Non-custodial bitcoin lending offers anyone with an internet connection and a Bitcoin wallet the ability to earn yield on their BTC or access bitcoin liquidity without having to sell any assets.

This guide will explain to you what non-custodial bitcoin lending is, how it works, the benefits and risks you need to know about, and how you can get started.

What Is Non-Custodial Bitcoin Lending?

Non-custodial bitcoin lending is a Bitcoin DeFi service that lets you lend or borrow bitcoin using other assets as collateral. The entire transaction is processed via a smart contract-enabled peer-to-peer arrangement and you never give up control of your assets to a third-party intermediary.

‘Not your keys, not your bitcoin’ is a warning that is often given in the crypto space to encourage investors to have full control of the private keys to their coins. In essence, letting others hold the keys on your behalf means that you don’t actually own your coins anymore.

Instead of trusting a company to hold and lend your bitcoin on your behalf, non-custodial lending allows you to directly lend BTC to others via a smart contract-enabled protocol. On their part, borrowers use crypto collateral, which is locked in the smart contract until the repayment is done.

Why Are Bitcoin Holders Turning to Non-Custodial Lending?

There are many reasons why bitcoin holders are choosing to explore non-custodial lending.

One of these reasons is the desire for bitcoin holders to stay in full control of their assets. This need has been fueled by the collapse of several centralized lending platforms.

The other reason that is making non-custodial lending attractive is the transparency that comes with the transactions. Since the details and terms of the transaction are on a smart contract that “lives” on the blockchain, everyone knows the rules up front and can see exactly what’s happening.

Last but not least, it’s a way to get value from your bitcoin without selling it. Many bitcoin holders believe that the price will go up in the long term, and therefore would rather HODL. Non-custodial bitcoin lending offers an opportunity to get yield from the bitcoin you’re HODLing.

How Does Non-Custodial Bitcoin Lending Work? An Example

Now, let’s take a look at how non-custodial bitcoin lending works in action.

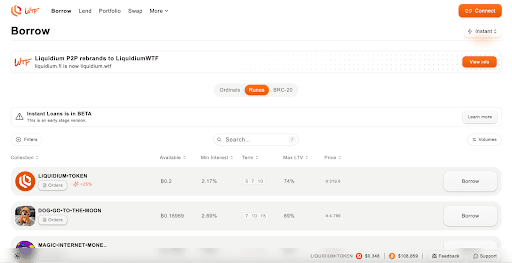

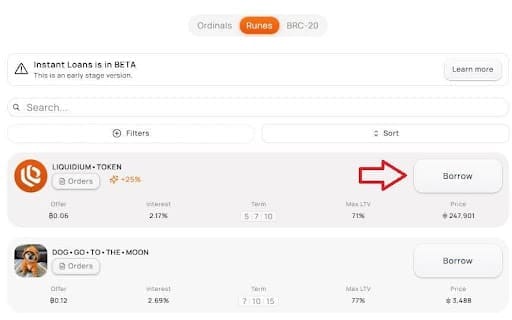

For our example, we are using Liquidium, a Bitcoin DeFi platform designed to collateralized bitcoin lending using Bitcoin-native assets like Ordinals and Runes as collateral.

Here’s how you can borrow BTC against Runes as collateral on Liquidium.wtf:

- Firstly, set up and fund a wallet that supports BTC and tokens issued on the Bitcoin blockchain. Xverse, Magic Eden, Phantom, or Unisat can serve you well here.

- Go to the lending platform, launch the app, and connect your wallet.

- Once you’ve connected your wallet, you’ll find the “Borrow” section on the dashboard, where you will have to choose the collateral you have and then the amount of BTC you would like to borrow.

- Make sure to check out the BTC loan conditions, such as interest, LTV, and duration, which you can adjust according to your repayment strategy.

- Consider the network fee that you will have to pay for the transfer of the loaned amount and then submit your loan offer.

- Confirm the transaction in your wallet and wait for a lender to agree to your loan terms.

- Once a lender agrees to your borrowing terms, you will receive your borrowed BTC, while your Runes tokens will be locked up as collateral for this transaction.

That’s it! You can now use the borrowed bitcoin however you please. When you pay your loan back on time, you will receive your Runes token collateral back in full after the lending period is complete.

What Are the Risks of Non-Custodial BTC Lending?

Non-custodial lending comes with major benefits. However, like with any other lending activity, there are risks to bear in mind. Understanding these risks can help you get the best out of non-custodial bitcoin lending.

The most notable risks to consider include:

- Liquidation risk due to the volatility of crypto prices.

- Bugs in the smart contracts could become vulnerabilities.

- Losing access to your wallet’s private keys.

You must learn how to mitigate these risks before you put your assets on any of the lending platforms.

Final Thoughts

Non-custodial bitcoin lending offers a great way to earn yield or access liquidity while maintaining control of your assets.

By retaining ownership of your private keys and using smart contract-enabled DeFi protocols, you can generate value from your BTC without relying on a third party. However, it’s important to be mindful of the risks involved, including liquidations and smart contract vulnerabilities.

As with any crypto investment activity, conducting thorough research, applying smart risk management practices, and staying updated on market conditions are essential to make the most of your non-custodial lending experience.

Disclaimer: This guide is for educational purposes only. Please conduct your own research and consider seeking professional advice before engaging in non-custodial lending or any other investment activities.