South Africa could avoid possible greylisting if it implemented recommendations in the Financial Action Task Force (FATF) mutual evaluation report.

The FATF commenced its assessment in 2019 and published its final report on 7 October last year.

The mutual evaluation report had an adverse rating under technical compliance and effectiveness. It made several recommendations.

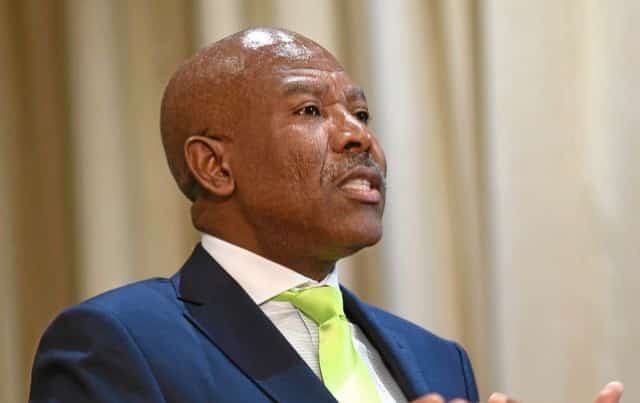

Addressing Parliament’s Standing Parliament on Finance, South African Reserve Bank (SARB) Governor, Lesetja Kganyago, said the report recommends that all regulatory authorities should subject beneficial owners to fit and proper assessments. Beyond this, all regulatory authorities should verify that directors, senior management and beneficial owners or their associates are not criminals.

However, Kganyago said, the process to avoid greylisting is more than what the Prudential Authourity (PA) is doing, and that it involves law enforcement and prosecuting authorities, among others.

“We have a programme that we initiated in October 2020. We’ve dedicated work streams and we are confident that based on all of this analysis, we will be able to comply,” he said.

The structure regulated by the PA consists of 31 registered banks and local branches of foreign banks, four mutual banks, five cooperative banks, 24 cooperative financial institutions, 69 life insuraers, 70 non-life insurers, eight reinsurers and nine market infrastructures.

Kganyago said: “… Providers of domestic money or value transfers services should be subject to licensing or registration… All supervisors should improve their understanding of money laundering and terrorist financing risks in particular, that is inherent and residual risks for both sectors and the individual institutions.

“… The report recommends that all regulatory authorities ‘do better in prioritising and scoping on site supervision based on money laundering or terrorist financing risks, which could be informed by offsite monitoring and findings from previous inspections’,”.

According to reports, South Africa scored moderate to low levels of effectiveness in the 10 requirement areas and low compliance levels in the 40 areas of technical compliance (such as wire transfers, reporting of suspicious transactions and transparency, and the beneficial ownership of legal persons). Thus, there are deficiencies which require South Africa to undergo an enhanced follow-up process.

Should South Africa not be able to meet the FATF recommendations by April 2023, it will be added to the FATF grey list, the Governor said.

The FATF called on the PA to ensure that higher risk financial institutions are inspected with more frequency.

Financial supervisors were called upon to supervise financial groups for money laundering and terrorist financing risks on a consolidated basis, not just the individual institutions.

This, said the Governor, would include the said organisation’s international operations and coordinate their supervision of financial institutions in different sectors which belong to the same group.

“… Providers should use a full suite of enforcement measures, including monetary penalties. Lastly, more specific sector guidance should be provided to help the private sector identify and understand money laundering and terrorist financing risks.”

Kganyago said he was confident that in the areas the PA is responsible for, it would be able to demonstrate significant progress and compliance by the end of this year.

Despite this, the report noted several positives in the country’s financial sector.

These include:

– The financial system has thus far weathered the shock of COVID-19, and that the banks and insurers appear well capitalised and have ample liquidity.

– The financial sector oversight is strong, reflecting a commitment to independent supervision and the implementation of international standards.

To improve impairments, the FATF recommended that the country strengthen its vulnerabilities analysis.

This, the report said, should include better strengthening of analytical tools in the financial sector, including risk based supervision, early intervention in banks and improved climate oversight, among other recommendations.

Kganyago said these assessments reiterate observations made by the SARB. – SAnews.gov.za