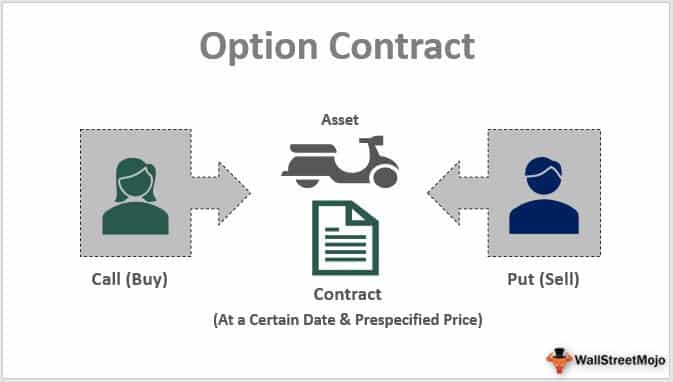

An option is a type of legal contract that gives the holder a right, but not an obligation, to carry out a certain pre-determined transaction with their counterpart at a pre-determined date or dates.

Options belong to the group derivatives since they are based on an underlying asset. Example: A stock option gives the holder a right to buy (call option) or sell (put option) a certain number of shares for a pre-determined price.

The options contract

Examples of information that should be answered by the options contract:

- Is this a put option (right to sell) or a call option (right to buy)?

- What is the underlying asset? (Example: Common shares in Company XYZ)

- What is the unit of trade? (Example: 100 shares)

- What is the exact strike price? (The strike price is the price at which the holder can exercise the option, i.e. use it.)

- What is the expiration date?

Call option vs. put option

- The holder of a call option has the right to buy the underlying asset at a specific price.

- The holder of a put option has the right to sell the underlying asset at a specific price.

Exercise date

Most options are either American-style or European-style.

- An American-style option can be exercised at any point as long as it hasn´t expired already.

- A European-style option can only be exercised on the expiry date.

The bid-ask spread

Compared to exchange-traded stocks, options tend to have a larger bid-ask spread. This is because generally speaking, the liquidity is lower at the options market. If you want to try your luck trading options, it is very important that you understand the bid-ask spread and how it will impact your profitability.

Tips for getting started with options trading

Do your own homework

There are plenty of people out there who wants to sell you the ”Perfect System for Options Trading” or make you believe that if you just follow their advice, making money from options trading is virtually guaranteed.

In reality, you need to do your own homework. Learn about options and options trading, and make informed decisions. Not only will it make you a better options trader; it will also help you cut through the bullshit and weed out scams and over-promises.

Be picky when you select a broker and trading platform

Having the right broker and using the right platform can make or break your profitability. It is important that you pick a broker and platform that is right for you and your options trading strategy.

If you are already doing other types of trading online, such as stock trading or FX trading, it can be tempting to simply stick with the same broker and platform. It should be noted however, that the broker/platform that is optimal for your stock trading needs might not be the best choice for your options trading, and so on.

For starters, brokers differ from each other when it comes to factors such as which options that are available and how trading costs are calculated. Comparing them can be tricky, and a broker that is advertising zero commission fees might be costly in some other regard. Always the take whole situation into perspective, including the spreads.

It is also worth knowing that some brokers offer several account types, and maybe you will find out that the account type that was best for your FX trading is far from ideal for your options trading. It can be worth contacting the broker´s customer support to inquire about a solution.

Don´t spread yourself too thin

When you start out options trading, you will probably see a lot of great opportunities that you are eager to jump on. Try to pace yourself. It is better to start out with a narrow scope and then gradually broaden it. If you start meddling with options with a dozen different underlying stocks, a bunch of currencies, some interesting commodities, etcetera you are much more likely to derail. Become an expert in one field before reaching out to the next, even if you have the capacity to spot a lot of interesting opportunities for profit. Otherwise, your options trading is likely to become more like playing roulette than trading. You might get lucky a few times, but in the long run, you have the odds stacked against you at the roulette table.