Two weeks ago, Telkom revealed its plan to sell its masts and towers business, Swiftnet. The giant telco said it has entered an exclusivity period with a preferred bidder, a consortium led by a reputable private equity firm with black economic empowerment backing.

Simultaneously, African Rainbow Capital (ARC) – empowerment investment company – announced plans to raise R750 million through a rights offer. The purpose of the rights offer is to raise additional capital for ARC Investment to invest in ARC Fund. This private equity fund focuses on market expansions for Rain and the growth of digital bank Tyme.

Rain is a data-only network provider.

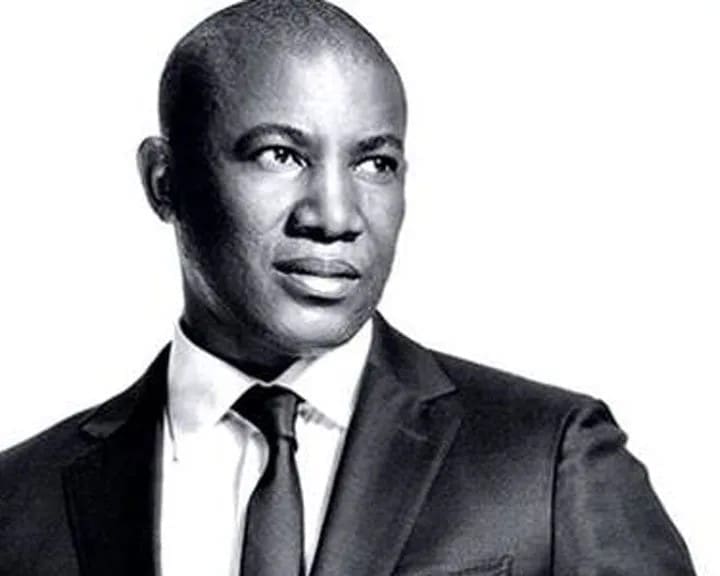

JSE-listed ARC Investments is incorporated in Mauritius and is 51.1% owned by billionaire businessman Motsepe’s ARC, which is 100% owned by Ubuntu-Botho Investments.

Notably, ARC Investments has secured commitments from shareholders representing 60.5% of issued ordinary shares to subscribe for the rights offer.

All these goings-on’s suggest that ARC Investments is the unnamed “preferred bidder” in talks with Telkom to acquire its masts and towers business.

I am convinced that the rights offer is aimed at raising money to buy Swiftnet from the partial state-owned company.

Given ARC’s reputable status and black ownership, it is anticipated that, with funds from the rights issue, Rain could capitalise on the opportunity to acquire Telkom’s masts and tower assets housed under Swiftnet.

Such a move would enhance Rain’s data strategy and help overcome last year’s setback of the failed share swap deal with Telkom.

Telkom’s Swiftnet holds significant assets with 4008 total productive towers. Telkom disclosed on Tuesday that its proactive site acquisition and permitting initiatives resulted in a total of 456 approved building plans that are ready for construction when triggered by customer commitment.

The primary focus remains on rolling out in-building solutions (IBS), traditional towers, the 5G outdoor Distributed Antennae System (oDAS), and the small cells pipeline, Telkom said.

If Rain acquires these assets, it could expedite network expansion, solidify its position as the largest data-only network, and diversify revenue streams, including entry into the energy space.

Swiftnet continues to pursue various value-added services, mainly Power-as-a-Service (PaaS).

In June 2023, Telkom CEO Serame Taukobong, said PaaS would help curb the impact of loadshedding in its operations.

Telkom also offers PaaS solutions as a value-added commercial offering – making alternative power available to customers struggling with power outages.

On Tuesday, Telkom disclosed that the planned PaaS first phase of the rollout would commence once commercial terms and sites were finalised with customers.

Rain could also use Swiftnet to diversify its revenue to the energy sector through PaaS.

The Swifnet deal could also change the dynamics of the telecoms industry in a similar way the proposed partnership by Johan Rupert’s Remgro’s Community Investment Ventures Holdings (CIVH) may transform the provision of data in the country.

Vodacom has offered R4.2 billion in network assets and R6 billion in cash to acquire 40% of Maziv’s shares, which hold CIVH’s interests in Vumatel and DFA. The Competition Commission South Africa recommended prohibiting the transaction in August 2023, but it awaits a final decision from the Competition Tribunal.

The proposed deal will enable both Remgro and Vodacom to pursue their data strategy.

In line with its ambitions, Rain could also proceed with its bigger data strategy in SA through the acquisition of Swiftnet.

However, potential political sensitivities may emerge, given South Africa’s upcoming elections and the involvement of President Cyril Ramaphosa’s brother-in-law, Motsepe, in the possible Rain-Swiftnet deal.

That said, I hope politicians remember that Rain, which is 20% owned by ARC, attempted last year to do a merger deal with Telkom.

Politicians should also understand that “masts and towers” are no longer strategic entities to telcos that are diversifying their revenues to financial services, Internet of Things, data centres, etc.

The telecommunications landscape has witnessed similar transactions, such as MTN South Africa’s tower infrastructure deal with IHS Towers in 2021. The passive tower infrastructure transaction with IHS Towers entailed the sale and leaseback of 5 709 of towers – comprising 4 000 greenfield and 1 700 rooftop sites.

The deal also included the outsourcing of PaaS, a strategic asset to a masts and towers business.

If the ARC Investment deal with Telkom works out, it could signify a strategic move for Rain and ARC against major masts and towers companies, IHS and American Tower.

The deal can allow Rain to proceed with its ambitious rollout and marketing strategy to cover more towns across the country and to continue densifying coverage in all major metros.

Rain could end up being a strategic player in SA.

If my assumptions are accurate, executives from Rain and Telkom are most likely already engaged in discussions with deal advisors as they diligently analyse the financial details.

What is certain is that Telkom is aiming to divest non-core assets such as Swiftnet, while Rain is eager to rapidly broaden its revenue streams and reinforce its data strategy.