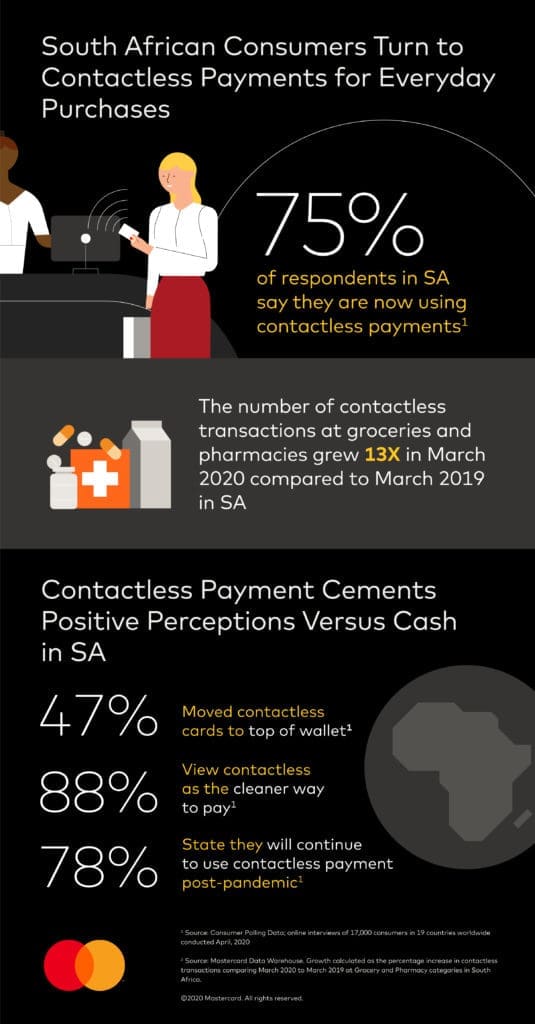

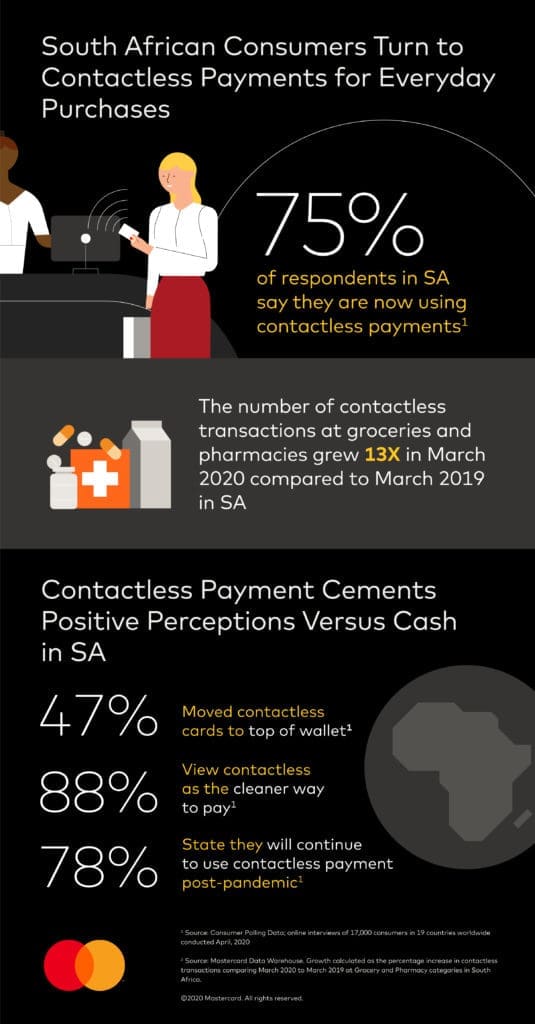

Three-quarters of South African consumers (75%) say they are now using contactless payments, citing safety and cleanliness as key drivers during the COVID-19 lockdown, new research reveals.

In order to curb the spread of COVID-19, the country imposed a 21-day lockdown that has since been extended by two weeks to the end of April. However, on Thursday President Cyril Ramaphosa announced five-level plan to ease lockdown.

Perceptions of safety and convenience have spurred a preference for contactless cards and reminded consumers of the convenience of tapping, according to consumer polling by Mastercard.

It further states that nearly half (47%) of South African respondents have swapped out their top-of-wallet card for one that offers contactless payment.

The disruption has led to increased concern from consumers about cash usage and positive perceptions towards contactless, due to the peace of mind that it provides.

The poll further reveals that forty-four percent of South African respondents have reduced their use of cash, while 20% do not use cash at all since the pandemic began.

Furthermore, eighty seven percent of South African respondents are concerned about the cleanliness of signature or touch pads, and the majority (88%) view contactless as a cleaner way to pay.

That said, about 79% of South Africans say contactless payments are faster than cash, enabling customers to get in and out of stores quicker.

“The act of buying everyday supplies such as eggs, toilet paper, medicine and other necessities has changed dramatically, with shoppers having to adjust to social distancing measures and other new challenges,” said Mark Elliott, division president for Mastercard, Southern Africa.

According to the new Mastercard study, this shift in behaviour is particularly clear at checkout as people express a desire for contactless and voice concerns over cleanliness and safety at the point of sale.

The Mastercard poll concluded that contactless payments are here to stay.

It shows that sixty-nine percent of South African respondents agree that contactless is now their preferred payment method, with 71% stating that they prefer shopping at merchants that accept contactless. The majority (78%) also say they will continue to use contactless post-pandemic.

The study revealed that since the beginning of COVID-19 in South Africa, 89% of South African respondents have been using contactless to pay for groceries, 60% for pharmaceutical items, 39% for other retail items, 15% for fast food, and 8% for transport.