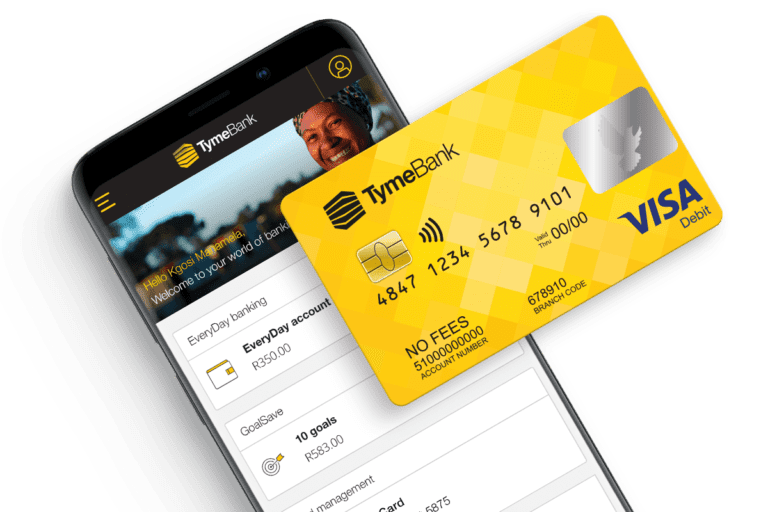

TymeBank, one of the world’s fastest growing digital banks, today announced that it reached its first month of profitability in December 2023, less than five years since launching in February 2019.

This makes it the first digital bank to break even in South Africa and on the continent. This milestone marks a pivotal moment for South Africa’s only black-controlled bank, making it one of the fastest growing digital banks globally, and the first African digital bank ever, to reach this milestone.

“We are extremely proud of our achievement, particularly when you consider that globally, less than half of the top 100 digital banks are profitable. In fact, a recent study stated that less than 5% of all neobanks worldwide had reached profitability,” said Coenraad Jonker, CEO of TymeBank.

And of those that are in the black, most have taken a lot longer to become profitable; notable examples being Latin America’s Nubank and London-based Monzo, which took eight and seven years respectively.

“Having achieved our first month of profitable operations in a significantly shorter timeframe is a South African success story that our 8.5 million customers can share with pride,” said Jonker.

The digital bank owned by billionaire Patrice Motsepe was launched in February 2019.

“As the country’s first digital bank we’ve overcome numerous challenges as we consistently innovated and broke new ground in the market. Through it, our team has remained focused and committed to our mission of providing South Africans with affordable, accessible, and quality banking services. This purpose has clearly resonated with consumers given our rapid growth, high levels of customer satisfaction and the successful introduction of a wide range of products and services,” Jonker added.

He added that the company was excited about what lies ahead as we build on this momentum to continue offering great value to our customers.

“We believe that we are now perfectly aligned with our goal of becoming one of the top three retail banks in the country. This ambitious target is our next measurable benchmark for success, one that will require strategic focus across all areas of our business. However, we are confident that our proven track record of success positions us well to achieve this audacious aim in the next few years,” stated Jonker.

The bank attributes its success to several key factors:

- Its unique model of combining digital channels with in-store kiosks at major retailers, consistently acquiring ~150,000 customers each month

- The long-standing, strategic relationships with Pick n Pay and Boxer, The Foschini Group (TFG) and the Zion Christian Church (ZCC)

- The rapid ~30% growth of its lending portfolio year-on-year, driven by Merchant Cash Advance, which is now financing more than 50,000 SMEs across the country

- The continued confidence of our shareholders in TymeBank, as evidenced by the Tyme Group’s successful capital raise last year, despite a tepid economic landscape

- the consistent innovation and launch of a list of firsts, including the most affordable banking offering in South Africa; the ability to open a bank account in under 5 minutes; South Africa’s leading fixed deposit savings rate of 11%; the launch of interest-free Grant Advance for social grant recipients; the launch of healthcare insurance (TymeHealth) in collaboration with the National Healthcare Group – a banking first in South Africa; and the launch of the buy-now-pay-later product, MoreTyme at a time when the concept was relatively unknown in South Africa.

TymeBank Chairperson, Thabani Jali, said: “Congratulations to the TymeBank team on an extraordinary achievement.

“On behalf of the board of directors and TymeBank’s leadership team, I must extend my gratitude for our investors’ continued faith in our vision and their commitment to our collective success. Their trust in TymeBank’s team has been instrumental in driving us to this outcome. To appreciate their investment, we are committed to building a sustainable future that delivers a solid return on investment.”

TymeBank has no monthly banking fees and in most cases, transaction costs are 30 to 50% lower than what customers would pay at other banks.

Dr Patrice Motsepe, Founder and Chairman of major shareholder African Rainbow Capital (ARC) said: “TymeBank’s landmark achievement comes after more than four years of dedicated effort, strategic investments, and an unwavering commitment to the business’s core mission to offer quality banking services to all South Africans. Having attracted more than 8.5 million customers, TymeBank’s unique proposition continues to digitally disrupt and transform the banking sector. And as the business evolves, we are seeing it gradually appeal to more affluent consumers who appreciate its unrelenting innovation, customer-centric transparency and accessibility.”

Also read: TymeBank Pays R200M In Unclaimed Motor Industry Retirement Funds Using Biometric ID