South African payments platform Payfast is looking to continue its acquisition spree. In 2021, DPO Group, of which Payfast is a part, was acquired by Network International, a globally renowned digital commerce provider in the Middle East and Africa. The company is now known as DPO by Network.

“We are currently exploring a number of partnerships,” said Brendon Williamson, managing director at Payfast, without giving further details.

“Even though we have gone through an acquisition phase as DPO Group and now DPO by Network, we will continue that acquisition phase as Payfast supported by Networks.

“So there are potential acquisitions that we are looking at in the South African market to further enhance our offering and services.”

Williamson shared this during the company’s major rebrand.

Following the merger with PayGate and SiD under Network International, the company has created a new home for its consolidated offering.

The rebrand, which includes a new logo and colour palette, was unveiled yesterday at an exclusive event for the media.

The new Payfast promises a better, more advanced experience for merchants. Merchants can rest assured that they are dealing with a single legal entity without having to give up the convenience of working with familiar products and systems from the Payfast, Paygate and SiD teams on a daily basis.

Looking ahead, the company plans to leverage the skills, technology and ideas of the combined workforce to enhance e-commerce opportunities and capabilities for its merchants.

The Covid 19 pandemic has forced the world to take a quantum leap into the digital future. By 2022, online retail has crossed the R50 billion milestone.

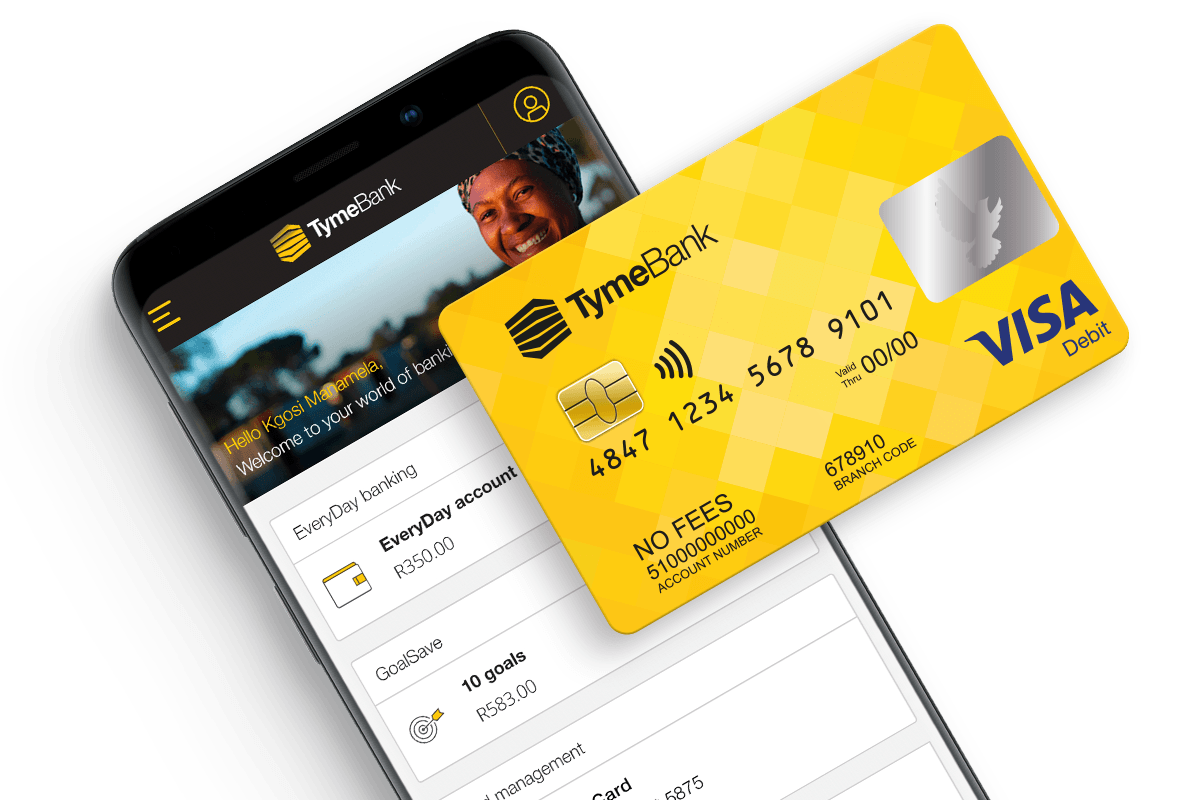

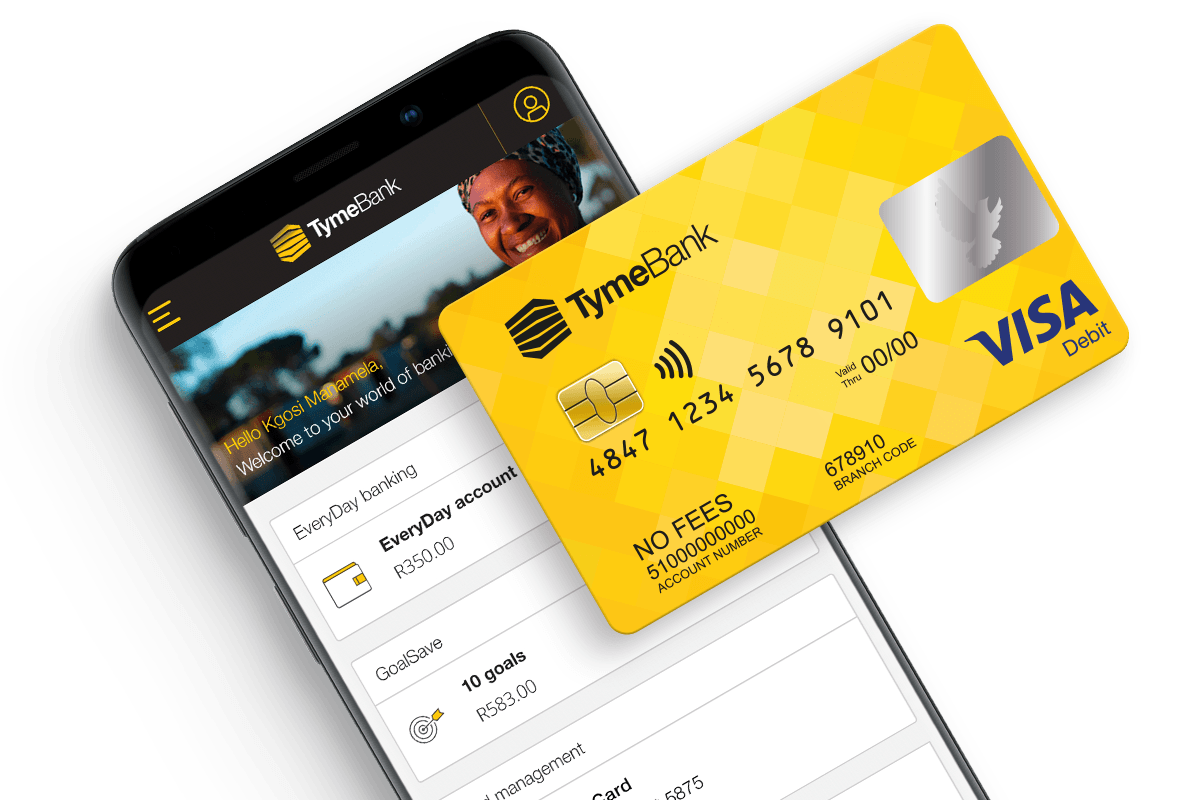

Partnership with Tymebank

When asked about the company’s strategy in terms of participating in Buy Now Pay Later (BNPL), Williamson said, “It’s an unregulated product in South Africa and globally. So we have been watching BNPL closely, what it does, how it works and how it will work in the future.”

“BNPL is largely unregulated and significant problems have arisen. Last year, 10.5 percent of users were charged at least one late fee, and various indications suggest that the number of arrears will continue to rise in 2022.

Users complain that it is difficult to get refunds and that the problems can affect their credit scores in ways they were not aware of. The biggest concern, however, is that many of these financial technology companies are not adequately assessing customers’ ability to repay and are using customer data to suggest more products to buy – on credit.

“From a Payfast perspective, we have partnered with a BNPL provider and that speaks directly with partnership we have with Network International to service TymeBank in South Africa from a solutions perspective,” Williamson explains.

“We have partnered with TymeBank.”

Why TymeBank and why a bank?

“We believe that the bank-operated space is better regulated from a BNPL perspective. We believe they are risk free.”

BNPL’s MoreTyme product from TymeBank offers an alternative payment option that is interest-free for a period of three months.

MoreTyme was launched in November at Jet Stores and all TFG branches.

“We actually work closely with MoreTyme and TymeBank in terms off innovation around their BNPL product,” said Williamson.

“We will put more focus on the MoreTyme product.”

1 Comment

Tyme bank can’t process refunds at all. You need to chase them for days every time. check this published notification from Peach payments https://support.peachpayments.com/support/solutions/articles/47001210103-tyme-bank-sms-bin-484795-refunds-not-possible