Payment and merchant solutions provider, Dashpay, has partnered with South Africa’s biggest financial marketplace, Fincheck, to offer an array of on-demand personal finance facilities via hundreds of thousands of Newland point of sale smart terminals, in stores across South Africa.

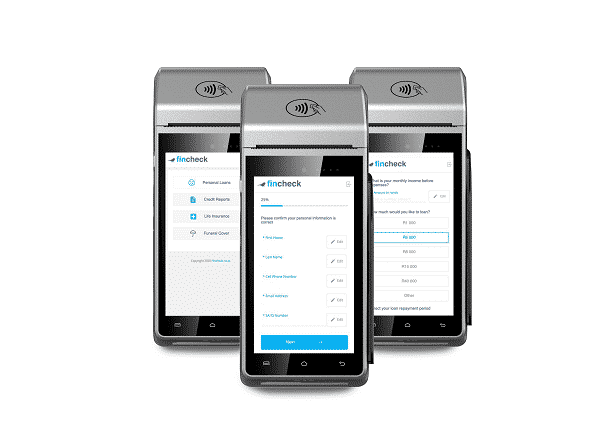

Dashpay’s Newland devices operate on the Android platform, which means that they are able to run a variety of applications, alongside the processing of traditional credit card purchases. The Fincheck app, which merchants can register for and download directly to the terminal, offers customers the opportunity to compare and apply for personal finance via the in-store terminal.

Fincheck compares offers from over 80 of South Africa’s major banks, lenders and insurers, allowing consumers to choose their best and cheapest form of finance – perfect for helping cover unexpected expenses or helping make ends meet, responsibly. The comparison is free and easy to use.

Future offerings will include the ability to access a free credit report, which will help South Africans understand their financial position and make better financial decisions. This feature will present the individual’s credit report to them in an easy to understand manner, showing clear action steps on how to improve their credit score and financial health.

“We are excited to work with Dashpay on this initiative,” comments Michael Bowren, a director of Fincheck. “The Fincheck vision is to allow all South Africans to compare various banks, lenders and insurers across the country, for free. This collaboration between Fincheck and Dashpay is an innovative solution, and one which has the goal of assisting South Africans make a better financial decision.”

Benefits for customers and merchants

The innovation offers mutual benefit for both customers and Dashpay merchants. Customers can quickly compare quotes from all major South African banks and lenders, which includes short- and long-term loans ranging from R1,000 to R350,000.

Merchants can potentially increase their average basket size by offering customers the chance to responsibly compare additional finance options for purchases. Once the customer has made the application to Fincheck, the communication happens directly between the financial product provider and the applicant. This is to enable a simple and streamlined application process for the customer, and preventing the administrative burden for the merchant.

“A seamless partnership like the one with Fincheck will assist consumers in managing their finances quickly and easily,” says Dashpay’s Benjamin Powell. “Whether it’s an emergency vet bill for a sick pet, additional finance to help purchase necessities, unexpected medical expenses, or other expenses which life presents from time to time – this integrated solution will make it both simpler and safer to access long- and short-term finance from a reputable financial services institution, via Fincheck”.

Dashpay, a division of Capital Appreciation, a JSE-listed company, is a supplier of Newland Payments devices within South Africa and the SADC regions. Newland Payments is the second largest point-of-sale (POS) manufacturer worldwide, offering a wide array of POS, mPOS and intelligent multimedia systems.