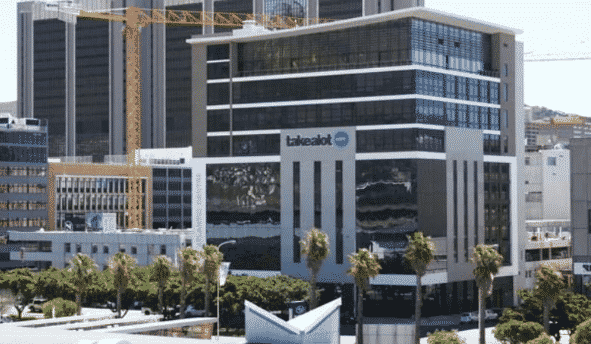

Naspers announced today it had spent $54.8 million (R786 million) to buy out non-controlling shareholders in Takealot, South Africa’s largest online retailer.

As a result, the JSE-listed company now holds a 100% interest (96% fully diluted) in Takealot.

Naspers added that this deal resulted in the cancellation of the written put option liability for this subsidiary which will be derecognised.

The group is assessing the impact of this transaction on equity.

Furthermore, Naspers announced that the Takealot group in South Africa also had a solid year, growing revenue by 55% to $606 million (R8, 6 billion). At the same time, the group said trading losses decreased to near breakeven.

Naspers said Takealot gross merchandise value (GMV) growth accelerated, yielding a full-year GMV of R16.7 billion, 69% higher.

The company added that Takealot’s 3P marketplace sales are growing faster than 1P offerings after adding new sellers and product categories.

“Superbalist, one of South Africa’s leading online fashion destinations, grew GMV 45% in local currency and continued to contribute healthy gross margins,” Naspers said.

“Takealot’s food-delivery business, Mr D, also had an excellent year as lockdown conditions shifted consumer demand from restaurant dining to online delivery.

“As a result, Mr D grew orders 117%, representing 93% (103%) growth in revenue year on year.”