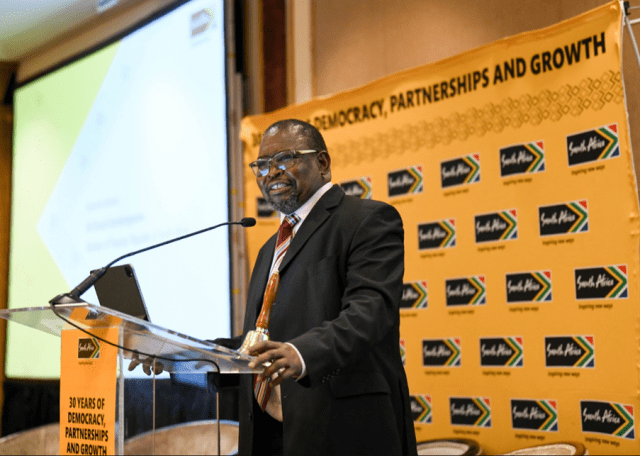

Finance Minister Enoch Godongwana has invited public comments and written submissions on draft amendments to the Money Laundering and Terrorist Financing Control Regulations.

“The draft amendments aim to strengthen South Africa’s system to combat money laundering and terrorist financing by enhancing the reporting of the conveyance of cash or bearer negotiable instruments into or out of the Republic,” National Treasury said on Tuesday.

The invitation for comments was published on 8 April 2024 via Gazette Notice 50450 no 4712.

The draft amendments are in terms of section 77(5)(a) of the Financial Intelligence Centre Act, 2001 (Act No. 38 of 2001 – ‘the FIC Act’).

“The draft amendments are proposed to be made in terms of section 77(1) of the FIC Act, read with section 30 of the FIC Act, to the Money Laundering and Terror Financing Control Regulations.

“Section 30 of the FIC Act provides for a requirement to report the conveyance of cash or bearer negotiable instruments into or out of the Republic to the FIC,” National Treasury said.

The objective of section 30 of the FIC Act is to ensure that information relating to the cross-border movement of cash and bearer negotiable instruments is made available to the FIC.

The FIC currently receives reports on cross-border electronic funds transfers (section 31 of the FIC Act).

In addition, the FIC receives reports on large cash transactions (section 28 of the FIC Act), suspicious or unusual transactions (section 29 of the FIC Act) and property that is linked to persons or entities who are subject to targeted financial sanctions (section 28A of the FIC Act).

“The proposed draft amendments are aimed at strengthening the country’s financial system and improve its resilience against abuse by money launderers and terrorist financiers. It is critical to the effectiveness of the FIC’s operational capabilities that the information it receives concerning cross border financial flows be expanded to include cross-border movement of cash and bearer negotiable instruments.

“This is envisaged to strengthen the FIC’s ability to detect possible suspicious or unusual activity and to disseminate the relevant information to investigating and prosecuting authorities. Section 30 of the FIC Act empowers the Minister to prescribe a threshold amount that will trigger reporting under this section.

“The Minister sets this amount through regulations that will support the implementation of reporting under section 30 of the FIC Act. The Minister proposes that the threshold for reporting under section 30 of the FIC Act be set at R24 999.99,” National Treasury said.

This means that persons who convey R25 000 or more into or out of the Republic will be required to report this under section 30 of the FIC Act.

Section 30 of the FIC Act also empowers the Minister to prescribe the information that must be included in a report on the conveyance of cash or bearer negotiable instruments.

“This information must be sufficient to provide the FIC with the necessary transparency and traceability information concerning the cross-border movements of cash and bearer negotiable instruments.

“A report under section 30 of the FIC Act must be made to a person who is authorised by the Minister to receive such a report. The Minister, after consulting with the South African Revenue Service (SARS), has determined that reports under section 30 can be integrated in reporting under the Customs and Excise Act of 1964,” National Treasury said.

To this end, the Minister intends to authorise Customs Officers to receive reports on the conveyance of cash or bearer negotiable instruments, either physically at ports of entry and exit, or electronically through the traveller declarations system that SARS has developed for this purpose.

The proposed Regulations:

(a) prescribe a threshold amount that will trigger reporting under section 30 of the Act;

(b) prescribe the information that must be included in a report on the conveyance of cash or bearer

negotiable instruments; and

(c) specify the person who is authorised by the Minister to receive a report under section 30 of the Act.

A copy of the Regulations and the Explanatory Memorandum are available on the National Treasury website: www.treasury.gov.za.

Written comments and submissions may be submitted to: [email protected] no later than 19 April 2024. – SAnews.gov.za