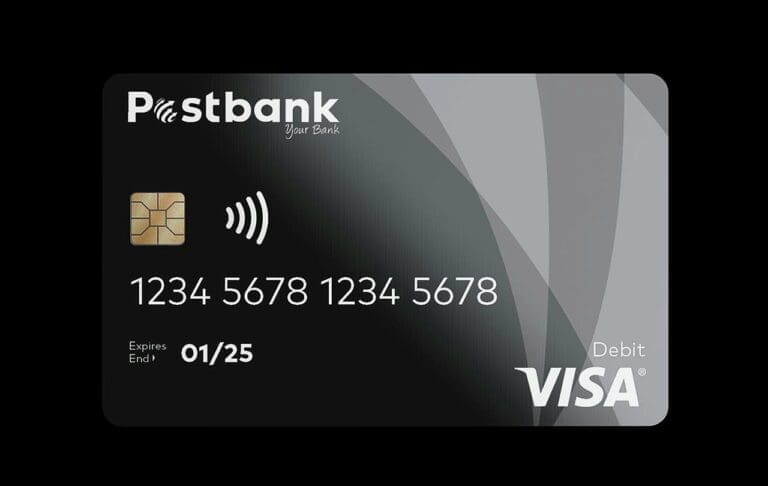

- Postbank and SASSA are racing against the 20 March deadline to replace 1.4 million expiring Gold Cards.

- In the Western Cape, more than 190,000 people still need to replace their cards with the new Black Cards.

- SASSA also said it is addressing long queues and staff shortages at its offices, while exploring doctor-initiated assessments to reduce office visits for disability grant applicants.

- The Agency also announced plans to implement biometric verification for all Social Relief of Distress grant beneficiaries to mitigate fraud and ensure the correct recipients are receiving grants.

Postbank and the South African Social Security Agency (SASSA) are racing against the clock to replace expiring Gold Cards. With the 20 March deadline fast approaching, about 1.4 million people still need to replace their cards with the new Black Cards.

This emerged during a media briefing on Thursday night at the President Hotel in Cape Town, where SASSA acting CEO Themba Matlou detailed the agency’s plans and challenges.

In the Western Cape alone, SASSA had to replace about 322,000 Gold Cards. According to SASSA’s provincial acting regional manager, Sibusiso Nhlangothi, over 102,000 Gold Card holders have switched to the new Postbank Black Card. About 28,000 beneficiaries opted to get their grants paid to other bank accounts. This means there’s still about 190,000 people who still need to replace their cards by next Thursday.

“We are optimistic that, with Postbank adding resources, like the partnership with SPAR, and beneficiaries opting to switch banks, we can manage the numbers if we don’t migrate all beneficiaries by the deadline,” said Nhlangothi, adding that the current cards are expected to stop functioning at the end of the month.

Social Development MEC Jaco Londt voiced concerns during the briefing, stating that many beneficiaries do not have access to enough service points to complete the transition. “SASSA provides a lifeline to the most vulnerable in the province, and without that lifeline, many will suffer,” he said.

Londt acknowledged the many people who have stepped in to help, including ward councillors and MPs. “We’re seeing banking institutions also stepping up,” he said, urging Postbank to act quickly with less than a week before the deadline.

Speaking to GroundUp, Londt expressed disappointment that SASSA’s event to discuss grants given to the most vulnerable groups, turned out to be a fancy plated dinner at the President Hotel.

“While I’m pleased that SASSA is at least playing open cards and communicating, I’m disappointed that the media briefing we were invited to turned out to be an unnecessarily lavish affair.”

“The agency should focus its resources on helping Postbank better manage the card migration process in the Western Cape. With less than a week to the deadline, it’s imperative Postbank increase service points and have roving teams in rural areas. We’re just not seeing this happen yet,” Londt said.

The briefing was hosted at The President Hotel in Bantry Bay where SASSA discussed the plight of the poor.

Vulnerabilities in the SRD grant system

Matlou said there are plans to implement biometric verification for all Social Relief of Distress (SRD) grant beneficiaries in the new financial year to combat fraud within the system. This follows findings of fraud in the SRD grant system by two Stellenbosch University students and a subsequent investigation by SASSA, which confirmed significant security flaws.

Matlou explained that they are reconfiguring the system’s rate-limiting capabilities, which would limit the number of times a second the system can be queried by a hacker. “We’ve also strengthened income checks with various banks so that people who apply are the right people,” he said.

Currently, SRD grant recipients who change their details or are suspected of fraud need to undergo biometric verification. They’re working with Home Affairs to implement this. “This will help us ensure that the right people are receiving the grants,” he said.

Long queues and not enough service points

Long queues at SASSA offices continue to be a major concern, especially in the Western Cape. Matlou acknowledged that part of the problem is insufficient service points and staffing shortages.

“We’ve written to the national minister of Public Works, to prioritise the Western Cape. The minister has responded positively, and we’ll meet soon to address outstanding office requests,” Matlou said.

SASSA is also in the process of hiring more front desk staff. “We know some people visit local offices despite online applications being available. So, we’re bringing in more capacity to reduce long queues,” Matlou added.

Nhlangothi said most people who queue at SASSA offices are applying for disability grants. “24% of those applying for disability grants are declined,” contributing to longer queues as rejected applicants make multiple trips back to the office, he noted.

To improve this, SASSA is exploring doctor-initiated assessments. This will allow state-appointed doctors to assess applicants before they visit a SASSA office.

Nhlangothi said that many people show up without appointments. He explained that SASSA takes bookings based on the number of staff at that office. “If the number of people in the office will allow us to see 200 people, we’ll book 200 people,” he said.

SASSA is actively encouraging more beneficiaries to use the online application system to streamline the process.

With SASSA set to administer R284-billion in social grants for the 2025/26 financial year, Matlou emphasised: “In the social sector, we carry the hopes of many people in our society — the marginalised, the vulnerable, and the poorest of the poor. We can’t afford to sleep on the job.”