Blue Label Telecoms remuneration committee seems not to be perturbed by shareholder destruction in the company.

The committee has rewarded the executives handsomely despite the company’s market value being hit hard by poor investment in struggling mobile phone operator Cell C.

Together with Cell C’s trading loss and further impairment of its property, plant and equipment and an impairment of our own investment, Blue Label recorded a net loss related to Cell C of more than R6 billion.

The company which used to be regarded as a JSE’s best-kept secret has seen its shares plummet 50% year-to-date and dropped 87% in the past 3 years, pushing its market value to R2.4 billion.

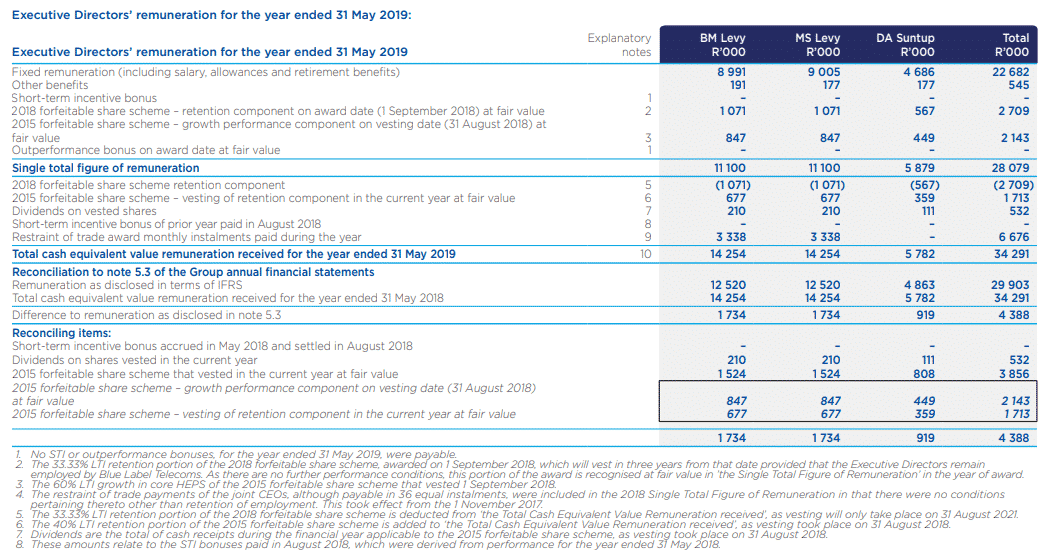

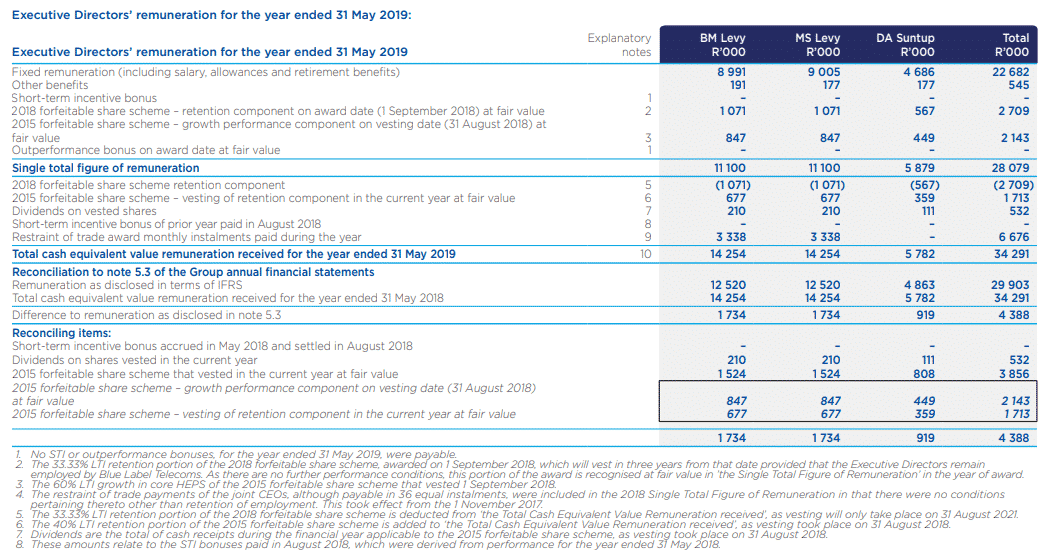

Blue Label joint-CEOs Mark and Brett Levy were paid a combined R28,5 million – taking home just under R14.2 million each. In 2018, both Mark and Brett were paid a combined R48 million.

The salaries comprise a basic salary of R8.9 million, and R3.3 million restraint of trade award monthly instalments paid during the year, and received dividends of R210,000. The Co-CEO forfeited share scheme payouts and short-term incentive bonus.

“We are mindful that during the year under review, the group performance and resulting impact on our share price, has been hugely disappointing. The executive directors have

consequently waived any entitlements to STI bonuses for this financial year,” Garry Harlow, chairman of the Remuneration Committee, wrote in the group annual report.“We acknowledge that we are on a journey of moving Blue Label closer to best practice and remain committed to this.”

Blue Label Telecoms listed on the JSE in November 2007 at R6.75 a share and attracted global tech giant Microsoft as an investor (which later sold its shareholding

in 2010).

The company’s growth enabled it to buy half of the mobile phone operator Cell C. Blue Label Telecoms’ market value shot up to R19.3 billion in October 2016 when the firm invested in Cell C. For more read: Is Blue Label Telecoms Headed for Delisting on the JSE?

Cell C is 45% owned by JSE-listed Blue Label Telecoms, 15% by Net 1, 3 Special Purpose Vehicles (SPVs) collectively hold 30% (in turn held by 3C Telecommunications and further in turn held as 29.4% by the Employee Believe Trust, 45.6% by Oger Telecoms and 25% by broad-based black empowerment grouping CellSAf); and Cell C Management and Staff hold 10%.

Betting the Farm

Blue Label Telecoms and Net 1 have written down to zero the value of their stake of the embattled mobile network, Cell C, which recently reported an R8 billion loss in the year to June, hit by impairments.

“The board and executive management are acutely aware of the destruction of shareholder value caused primarily by our investment in Cell C,” Blue Label’s independent non-executive chairman Larry Nestadt, wrote in the company’s integrated annual report published yesterday.

He added that “this is the hardest Chairman’s report I have had to write in my 25 years of serving on listed company boards”.

“The investment in Cell C was motivated to the board, on the basis of a defensive strategy of protecting higher margin business flow received from Cell C, the ability to extract synergistic savings and an opportunistic approach to investing in a distressed asset,” he wrote.

“The board were however concerned by the quantum of our investment in Cell C. We were very aware that we might be betting the farm. Our concerns were overcome by the subsequent due diligence conducted by international experts, and the business plans and

budgets presented by the then Cell C management.”

Fairly soon after our investment of R5.5 billion in Cell C and a further R750 million liquidity support to the SPV structures, it became clear that the Cell C budget plan was not being met, he said.

“This lead to our re-examination of the business plan and budgets presented to us by the previous management team at Cell C, which had predicated our investment decision. It was evident that further capital would be required far sooner than initially expected,” Nestadt explained.

“This sequence of events led to an unusually high level of board oversight in support

of the concerns of Blue Label’s Executive Management. Additionally, the Cell C board

conducted their own investigation, which led to the early termination of certain senior management contracts.”

Management Reset

A new management team has been appointed at Cell C, and “it has developed business plans that are more realistic and innovative. This turnaround strategy is starting to show encouraging results at Cell C.”

He further reiterated that the board is aware that the erosion of shareholder value as a result of the investment in Cell C has to be met by accountability and consequence senior

management.

“The board will initiate a management and board reset to restore the Blue Label core business focus. The balance sheet restructuring has already begun with the disposal of non-core assets to address gearing and liquidity management,” he said.

“In addition, we have adopted a far more conservative risk framework and revised capital allocation policy.

“The non-executive board members are completely committed to continuing to mentor our highly entrepreneurial and talented management team and returning Blue Label to the cash-generative business it was prior to the acquisition of Cell C. We are determined to rebuild stakeholder trust and shareholder value.”

Execution of Cell C’s New Strategy

Blue Label’s entire investment into Cell C and its exposure in the SPV1 and 2 structures, was written down to zero.

“We remain confident that Cell C will continue to operate.”

However, should this not be the case, it is anticipated that the loss in revenue from trading

with Cell C ordinary business with the group would equate to approximately a 25% reduction in net profit after tax, Blue Label Telecoms informed investors.

“This business would however revert to the other mobile operators, in which case Blue Label is likely to be able to recover some of this business, albeit at a lower margin,” the company said.

“The transactions currently being considered by Cell C regarding the extended roaming agreement and recapitalisation are progressing well.”

For more on Cell C’s woes: Read our exclusive stories here

team