In the first half of 2023, the world’s central banks are at the end of rate hike cycles, leading to a weakened U.S. dollar. The banking crisis threatened to collapse financial markets and still influences them, shaping winning investment strategies.

High inflation in early 2023 forced central banks worldwide to increase interest rates. This significantly impacted the financial sector, with many regional banks facing the risk of bankruptcy or going bankrupt. The demand for AI (artificial intelligence) technologies drove growth in capital markets. Having a clearer picture of the peak rates, investors can now consider investment options most likely to bring them profits in the second half of 2023.

Inflation eases as central banks adopt a dovish stance

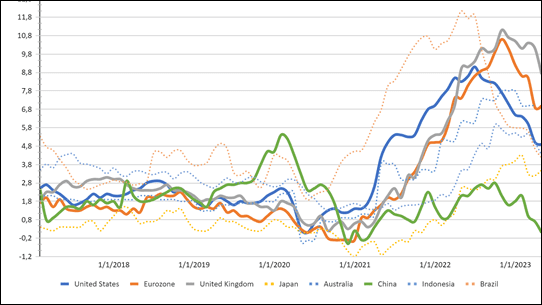

Capital flows between markets are influenced by the economic cycle in developed and emerging markets. To determine the stage the world economy is in currently, it’s important to consider inflation and interest rates.

Consumer inflation data indicates that the inflationary shock experienced in early 2021 subsided by the end of 2022, and global inflation is currently declining.

With declining inflation expectations, central banks are pausing rate hikes. This suggests that the global economy is ready for solid growth and is in the early cycle phase.

What types of assets might present significant investment opportunities?

- Gold: with the U.S. Fed’s primary rate hike cycle ending, the weakening dollar is expected to boost gold, which might surpass 2,000 USD per ounce.

- Euro: the European economy is currently facing greater challenges than the American economy. Consequently, the European Central Bank (ECB) is adopting a more hawkish stance, planning a 0.25% rate hike in both June and July, potentially leading to EURUSD rising to 1.1800.

- Japanese yen: Japan’s inflation remains high, and analysts anticipate the Bank of Japan (BOJ) policy change on yield curve control at the July meeting. Therefore, the forecast for USDJPY stands at 150.

The early business cycle creates headwinds for oil

Each stage of the business cycle has its own winners and losers. The early phase, which typically lasts about a year, is characterised by significant market growth of around 20%. Financial institutions benefit from low rates and increased lending, while the production and sales of consumer discretionary and durable goods experience active growth.

During this period, Energy demonstrates the most significant negative trend. Historically, the oil and gas industry performs poorly in the early stages of the business cycle when the economy is just starting to recover—this is due to low inflation.

The industry performs best at the end of the business cycle. As the purchasing power of money weakens, tangible assets like real estate, commodities, and hydrocarbons gain value, making oil a natural hedge against inflation. Due to the inflationary shock, we have seen oil surge from 20 USD to 120 USD in the past two years, but now it’s going down. Investment opportunities in the industry appear to be exhausted.

Bottom line

‘In the second half of 2023, investors should consider the expected decline in inflation and interest rates, which will likely weaken the dollar and strengthen gold. Due to varying monetary policies, such currencies as EUR, JPY, AUD, and NZD might experience significant growth, while oil and gas instruments may be less attractive during this period,’ said Kar Yong Ang, the OctaFX financial market analyst.