Huawei launched its MEGA ICT infrastructure package solution for the African banking market, at Huawei Intelligent Finance Summit for Africa 2023 in Cape Town. The solution aims to ensure that banks and other financial service companies across the continent are positioned to embrace a digital-first approach that will be critical to their ability to remain competitive.

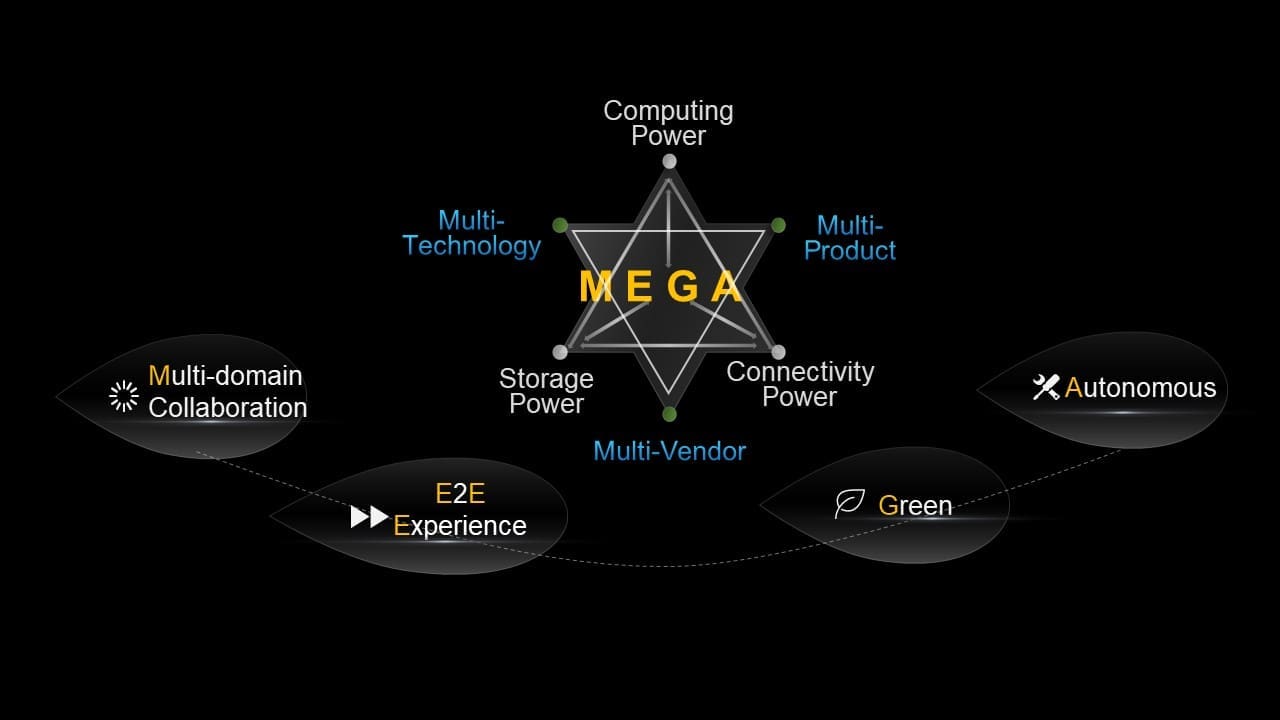

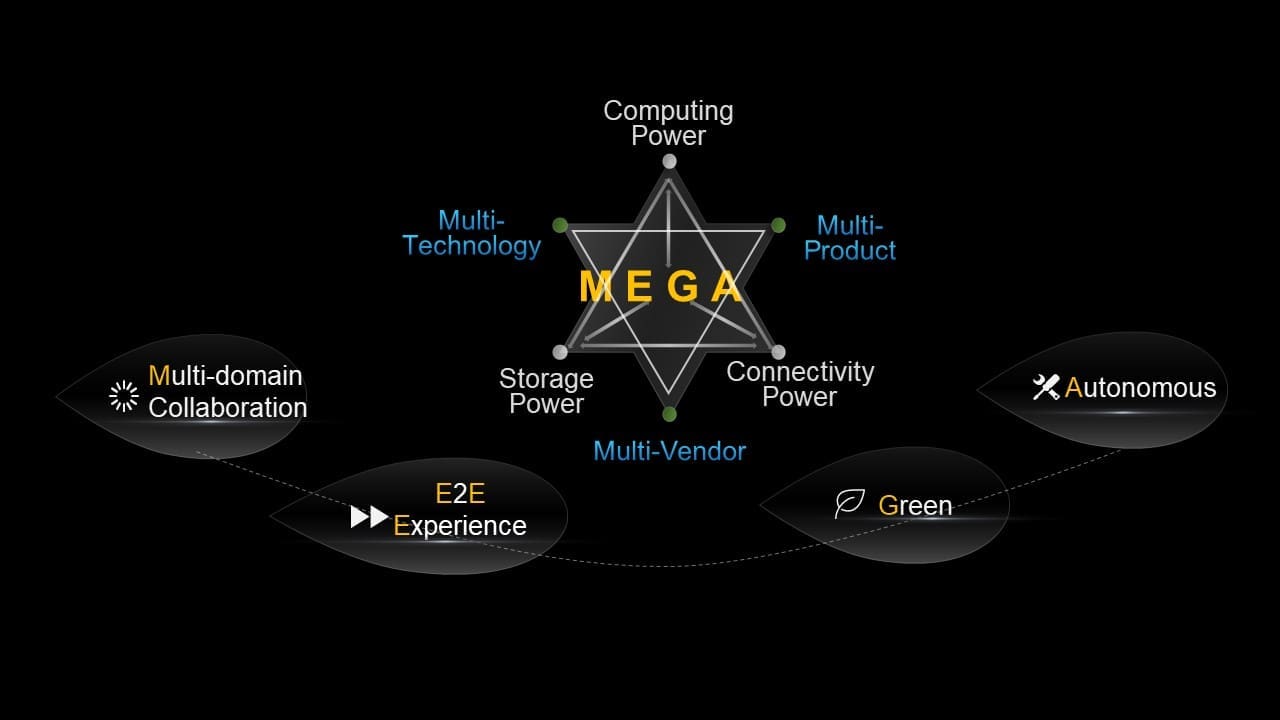

Standing for “Multi-domain collaboration, End-to-end experience, Green, and Autonomous”, the MEGA package is designed to help banks meet their ICT requirements in order to achieve full digitalisation. As such, the solutions bundled in with MEGA include ones that help reshape the computing power, storage, and connectivity abilities of financial institutions.

Setting the scene for why the solutions included In the MEGA infrastructure package are so important, KT Chen, Chief Digital Transformation Officer, Huawei Global Digital Finance explained that nature of banking has fundamentally changed, and that infrastructure will be crucial to banks remaining relevant and competitive.

“Technology enables the whole of society and the economy, including the financial sector,” he said, adding that it’s evolving all the time. “Devices are changing and right now we’re having another iPhone moment with AI co-pilots.”

Banks, he said, must be able to adapt and innovate around those changes and having the right backend infrastructure in place will be critical to their ability to do so.

“Today, data is really important to every bank, and everything can be automated,” added King Tsui, Chief Technology Officer, Global Digital Finance, Huawei. He further explained how MEGA can help banks ensure that they have access to, and can take full advantage of, the data available to them, while also experiencing less downtime and being kinder to the planet.

The MEGA infrastructure package, he said, allows banks to better meet their infrastructure requirements and achieve high performance, high availability, high security, highly efficient operation and maintenance (O&M), and low carbon. As a result, those that adopt the package will be able to achieve non-stop digital service operation.

Each of the solutions in the package are powerful on their own but are their most effective as part of a package.

Huawei’s Storage-Network Coordination solution, for instance, reduces CPU read and write wait time of the application server from 17ms to less than 1ms in database applications. The all-flash storage acceleration and network protocol acceleration, meanwhile, lowers application latency by 30% and increases the number of transactions per second (TPS) the organisation can handle by over 40%.

The package also aims to help banks achieve high digital infrastructure availability of their digital infrastructure. In pursuit of this, Huawei introduced the industry’s first unified disaster recovery portfolio solution based on Storage-Optical Connection Coordination, which shortens the I/O switchover from 120 seconds to two seconds in case of a faulty transmission line, ensuring zero transaction failure and 24/7 online digital services for financial customers.

As Bill Rafterty, Senior Vice President of Huawei’s Data Storage Research Centre, that’s the kind of performance that banks will have to make the norm if they are to compete with the fintechs that are out to grab customers from them.

“If you don’t think the threat of fintechs is real, it’s very real,” he said. “There is no such thing as downtime anymore. High availability is where you need to go and where you need to go now.”

“No one else in the industry can help you achieve this kind of availability,” he added.

In terms of high security, Huawei introduced the industry’s first multi-layer storage-network collaboration security protection solution, integrating firewalls, all-flash production & backup, implementing integrated protection for virus detection, defence, isolation, and recovery, which increases the virus detection rate from 99.5% to 99.9%, and shortens the backup and restoration time by five times, enabling effective prevention of virus attacks such as ransomware and ensuring the security of core financial data assets.

As Tony Tang, Chief Architect of Huawei’s Data Storage Research Centre, pointed out, having that kind of security infrastructure in place is incredibly important, especially given that the number of cyberattacks has increased 57 times since 2021.

“Cybersecurity is becoming increasingly relevant in the banking industry,” he said. “Not only do cyberattacks cause financial loss, but they can also result in reputational damage.”

“Most traditional cybersecurity solutions cannot handle increasingly complex ransomware attacks,” he added. “But at Huawei, we believe that you need multiple lines of defence. The data centre is the last and most effective line of defence against cyberattacks.”

In terms of efficient O&M, the AIOps (Artificial Intelligence for IT Operations) solution jointly developed by Huawei & Netis enables real-time tracking of service tracks across services, applications, networks, and devices, which will locate system errors within seconds.

Huawei is also committed to helping banks achieve efficient energy supply, consumption, and management through technical approaches. An example of this is its use of green energy such as solar power to improve the conversion efficiency of different power supplies in data centres. AI technology is used by Huawei to improve air cooling efficiency, reducing data centres’ power usage effectiveness (PUE) by 30%. Huawei also reduced the power consumption per TB of its data centres through all-flash production & backup storage technologies.

Huawei believes that secure, reliable, agile, and intelligent ICT infrastructure is the basis for the uninterrupted operation of digital financial services in the banking industry. Leveraging its technical strengths in storage, fibre networks, IP networks, and data communications, Huawei will continue to work with its partners in the banking industry to jointly innovate and drive Africa’s banking industry take its digital transformation to a new level.