TymeBank and JSE-listed retailer TFG have established a co-branded TymeBank TFG Money account debit card, which has attracted 180 000 customers. This follows a partnership that was established in October 2021.

The partnership has enabled the creation of more than 600 TymeBank TFG Money branded kiosks located in TFG stores across the country, enabling customers to have direct and convenient access to transactional banking and through the TymeBank TFG Money bank account.

Customers can open a TymeBank TFG Money bank account at a kiosk in select TFG stores.

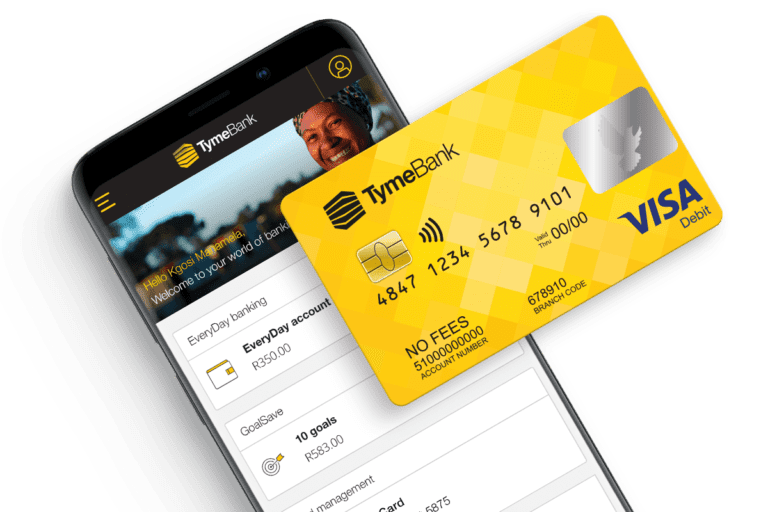

It takes less than 5 minutes. No paperwork. No monthly fees. Customers will get a TymeBank TFG Money debit card.

The kiosk, together with the TymeBank app and other digital interfaces, gives TFG customers access to financial services such as electricity payments, money transfer and savings products, thereby allowing customers to shop and transact at the same time.

With a TymeBank TFG Money bank account you get your monthly salary a day early (T&Cs apply), no monthly fees and competitively low transaction fees. Customers are also able to access the GoalSave savings product, which offers an interest rate of up to 10% p.a.

TFG customers benefit from TymeBank’s ‘Buy Now Pay Later’ product MoreTyme™, which is interest-free with no fees over a three-month period with 3 equal instalments.

The TymeBank TFG Money debit card is linked to two of South Africa’s leading rewards programmes; customers benefit from TFG Rewards and Pick n Pay Smart Shopper when they shop at any one of the 20+ TFG brands, in-store or online, and double Pick n Pay Smart Shopper Points when shopping at Pick n Pay.

“TFG is renowned for its retail strength and strong customer focus, and this partnership is a unique example of two leading brands coming together to offer a truly innovative and customer-centric way of banking – a ‘new front door’ to banking,” said TymeBank CEO Coen Jonker.

“As TymeBank we’re excited about how this partnership is further expanding our reach and diversifying the current TymeBank customer profile. With the potential to expose over 30 million TFG loyalty programme (TFG Rewards) members to the TymeBank brand, we believe this partnership accelerates our mission to bring accessible, affordable banking to all South Africans.”

TymeBank’s model of strong, strategic partnerships with large-scale retail ecosystems has shown impressive outcomes since launching in 2019. The bank has acquired 6.1 million customers in under four years. Indicators show customers are embracing TymeBank’s unique offering, with an average 23 million transactions per month, a 70% 30-day account activity rate, and an average acquisition of 188,000 customers per month.

“Establishing a long-term partnership with TymeBank and being able to offer their products and services to our customer base under the TFG Money umbrella, is perfectly aligned with our goal of driving financial inclusion,” Scott Brown, MD of Value-Added Services at TFG said.

“The cobranded product suite is complementary to the TFG Money Account and opens the door for new customer segments to engage with and benefit from financial services solutions enabled by TFG.

“There is a great fit between our brands, our goals, and the way we work, and this has allowed us to be fast-to-market with our first set of cobranded products.

“We’re looking forward to working alongside TymeBank to further establish TFG Money as a “go to brand” for South Africans who want to benefit from a new style of banking.”