The rapidly growing number of subscribers to Liberty’s Stash tax-free investment app is showing the difference in investment outlooks by different age groups and living circumstances in South Africa.

Broadly, the app shows that younger investors are more tech-savvy and look online for investment options that provide them with flexibility, while older Stash investors over 40 are more focused on long-term savings goals.

The app is also generating a considerable amount of interest in investing among people who don’t live in major cities but in semi-urban and rural areas.

Liberty said Stash has a 111,000 active TFI accounts and over 189,000 downloads.

“Many users of Stash are from these areas, making up about 25% of stashers, and this shows a desire for more access to formal investment products in the outlying areas,” says Liberty’s Stash app lead, Glenn Grimley.

He says this is a key insight that shows that irrespective of location, app-based services powered by mobile devices are becoming a pathway even for non-city people who are looking for ways to invest.

“An app like Stash meets you in your reality, this means it can offer a number of different paths for investors at different life stages,” he says.

“Our user research shows people between the ages of 25 to 35 are more willing to engage in savings with an app. They look for financial products online, they are comfortable with what they find and are willing to use it straight away.”

It is not surprising then that users belonging to this age group make up the largest group of Stashers. This key demographic amounts to about 45% of the app’s users.

“Generally younger users put aside less money per month than older users, most likely because they earn less. But the fact that they are putting some money aside regardless is encouraging. They also tend to use Stash to create emergency savings. An example of this was when the first COVID lockdown came around, the number of Stash users jumped considerably.”

In just over a year, from April 2020 when lockdown started, the number of users from our base went up by 139%. This may have been because of an increase in awareness of the importance of saving to help assist in the time of a crisis, adds Grimley.

Interestingly, the number of Stash users over the age of 40 drops off slightly, but they invest significantly more than their younger contemporaries. This group forms about 21% of the app’s users, but 42% of the total investments in Stash.

“What many people over 40 want is a cost-effective place to put their annual tax-free savings allowance and Stash is a simple way to put your money into different investment portfolios.”

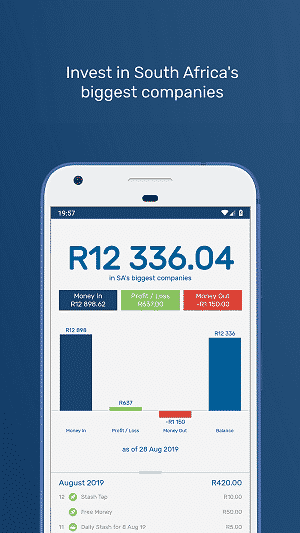

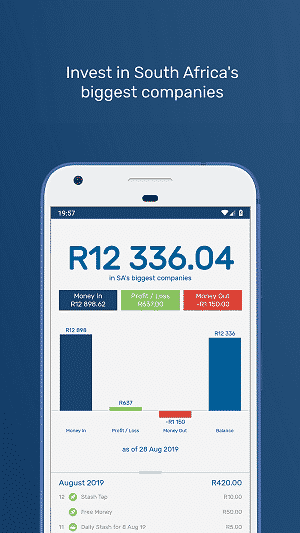

Stash has two investment portfolios: a low-risk Cash + portfolio, which offers a guaranteed 3.5% growth per year; and the SA Top40 Shares portfolio, which is an equity portfolio that tracks the performance of the FTSE/JSE Top 40 shares index, including dividends. . Since the launch of the Cash+ portfolio last year, about two-thirds of all new investments are made into that portfolio, which correlates with the need to create emergency savings post lockdown.

People are also looking more actively for opportunities to save and invest. Across all age groups, post lockdown, Stash has seen a 600% increase in the use of the Stash Tap button, and this really is part of Stash’s broader message of making use of discretionary savings opportunities, like instantly putting R20 into your account instead of spending it on a morning cappuccino.

“In short, the reason for the growing popularity of Stash is that it enables people to start an investment journey without all the paperwork and bureaucracy this usually entails. Customers have full control over how much and when they invest as the account can be accessed anytime on their phone via the app,” says Grimley.