Pi Coin investors have been wondering something for quite some time – who actually owns most of the supply? Since its long-awaited mainnet launch earlier this year, Pi has struggled to live up to years of hype around mobile mining and promises of mass adoption. The token trades near $0.34, almost 90% below its peak, leaving many early supporters disillusioned. Blockchain data now reveals just how concentrated Pi ownership really is – and the picture raises tough questions about the project’s long-term credibility. Some investors are even looking for other opportunities such as MAGACOIN FINANCE as experts predict it will be the breakout token of 2025.

From Hype to Harsh Reality

Pi Network first captured attention by offering “mining” through a mobile app, allowing millions of users to accumulate tokens without expensive hardware. For years, the promise of a people-powered cryptocurrency drew massive participation, with over 30 million wallets reportedly created. Supporters saw Pi as a potential gateway to mass adoption, a coin that could bring crypto to people who had never used Bitcoin or Ethereum.

But the launch of its mainnet in February 2025 shifted the narrative. After years of waiting, the market valued Pi at just a fraction of the expectations built up during its early phase. Its price plunged from early speculative highs to just above $0.34. For users who mined diligently for years, their holdings are often worth less than they imagined – and in many cases, barely a few dollars. The result has been frustration, disappointment, and growing scrutiny of where the real wealth lies.

Whales at the Top

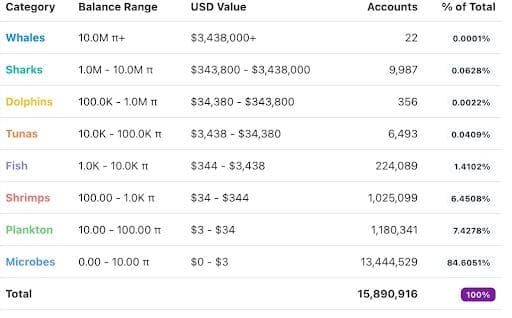

According to PiScan, a blockchain tracker, wealth within the network is highly concentrated. At the very top are the whales: just 22 wallets control over 10 million Pi each, and the single largest address holds a staggering 377 million tokens. At current prices, that equates to about $128 million in value.

For a project branded as a “people’s cryptocurrency,” this degree of concentration is striking. It undermines the grassroots narrative and has sparked speculation about the identities of these massive holders. Are they early developers, private insiders, or opportunistic external investors betting on a future exchange listing? Some whispers even connect figures like Tron founder Justin Sun, who has been linked to large holdings in other projects, though such claims remain unverified.

Sharks, Dolphins, and the Mid-Tiers

Beneath the whales are the sharks, nearly 10,000 wallets holding between one and ten million Pi each. Their balances are worth between $343,000 and $3.4 million apiece, making them highly influential players but still nowhere near the dominance of the top 22 wallets.

Next come the dolphins, a far smaller club with 356 wallets. Each dolphin controls between 100,000 and one million Pi, valued up to $343,000. Though not insignificant, their holdings are modest compared to the vast concentrations above them.

These groups together make up a narrow slice of Pi’s user base but command disproportionate influence over the token’s supply and market potential.

Tunas, Fish, and the Lower Levels

Further down the hierarchy, the numbers become larger but the value drops significantly. Tunas, holding between 10,000 and 100,000 Pi, number in the thousands. Their balances equate to $3,400 to $34,000 at today’s prices.

Fish are more numerous still, with over 224,000 wallets holding between 1,000 and 10,000 Pi. Even so, their collective impact is small. At best, a 10,000 Pi balance is worth only $3,400 – hardly life-changing wealth in the crypto world.

The Mass of Small Holders

The overwhelming majority of Pi holders belong to the bottom categories: shrimps, plankton, and microbes. Over a million addresses hold between 100 and 1,000 Pi, another 1.18 million accounts have just 10 to 100 Pi, and a staggering 13.4 million wallets – 84.6% of the total – hold fewer than 10 Pi each.

For most, years of phone-based mining have produced holdings worth just a few dollars. The grassroots dream of widespread financial empowerment looks hollow when compared to the immense concentration in a handful of whale wallets.

A Concentrated Network

This wealth distribution paints a sobering picture. Despite years of promotion as a democratized digital currency, Pi is anything but evenly spread. Instead, it is dominated by a small group of whales and sharks who collectively control billions of tokens.

That concentration raises uncomfortable questions. Can Pi truly claim to be a “people’s crypto” when most users hold balances too small to matter? Will whales dictate the future of the project by controlling liquidity and market supply? Unless Pi delivers real adoption, exchange listings, and utility, its vast base of small holders may remain powerless spectators.

A New Contender Emerges

While Pi grapples with these issues, investors are turning toward projects with stronger fundamentals and more transparent tokenomics. One standout is MAGACOIN FINANCE, which has quickly raised more than $13.5 million in its presale. Unlike Pi, MAGACOIN FINANCE emphasizes community-driven growth, rigorous audits for security, and a clear roadmap for utility.

The project has already been compared to early-stage tokens like Shiba Inu and Dogecoin, which delivered massive gains to those who got in early. Analysts suggest MAGACOIN FINANCE could see returns of up to 45x, positioning it as one of 2025’s most promising opportunities. Crucially, its tokenomics avoid the extreme concentration seen in Pi, making it far more appealing to both retail investors and whales looking to diversify.

Lessons for Investors

The contrast between Pi and MAGACOIN FINANCE illustrates an important lesson in crypto investing: ownership distribution matters. A token with millions of users but extreme wealth concentration risks alienating its community and undermining its own credibility. By comparison, projects that emphasize transparency, fairness, and utility stand a better chance of delivering sustainable growth.

As altcoin season approaches, smart money is flowing into tokens with clear potential rather than those weighed down by imbalance. Pi’s future depends on whether it can close the gap between its marketing and reality. Until then, projects like MAGACOIN FINANCE are stealing the spotlight.

Conclusion

Pi Network’s whale data reveals a startling truth: billions of tokens are concentrated in the hands of a select few, leaving most of its millions of miners with balances worth just a few dollars. The promise of a people-powered cryptocurrency rings hollow when such inequality exists at the core of the project.

Meanwhile, MAGACOIN FINANCE is emerging as a strong alternative, raising millions and attracting both whales and retail investors with its transparent approach and potential for extraordinary returns. For those looking ahead to 2025, the choice seems increasingly clear: stick with a struggling network weighed down by concentration, or move into a rising contender that could define the next phase of the altcoin market.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance