Digital payments company Ozow, has launched the Ozow Revolution. According to the company, the Ozow Revolution is a visionary effort to make digital payments available to everyone and create greater opportunity to participate in the digital economy – especially for historically excluded communities that rely on costly and unsecure cash payments.

Thomas Pays, CEO and co-founder of Ozow, says far too many consumers and businesses have been excluded from the benefits of the digital economy.

“As an impact-driven and market-led company, Ozow is at the forefront of developing breakthrough payments products that enable greater financial and digital inclusion. While more than 80% of South Africans hold a bank account, only one out of every eight have a credit card. This locks the vast majority of consumers out of digital payments and excludes them from a huge range of services,” he says.

“By simplifying payments for consumers and merchants alike and supporting them with helpful innovations such as zero-rated data costs, we can enable greater participation in the digital economy for all consumers and businesses.”

As the first step of its Ozow Revolution, the company has introduced two new online payments solutions to its platform for the South African market, Ozapp and Ozow PIN.

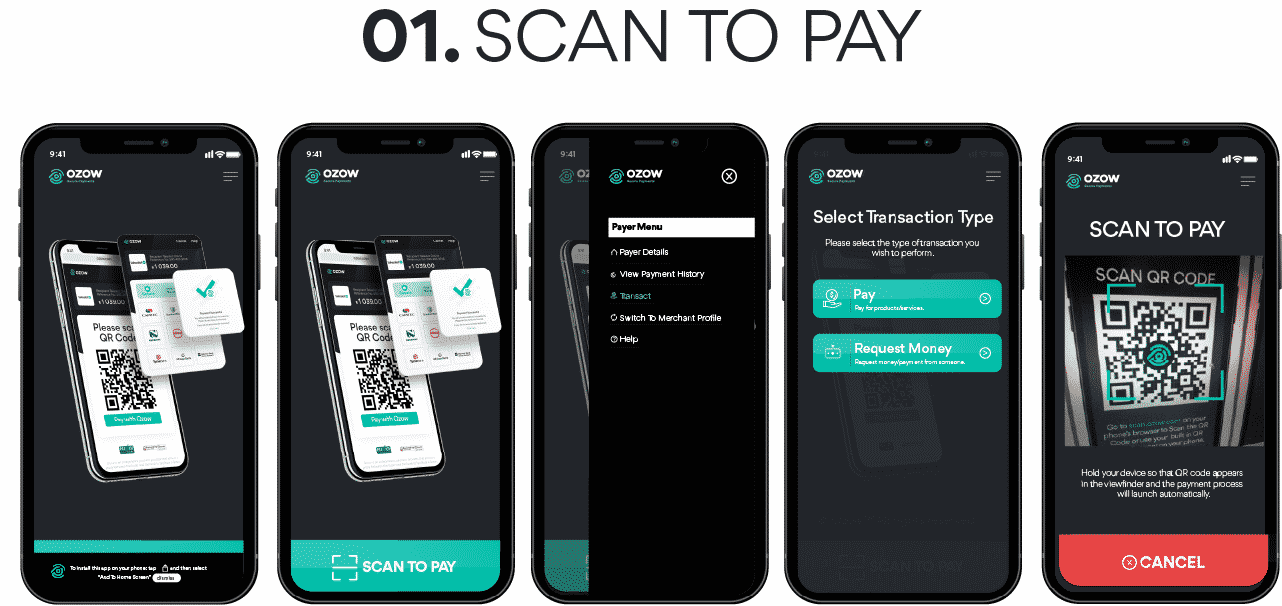

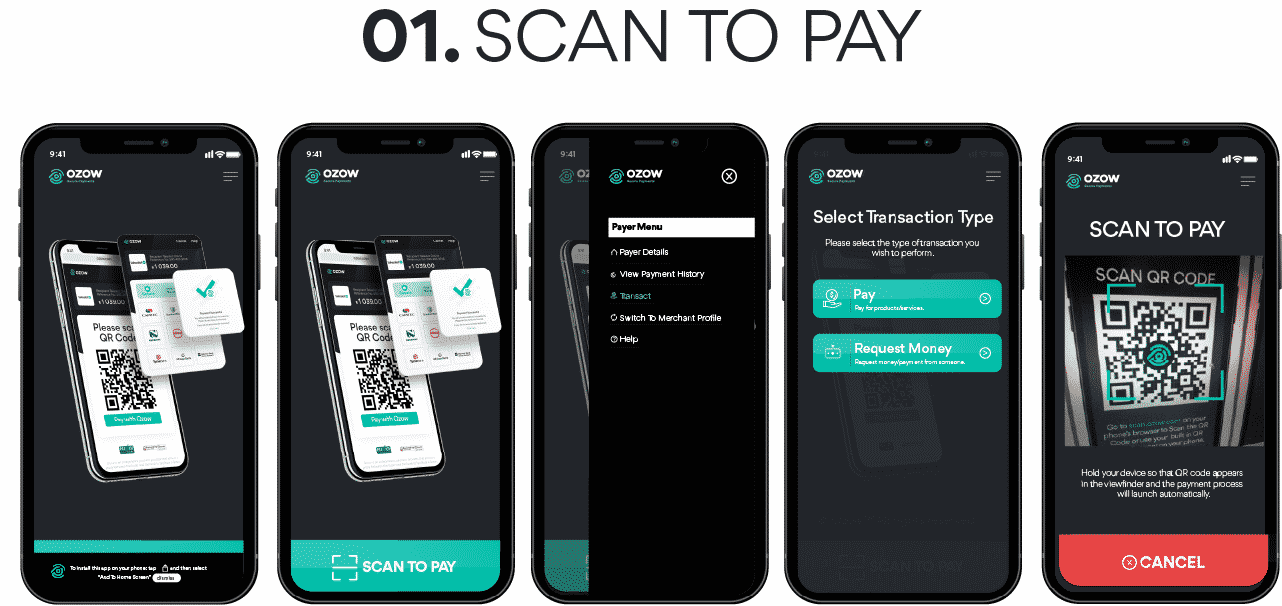

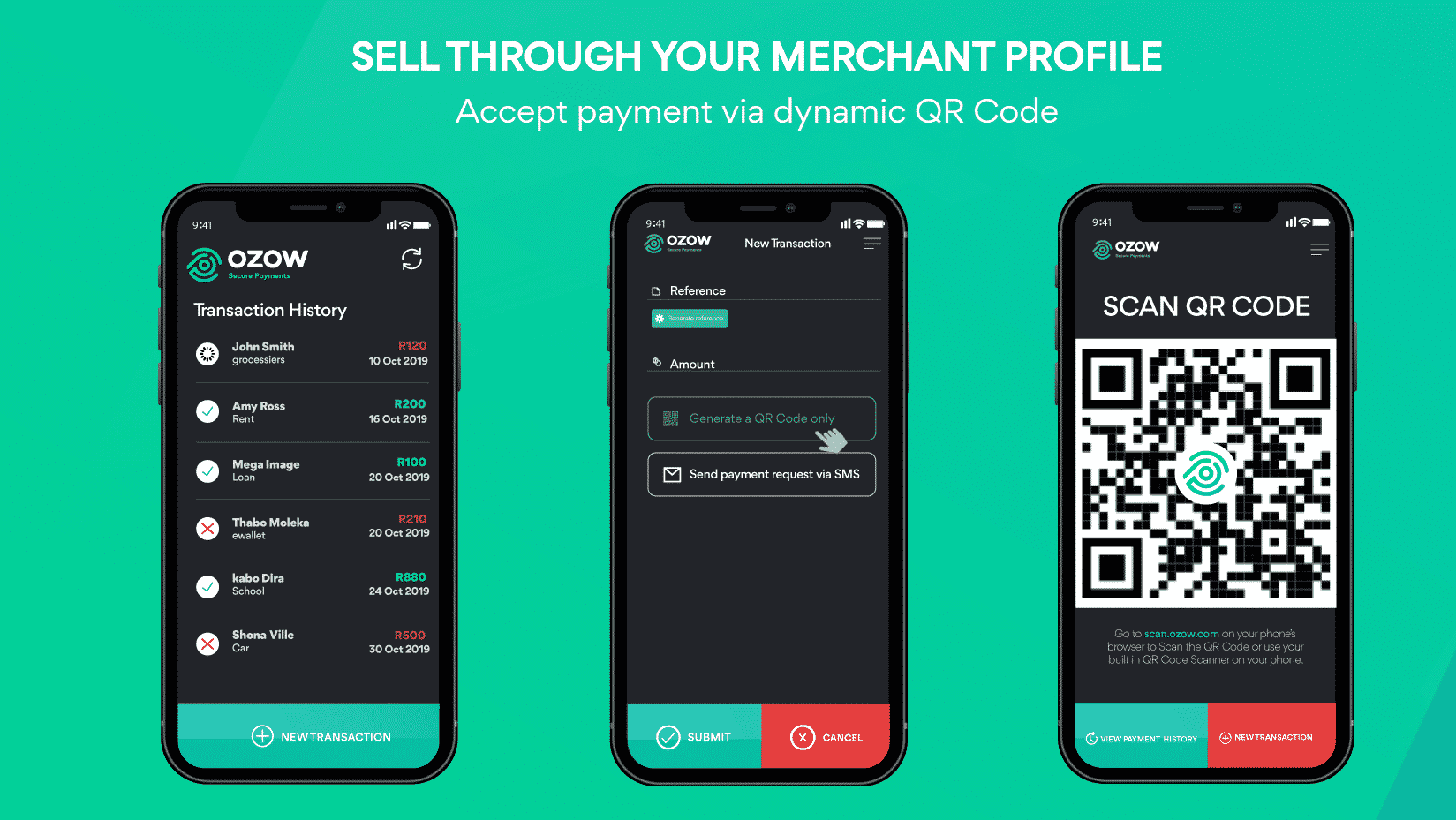

Ozapp is a progressive web application (PWA) that enables any customer with a bank account or eWallet to transact without a card through a QR-code enabled payment. Pays says it is designed to ease adoption by doing away with the need for a dedicated native application.

“Despite smartphone penetration standing at more than 90%, many South Africans still rely on lower-cost models that lack the storage space needed for many mobile apps,” says Pays.

“In a further effort at enabling greater digital inclusion, the data needed to use Ozapp is zero-rated, meaning consumers have zero data cost to make use of the progressive web app and can make payments anytime at any Ozow-enabled point-of-sale or pretty much anywhere, including the comfort of their home.”

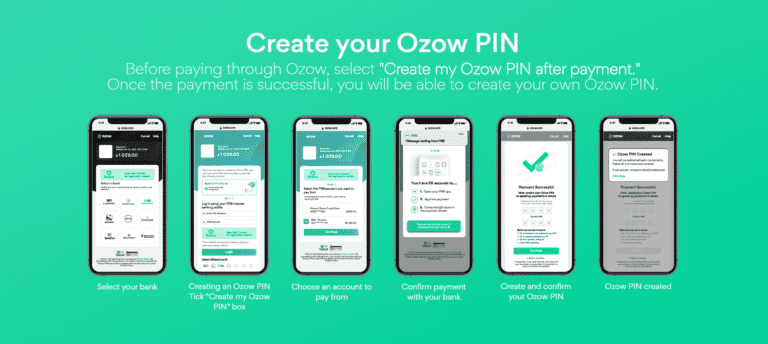

To further ease the customer experience and drive greater adoption, Pays also introduced Ozow PIN, which radically simplifies EFT payments through an easy four-step payment process that can be completed in seconds. The speed and convenience of Ozow PIN makes a compelling value proposition for more South Africans to engage in e-commerce at a time when physical retail is experiencing unprecedented disruption.

“With the launch of Ozow PIN, we are revolutionising the payment experience with a new patent-pending simplified payment innovation that delivers a seamless customer experience without compromising on safety,” says Pays.

“And in keeping with our commitment to greater digital and financial inclusion, Ozow PIN will be developed into all eleven official languages by the end of the year.”

Pays says Ozow PIN is particularly beneficial to merchants and e-commerce sites with large numbers of returning customers that make regular purchases.

“By reducing the time needed to make EFT payments and removing friction in the transaction process, Ozow PIN can help grow transaction volumes while attracting new customers. It’s a win-win for consumers and merchants.”

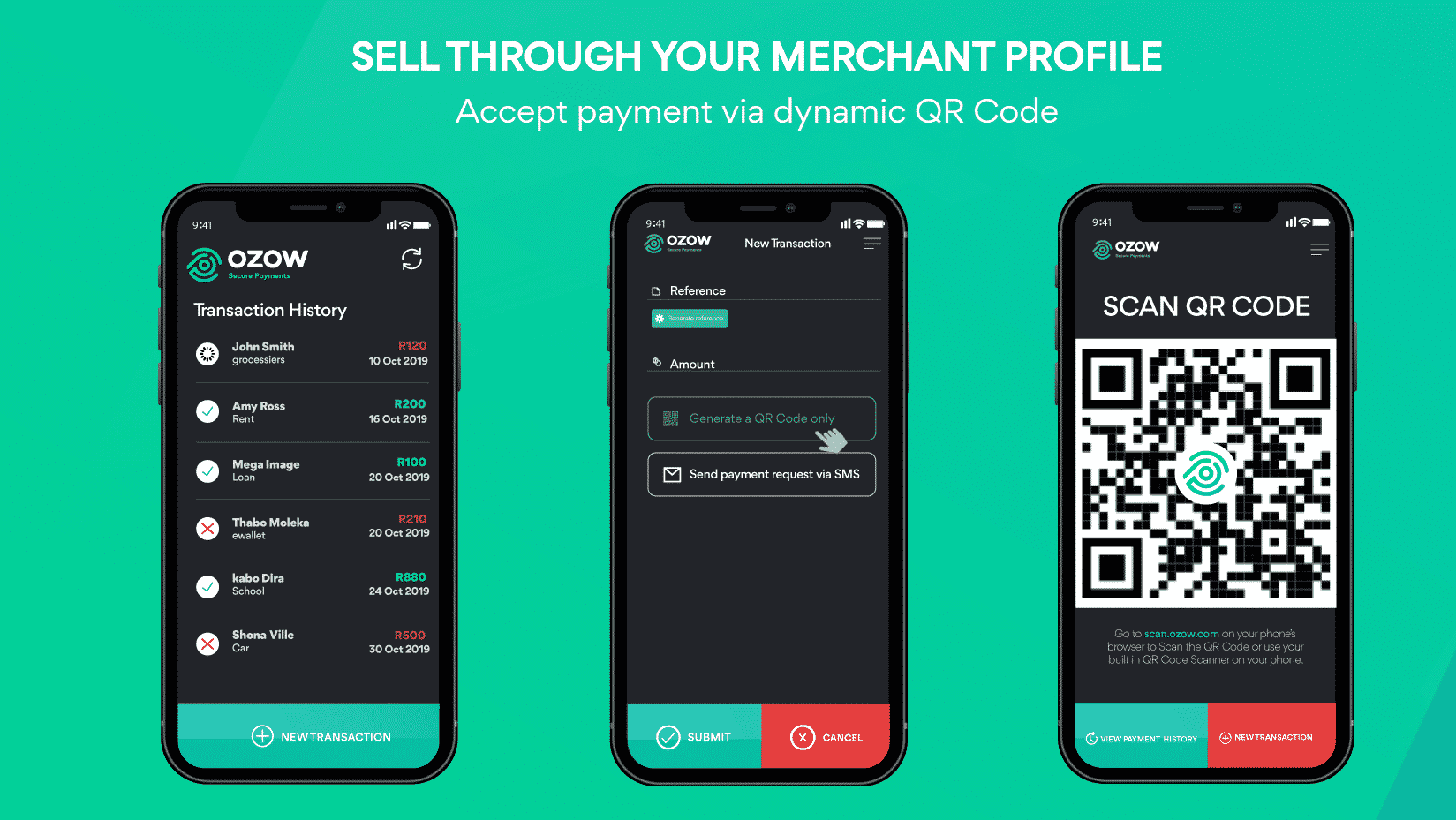

In addition, individuals and sole proprietors can now make use of Ozow as a payment provider too free of charge for the first 12 months or up to R1-million free processing per month. Previously, Ozow’s payments innovations were only available to enterprise and SME merchants, but due to demand, the company has expanded its services to sole proprietors and individuals.

The Ozow Revolution is driven by a healthy pipeline of new payment products that will be launched over the coming months.

“We’re only just getting started with developing new innovations that enable more South Africans to enjoy the benefits of digital payments. As a business, we will continue to find ways to drive digital inclusion until every person on the African continent can make or receive safe, convenient digital payments.”