There’s a certain clumsiness to how we still pay for things. You’re standing in line, juggling your phone, your wallet, trying to remember the right PIN. Or worse, waiting behind someone else who’s doing the same.

Add to that the constant worry about fraud – cards being skimmed, accounts hacked, passwords leaked, and it’s easy to see why more people are ready for something different.

Biometric payments are quietly becoming that something. Not in a flashy, sci-fi way, but in small, practical moments. A thumbprint here. A face scan there. You’ve probably already used them without thinking much about it.

And the best part? You don’t need to do anything new. Your body already knows the code.

From Fingerprints to Faces: The Tech Behind the Shift

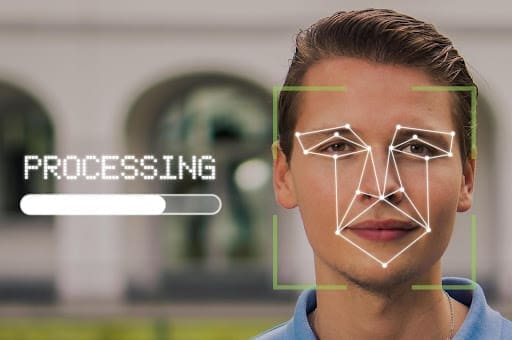

Biometric payment technology relies on something simple: your body becomes your ID. Instead of typing a code, your fingerprint or face confirms who you are instantly.

Here’s a closer look at how these systems function:

- Fingerprint scanning works by reading the tiny ridges on your finger and matching them to what’s stored on your device.

- Facial recognition, on the other hand, scans your face – usually with your phone’s camera, and checks it against a saved image to make sure it’s you.

- Iris scanning, though less widespread, offers even higher precision for authentication.

Behind the scenes, biometric payments are powered by:

- Secure chips built right into smartphones keep your biometric data safe.

- Mobile apps like Apple Pay and Samsung Pay use your face or fingerprint to make logging in and paying quick and easy.

- Tokenization, which replaces your actual card data with encrypted codes during transactions

What makes biometrics so appealing is that you don’t need to remember passwords or carry cash; your body becomes the key.

Biometrics in the Wild: Real-Life Daily Use Cases

Biometric payments are no longer just a glimpse into the future; they’re happening right now, including in South Africa. Thanks to a recent major upgrade by the Department of Home Affairs, the digital verification system that supports biometric ID checks is faster, more accurate, and more reliable than ever before. This system underpins not only government services (like verifying social grant recipients) but also powers the financial sector and private businesses to confirm identities securely using fingerprints and facial recognition.

You can already see biometric technology in use across different areas of daily life:

- Government services

- Banking and financial sector

- Retail checkouts

- Public sector integrations

These aren’t isolated examples; they show how biometric authentication is already becoming part of daily life in practical, visible ways.

Trust, Security, and What Consumers Still Worry About

Even with all the innovation, people have concerns – and rightly so.

What if my biometric data is hacked? Can it be changed like a password?

That’s the biggest fear. Unlike a password, you can’t “reset” your fingerprint. However, companies are aware of this and are working hard to:

- Encrypt biometric data at the source

- Store it locally on devices, rather than in vulnerable cloud servers

- Use multi-factor authentication, pairing biometrics with another method (like a device token)

Beyond Shopping: Where Else Biometrics Matter

Biometric technology isn’t just about faster shopping. It’s also gaining traction in places you might not expect:

- Hotels are testing fingerprint scans for check-ins, replacing ID cards.

- Government services are using facial recognition to prevent identity fraud in benefits systems.

- Banks and insurers are using biometrics to verify customers, especially as remote services grow.

And it’s not just shops and banks getting in on the trend. Entertainment platforms are picking it up too, though maybe not in ways you’d immediately notice. Whether you’re logging into a streaming service or playing an online game, more companies are starting to ask for biometric sign-ins – just a quick scan to get you in, without the hassle of passwords.

Even sites that offer online slots are beginning to use this kind of tech. It’s not just about making things easier. It helps confirm people are real, old enough, and not using multiple accounts. That way, it feels safer and more straightforward for everyone.

Crypto’s Role in the Biometric Ecosystem

Interestingly, cryptocurrency platforms are also exploring biometric security.

Take South Africa, for example. Experts suggest that aligning just one aspect of local crypto regulation with global standards could generate R540 million in additional tax revenue. As the country grapples with slow growth and high debt, digital assets – secured by biometrics – are being looked at not just as tools for personal finance but as drivers of national economic expansion.

It’s not a stretch to imagine a near future where buying crypto, logging into your digital wallet, and spending across borders will all require just a quick scan of your face.

Looking Ahead: What This Means for Everyday Users

Will wallets become obsolete? Not just yet.

As more phones, shops and apps start using biometrics, the way we pay is slowly changing. No more digging for your card or trying to remember a PIN. If you already use your face or fingerprint to unlock your phone, you’re pretty much used to it already. The more people trust it, and the better the tech gets, the more likely it is that paying this way will become completely normal.