Venture capital is not just about pitch decks or numbers, it is about relationships and trust. In South Africa, those circles are concentrated in the Stellenbosch network and the Jewish business community, where capital circulates naturally. Black founders are often absent from these networks, and the few Black angel groups that exist remain fragmented and undercapitalised.

Most high-net-worth Black individuals are products of BBBEE deals or tenderpreneurship. Their wealth gravitates toward corporate, property, and infrastructure projects with predictable returns, not risky startups that require building, validating, and scaling.

Another gap is friends-and-family capital. White founders often bootstrap with generational wealth until VCs step in. Black founders rarely have this privilege, unless they approach ESD programmes or DFIs, which are slow, compliance heavy, and rarely catalytic. As a result, they pitch earlier, with less traction and smaller funding asks, and are seen as “unfundable” due to the absence of sales.

Wealthy Black investors often dismiss such opportunities as too small to bother with, focusing instead on how quickly money will be repaid. This short-term, guarantee seeking mindset leaves founders stranded between private wealth uninterested in risky ventures and DFIs that move too slowly.

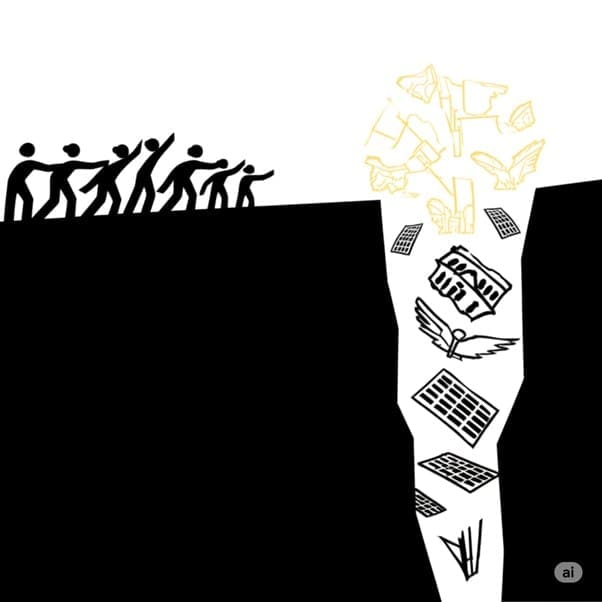

The journey for Black founders often feels like trying to bridge a vast chasm. On one side stand innovative ideas and determined entrepreneurs, ready to build and scale. On the other, the resources, networks, and investment appetite that fuel high-growth ventures. This divide isn’t merely about a lack of polished pitch deck; it’s a structural fault line created by historical exclusion and reinforced by how capital continues to flow. Fragmented angel networks and a scarcity of early-stage funding leave many stranded, unable to make the leap across this significant gap.

Some will argue that “we need stronger businesses with clear models.” Founders do need to build scalable, execution-strong ventures, but the real gap also lies in investor imagination, access to networks, and a willingness to embrace entrepreneurial risk.

Comprehensive data on investment in Black-founded startups across sectors such as fintech, e-commerce, agri-tech, renewable energy, and software is often limited. Even so, meaningful entrepreneurial activity and emerging investment are taking place. The dynamism and innovation coming from Black founders in these areas show that capital is beginning to flow, even if not always through traditional VC channels. Recognizing these developing successes, despite gaps in the data, provides a necessary counterbalance. It highlights both the progress and potential within the ecosystem and underscores the urgent need for more transparent and equitable funding pathways.

A silhouetted group of Black entrepreneurs stand on one side of a chasm, reaching toward a brightly lit cluster of venture capitalists on the other. The chasm symbolizes capital and network gaps, with fragments of angel groups and traditional funding paths scattered within it.

Call to Action: If you know Black investors backing high-growth Black-owned businesses, name them and share their wins. If you cannot list ten such companies in South Africa today, then perhaps the gap is not imagined, it is structural, cultural, and urgent.

- Mpho Sefalafala – Entrepreneur, CEO of FibrePoynt, and PhD Candidate (Finance)