The crypto market is regaining momentum as traders return to risk assets in the final quarter of 2025. With renewed liquidity, increased trading volumes, and optimistic macro signals, new debates have emerged in the digital asset space.

With countless coins vying for the spotlight, Solana (SOL) and MAGACOIN FINANCE have emerged as the most talked-about names this season. Across research desks, analysts are weighing their options, seeking to gauge which offers better prospects before year-end. While both have distinctive advantages, one is built on solid fundamentals, the other on early-stage growth momentum.

Solana (SOL) — Institutional Demand and Network Strength Drive Confidence

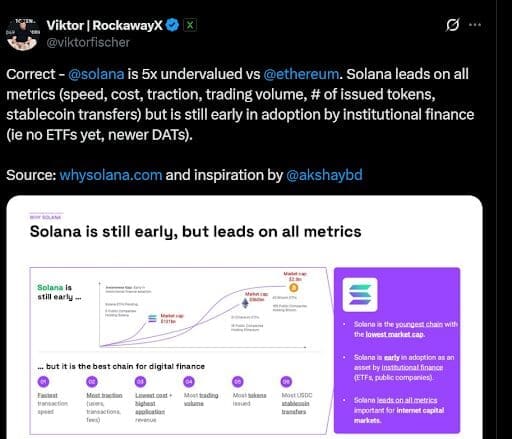

With its robust fundamentals in place, Solana remains attractive to investors worldwide. The network outperforms Ethereum on almost every major performance metric, yet many analysts still think SOL is underpriced given its capabilities.

Viktor Fischer, CEO of RockawayX, has emphasized Solana’s superiority in terms of transaction speed, cost efficiency, and network activity. According to data from whysolana.com, the blockchain leads in six key areas: fastest transaction speed, most users, most trading volume, most tokens issued, lowest transaction cost, and largest stablecoin transfers.

Source: X

Source: X

The interest from institutions is increasing. Solana-based investment products have crossed $500 million in total assets under management, with the Solana Staking ETF (SSK) offered by REXShares at $400 million, and BSOL ETP offered by Bitwise at $100 million.

Meanwhile, the Open interest for CME Solana futures recently reached its highest ever at $2.16 billion, a sign of institutional accumulation. This persistent momentum is expected to carry on as investors prepare ahead of the SEC’s looming decision on a potential Solana ETF.

This sustained capital inflows and network growth reinforce Solana’s position as a foundational Layer-1 asset throughout the remaining months of 2025.

MAGACOIN FINANCE — Presale Success and Growing Investor Interest

MAGACOIN FINANCE is quickly making a name for itself as one of the most promising new altcoins in 2025. Built as an Ethereum Layer-2 project, it is built around the idea of cheaper, faster, and more efficient blockchain-based smart contracts for decentralized applications.

The project’s presale has raised over $15 million from over 14,000 investors, indicating strong investor confidence.

With its well-defined structure and community interactions, analysts point out that MAGACOIN FINANCE structure assures how it shall keep itself sustainable for a long time, no matter how much it expands. With an exchange listing price estimated to be around $0.007 per token, it has gained traction on crypto forums and social networks.

Unlike established coins like Solana, MAGACOIN FINANCE provides early investors with an opportunity to enter before major price discovery. Its smaller market cap means it benefits from much higher upside potential if listing demand holds strong. Analysts suggest that this market position could lead to even sharper gains during the current quarter as liquidity continues to flow into new tokens.

Market Sentiment — Two Paths, One Common Momentum

Both Solana and MAGACOIN FINANCE are benefiting from an improving sentiment in the altcoin space. Solana’s mature ecosystem and institutional depth reassure risk-conscious investors. Meanwhile, MAGACOIN FINANCE is drawing those looking to gain greater growth potential from emerging assets.

Both have a high level of social activity, with more mentions on major crypto tracking sites. Analysts cited Solana’s appeal to long-term holders and MAGACOIN FINANCE’s appeal to newer investors who value low entry prices and growth potential.

With liquidity flowing back into the market, both altcoins could remain key drivers of trading activity through the remainder of Q4.

Final Take — Two Winners, Different Scales of Return

Solana represents strength, scale, and credibility as institutional exposure expands. MAGACOIN FINANCE, by contrast, offers agility and growth potential unmatched by larger-cap coins. Analysts agree that both are positioned to perform well, but MAGACOIN FINANCE’s smaller market cap could amplify its price movement if post-listing demand accelerates.

Both coins embody different market strategies — stability versus upside. Yet, together, they highlight the diverse opportunities shaping the 2025 crypto cycle, where proven networks and ambitious newcomers compete for investor attention.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance