offshore expansion opportunities.

The proceeds will also finance the Philippine venture, Coen Jonker, co-founder and executive chairman of Tyme, told Reuters.

Tyme is now looking to replicate part of that strategy in the Philippines, where it can piggyback on JG Summit’s retail reach in shopping malls, grocery and pharmacy stores. JG Summit’s other interests include food manufacturing, real estate and hotels.

“We believe that the future of digital banking in emerging markets is multi-country, to actually build a banking group where there is enough critical mass of customers,” Jonker said in an interview on Monday.

“For us, Philippines represents the best fit in terms of our business and operating model to expand, and JG Summit the best partner in terms of the retail capacity that they have and their loyalty programmes.”

The bank said the investment represents a strong endorsement for both TymeBank as one of the world’s fastest-growing digital banks and for South Africa’s banking sector overall.

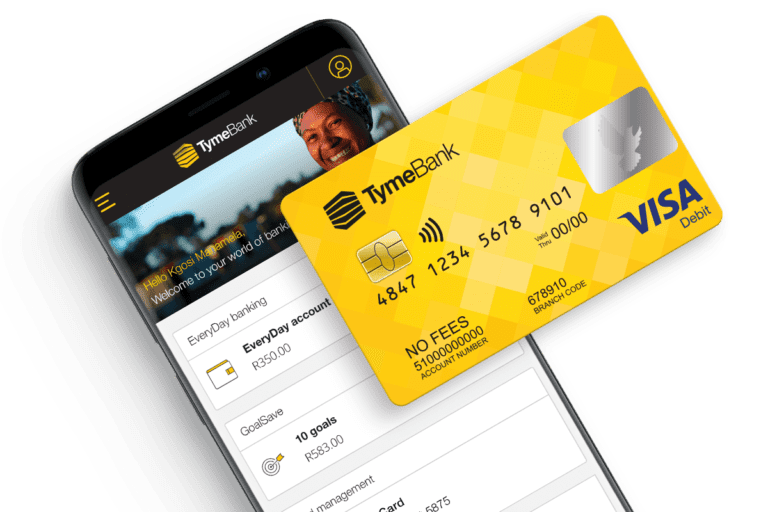

Like all banks in South Africa, TymeBank is regulated by the Prudential Authority of the SA Reserve Bank. TymeBank is the first bank in South Africa to be operated fully off a cloud-based infrastructure network. It was also the first bank to be granted a commercial banking license since 1999.

TymeBank said it continues to onboard an average of 110,000 new customers per month. Having launched formally in February 2019, the bank will reach the 3 million customer milestone in March 2021.

Some aspects of the transaction remain subject to regulatory approvals.