The world of finance just got a major wake-up call. Speaking at the Token2049 conference in Singapore, Robinhood CEO Vlad Tenev said that the tokenization of assets will eventually reshape global finance from the ground up.

He compared the shift to a “freight train” that no one can stop, pointing to how digital versions of real-world assets — from stocks to real estate — are already starting to move on-chain.

His comments sparked a wave of conversation across the crypto industry. If traditional assets are moving to blockchain networks, the future of banking, payments, and investing could soon look completely different. And in that shift, smaller projects working on real-world payment tools — like Digitap ($TAP) — may be the ones to see the fastest growth.

Top Crypto Trend in 2025: Tokenization Takes Center Stage

Tokenization isn’t a distant vision anymore. It’s already happening. Robinhood has begun offering tokenized stocks to users in Europe, letting them trade shares around the clock, not just during market hours. Tenev believes this model will eventually apply to almost everything: real estate, private equity, art, even commodities.

In his words, the movement toward tokenized finance will eat the entire system. This means that traditional markets won’t be able to keep up with blockchain’s speed, efficiency, and transparency. Long settlement times and layers of middlemen will make them less competitive as tokenized systems expand.

The challenge, however, is regulation — questions about ownership, custody, and compliance still need answers. Still, progress keeps building. As the rules take shape, major institutions are expected to move in, and the divide between traditional finance and crypto will start to fade.

Why Investors Are Moving Toward Real-World Utility Projects

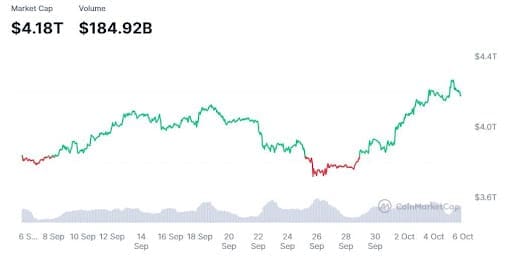

Tenev’s statement reflects a broader truth: traditional and digital finance are merging faster than many expected. The value locked in crypto markets is already more than $4.2 trillion, and tokenized assets could soon multiply that number.

Tokenization could make markets faster, cheaper, and more open. Instead of buying an entire property or waiting for a broker, investors could soon own fractions of real-world assets instantly. That kind of change opens the door to a new type of financial inclusion — one where people can participate in asset markets without needing millions of dollars or a Wall Street connection.

But tokenization also needs rails — systems that connect traditional money with crypto tokens. That’s why projects building practical payment tools are suddenly at the center of attention. Among them, Digitap ($TAP) stands out as a project building a platform designed for the tokenized economy that Tenev described.

Source: CoinMarketCap

How Digitap Is Building the Future of Banking

Digitap is merging crypto and fiat accounts into a single system, which would allow users to hold digital tokens and traditional currencies in one place, move funds across borders, and spend with ease. Its platform lets users pay in crypto or fiat anywhere Visa is accepted, without needing exchanges first.

Both virtual and physical cards are available, with Apple Pay and Google Pay support for simple mobile payments. The platform also plans to offer anonymous virtual cards and no-KYC onboarding for select services, which would give users greater privacy, flexibility, and control over how they manage and secure their funds.

Security isn’t an afterthought for Digitap — it’s built into everything the platform does. Funds are stored safely offline, and its smart contracts go through independent audits before release. Every transfer requires two-factor checks, and the system keeps an eye out for suspicious activity to stop it before it becomes a problem.

Why Digitap’s Next Round Could Move Fast

Why Digitap’s Next Round Could Move Fast

The $TAP token sits at the center of the system. It powers fees, cashback, staking, and premium features inside the app. The token design is deflationary, with a fixed supply of two billion coins, no buy or sell tax, and token burns that reduce supply over time.

Digitap’s presale is currently open at $0.0125 per $TAP token, which makes it one of the lowest-entry points among utility-driven tokens in Q4. The next round will raise the price to $0.0159. The team has locked its own tokens for five years, which shows long-term alignment rather than quick profit-taking.

Many analysts watching new projects say Digitap’s timing is ideal. With tokenization gaining real traction, the demand for payment systems that connect digital and traditional finance is set to rise sharply. If Tenev’s “freight train” analogy proves correct, the projects laying the rails now could be the biggest winners later.

Many analysts watching new projects say Digitap’s timing is ideal. With tokenization gaining real traction, the demand for payment systems that connect digital and traditional finance is set to rise sharply. If Tenev’s “freight train” analogy proves correct, the projects laying the rails now could be the biggest winners later.

For that reason, traders see Digitap as one of the low-cap gems in this cycle — a utility token that could grow 50x as adoption spreads and the product rolls out globally.

Best Crypto to Invest In Now

When a major CEO like Vlad Tenev says tokenization will “eat the entire financial system,” it signals that the future of finance is already being rewritten. The focus is shifting from speculation to real-world use — faster payments, fractional ownership, and borderless banking.

Digitap fits in that movement perfectly. Its product plan, token model, and early-stage pricing combine the two elements that matter most in crypto today: utility and timing. The presale is live and it offers early access before the price moves up.

To join the presale, users need to connect a crypto wallet such as MetaMask, choose the amount of $TAP they wish to purchase, and complete the transaction using ETH or USDT. Tokens will be claimable after the presale ends.

The freight train is moving fast and Digitap may be one of the few projects already building the track ahead of it.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Why Digitap’s Next Round Could Move Fast

Why Digitap’s Next Round Could Move Fast