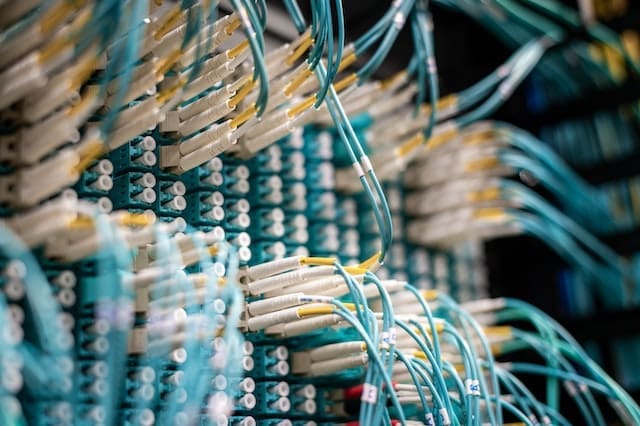

In a strategic move to solidify its high-growth technology segment, Balwin Properties has announced a major restructuring of its fibre-to-the-home (FTTH) business, Balwin Information and Communication Technology Proprietary Limited (Balwin ICT). Effective 1 March 2025, Balwin Annuity has entered into a subscription agreement that increases the shareholding of its non-controlling interest partner to 50%, valuing the transaction at R73.8 million.

Crucially, Balwin Annuity will retain operational control of the subsidiary, ensuring strategic alignment with the wider group’s objectives while deepening the commercial partnership.

The deal emphasises the immense value Balwin places on its fibre assets, which are a cornerstone of its strategy to diversify group income beyond its traditional property development cycle.

The annuities segment, driven predominantly by ICT services, is delivering on this promise, reporting a massive 55% revenue growth to R101.5 million for the period ending August 2025, up from R65.7 million the previous year.

“The strengthened partnership provides long-term stability to this vital commercial relationship and reaffirms the premium long-term value we see in our fibre infrastructure,” the company stated.

The performance of Balwin Annuity is a bright spot for the group, increasing its contribution to total group revenue to 8.3%.

The strategy is not only about financial diversification but also about enhancing the core residential product. By providing seamless fibre connectivity, Balwin enhances the client experience, promotes a cost-effective lifestyle, and builds a powerful competitive moat.

These “intangible benefits,” as Balwin refers to them, include stronger customer acquisition and retention, which enhance the overall appeal of its estates and support a pricing premium for residential sales.

The growth is reflected in user numbers.

The number of households connected to Balwin’s fibre networks grew to 10,888 in August 2025, a significant increase from 9,630 in the same period in 2024.

Every apartment across Balwin’s estates is pre-equipped as fibre-ready, making the installation of high-speed internet a standard modern amenity, much like a fitted kitchen.

This strategic partnership and the accompanying financial results signal a clear direction for Balwin: a future increasingly powered by recurring, tech-driven annuity income.