Cape Town-headquartered Venture Capital (VC) firm HAVAÍC has announced its first investment in Sportable. The sole African institutional investor, HAVAÍC is contributing US$1 million as part of a US$15 million Series A investment round, also including renowned US-based sports investor Ryan Sports Ventures and Australian fund XV Capital led by Stirling Mortlock and James Godfrey.

Founded by three South Africans in 2016, Sportable deploys Micro-Tracking (MT) technology to enhance data collection and analysis in ball and contact sports, particularly rugby, soccer, and American football.

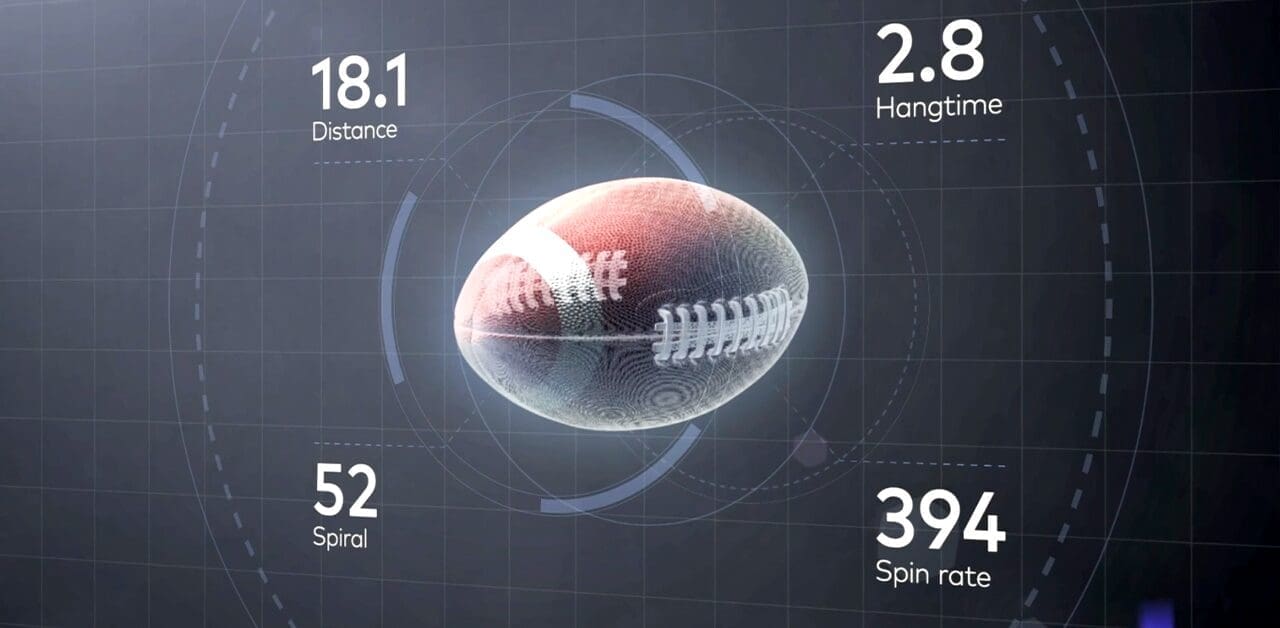

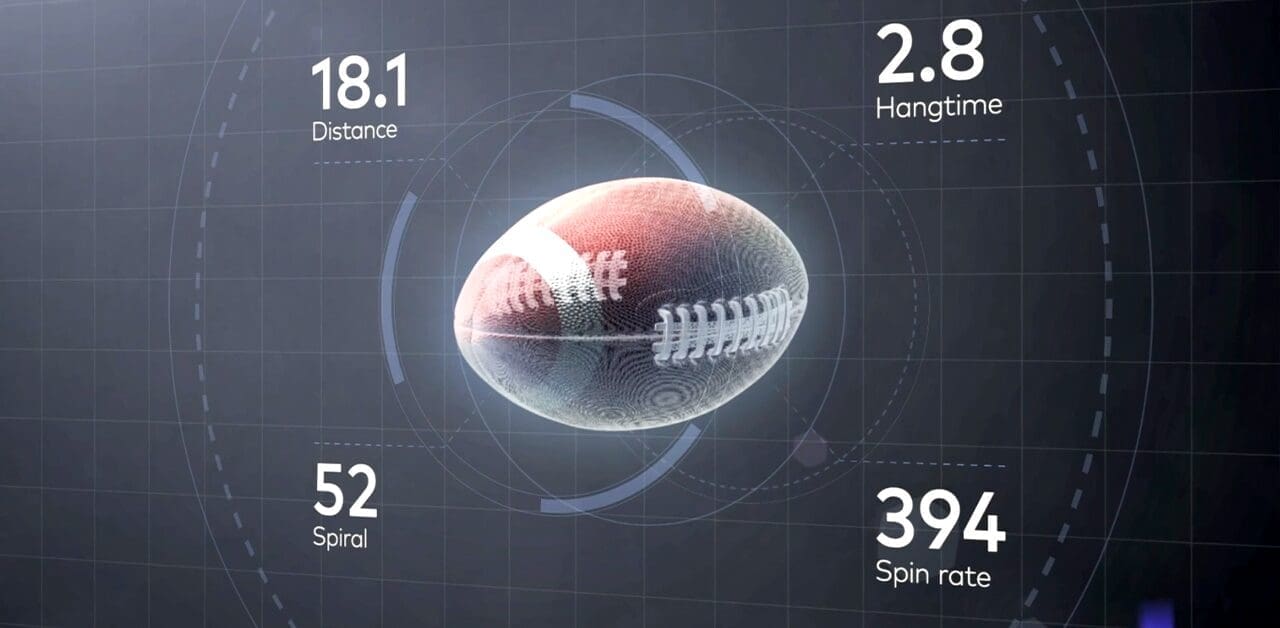

MT modules fitted in balls and on players are plotted by Radio Frequency (RF) beacons around the field to accurately capture and process data. The wireless hardware and cloud-based platform can be set up and broadcast-ready within 90 minutes to analyse games with near-zero latency. Partners use the insights delivered via APIs and event streams to produce actionable real-time data.

According to the latest Sports Global Market Report (The Business Research Company), the global sports market is worth $512 billion in 2023, growing at a compound annual rate of 5.2%.

Sportable empowers industry players, including sporting leagues, teams, players, media, sponsors, betting companies, and fan applications, to improve performance at every segment of the value chain.

The investment will allow Sportable to further expand its successful partnerships with leading international tournaments, including the Six Nations Rugby Championship, as well as global ball manufacturers, media companies, and sporting leagues.

The company has a growing global footprint with offices in London, Melbourne, and Cape Town under the leadership of CEO Dugald Macdonald, CTO Peter Husemeyer, and VP Engineering Dan Davson.

Formerly an investment analyst, Macdonald is a casual rugby player with two Master’s degrees from Oxford University. Husemeyer is a former NASA engineer with a Ph.D. in Nuclear Engineering from the University of Cambridge, and Davson is an electronic engineer with an Honour’s degree in Mechatronic Engineering from the University of Cape Town.

.

Said Ian Lessem, Managing Partner at HAVAÍC, “The team’s reach into the big leagues and brands across rugby, American football, and soccer is very impressive. Sportable has a potent combination of exceptional experience and far-reaching connections, not to mention a very robust product with exhilarating potential to scale. As champions of African tech innovation with global prospects, Sportable 100% hits the mark for HAVAÍC.”

Sportable joins a growing cohort of African-born technology companies that operate globally and reinvest in Africa by creating skilled employment and bolstering local economies. The team is currently on a recruitment drive to grow its Cape Town-based team.

Said Macdonald, “We look forward to tapping into HAVAÍC’s unique insights, networks, investing approach, and impressive experience. They are a steady partner and guiding light to help navigate the opportunities and challenges of scaling technology across borders.”

The announcement follows HAVAÍC’s most recent investments in RapidDeploy, RNR, FinAccess, ShopEx, and Talk360. The VC now serves a combined 20 million customers in over 180 countries worldwide via its 21-strong portfolio of early-stage, high-potential tech companies.

To date, HAVAÍC has achieved five international exits, delivering annualised returns far exceeding its 30% target.

1 Comment

Pingback: La société de technologie de ballon intelligent Sportable lève 15 millions de dollars dans le cadre d’un financement de série A – News 24