Digitap ($TAP) has become one of the most discussed names in crypto over the last several weeks. Investors and analysts are focusing on a single, powerful narrative: omni-banking. While most blockchain projects are years away from achieving their stated goals, Digitap already operates as a live platform, offering banking-style services to a global audience.

With the presale price at $0.0159 and a 22% jump set for the next stage, traders see it as one of the best cryptocurrencies to invest in before its wider listing. The question is whether this narrative can drive prices far beyond early projections — possibly toward the ambitious $19 mark. This would constitute a jump of about 1200x from its current price.

Why the Omni-Banking Narrative Matters

Everybody around the world is looking for streamlined financial services. The 1.4 billion unbanked want access to basic banking. Meanwhile, first-world residents want an application that allows them to pay for goods and services using fiat or crypto. The aim is to create an omni-bank that facilitates all payments through a single secure interface. The market potential is massive.

It will also bring the world together, as regardless of where a user resides, payments can be made in the currency of choice, for a tiny fee. This eliminates the extortionate FX costs associated with credit card companies and the complicated, ever-changing fees that seem impossible to understand.

Remote workers can get their wages paid to an IBAN of their choosing, eliminating geographical barriers. Money can be sent to friends and family without going through burdensome KYC checks every time. Traditional banking structures are expensive to maintain and slow to evolve.

By removing unnecessary middle layers and building compliance into the technology, Digitap can offer faster, cheaper, and more flexible services. The current financial system is slow, fragmented, and often inaccessible to billions. Digitap offers a simple alternative: one account, multiple currencies, global access, and privacy protections.

This message resonates with both retail users and institutions. This is a narrative that appeals strongly to markets. It’s not purely technological. It taps into macroeconomic frustrations: costly cross-border transfers, inaccessible financial systems, and overregulation that excludes rather than includes.

Digitap’s Omni Banking Model and Global Reach

Digitap’s value proposition is built around solving real-world problems. At its core is a working omni-bank structure that allows users to hold fiat and crypto in a single account. This includes access to multi-currency IBANs, real-time transfers, debit cards, and global payments — features normally reserved for traditional banking institutions.

What makes this model stand out is accessibility. In compliant jurisdictions, users can onboard through a zero-KYC framework, giving them access to global payment systems without extensive identity verification. This is a game-changer for many regions where banking services are difficult to access.

Digitap combines privacy with legal compliance, and its staking APY of 124% adds an income layer for token holders. In addition, 50% of platform profits are allocated to burning $TAP and rewarding stakers, directly linking business success with token value.

As analysts look for projects that can sustain demand over the long term, this kind of practical utility is seen as a major advantage. It’s also a big reason why Digitap has climbed up shortlists of the best cryptocurrencies to invest in for 2025.

Presale Price, Tokenomics, and the $19 Scenario

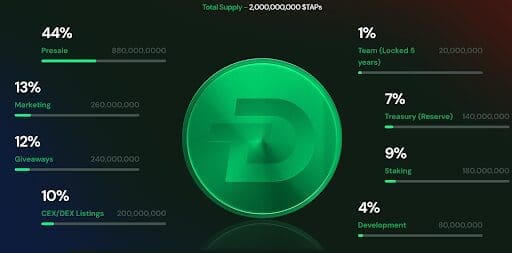

Digitap’s tokenomics are designed to support sustainable growth rather than one-off hype. With the presale currently priced at $0.0159 and a 22% jump set for the next stage, early participants can secure a meaningful discount compared to later entrants. Many view this pricing structure as a straightforward way to align long-term incentives and attract strategic buyers.

The token burn mechanism is a central part of this. Every month, half of the platform profits are used to reduce the circulating supply of $TAP while distributing rewards to stakers. This steady deflationary pressure creates a supply-demand dynamic that can support higher valuations over time.

Price projections of $19 may sound bold, but they are not without precedent. In past market cycles, early-stage tokens with clear use cases, working platforms, and aligned tokenomics achieved exponential multiples from their presale price. If Digitap scales its user base in line with its business model, this kind of growth is plausible.

Why Digitap Is on Analysts’ Watchlists

The combination of a working platform, omni-banking accessibility, and a clear burn-and-reward structure gives it an advantage over typical presales. It is also entering the market at a moment when digital payments and privacy are among the strongest emerging themes.

Many investors are now treating Digitap not as a speculative side bet but as a core growth exposure. If adoption continues at its current pace, it could be one of the defining stories of this market cycle.

The future of money is here. The banking system is a dinosaur, and the people want an integrated financial superapp for payments, salaries, and invoices that works 24/7, across the globe.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app