Top Sub-Saharan African banks suffered a 15% drop in fees from advising on mergers and acquisitions (M&A) in 2020 as a fall in overall dealmaking transactions ate into their revenues.

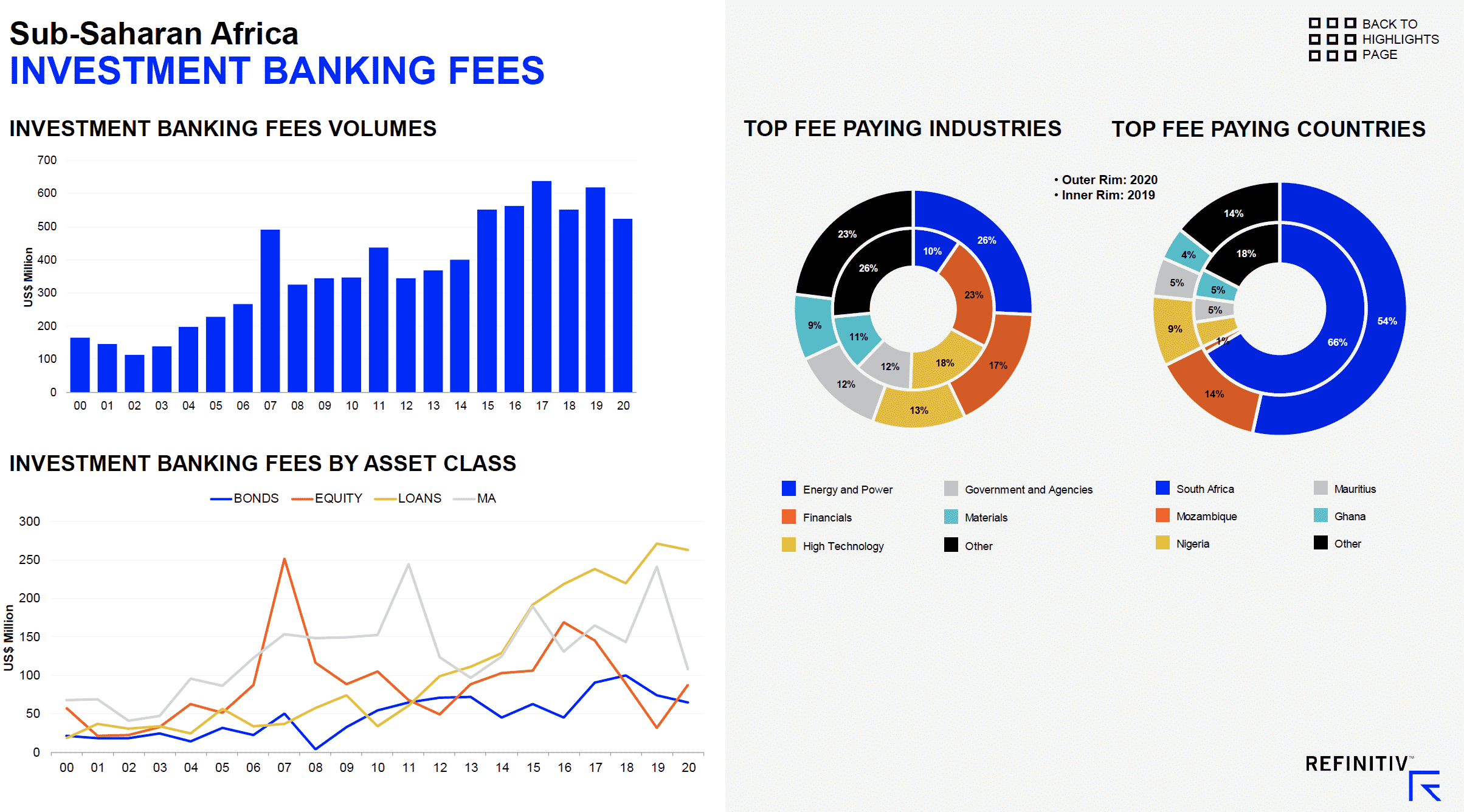

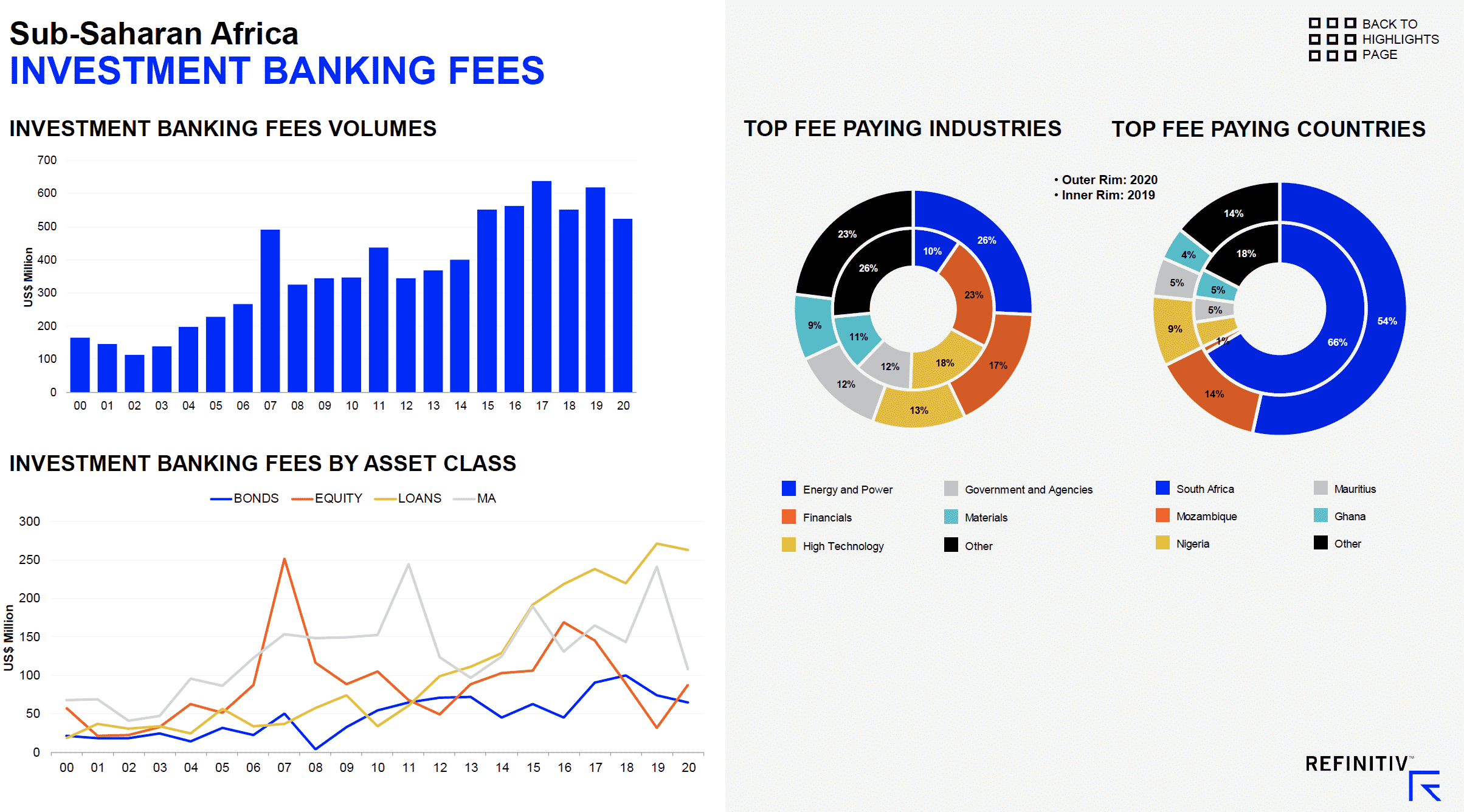

An estimated $523.7 million (R8 billion) worth of investment banking fees were earned in Sub-Saharan Africa during 2020, down 15% from 2019 and the lowest annual total in six years, according to data provider Refinitiv.

Fee declines were recorded across M&A advisory, debt capital markets underwriting, and syndicated lending.

Advisory fees earned from completed M&A transactions generated $108.3 million (R1,6 billion), down 55% year-on-year to the lowest level since 2013. Debt capital markets underwriting fees declined 13% to $64.9 million (R1 billion), a four-year low, while syndicated lending fees fell 3% to $263 million (R4,1 billion). Equity capital markets underwriting fees totalled $87.5 million R1,3 billion), almost three times the value recorded during 2019.

Refinitiv said fees generated in the energy & power sector account for 26% of total investment banking fees earned in the region during 2020, up from 10% during the same period last year, while the financial and technology sectors account for 17% and 13% respectively. South Africa generated the most fees in the region, a total of $279.9 million (R4,3 billion) accounting for 53%, followed by Mozambique with 14%. Boosted by lending fees, Sumitomo Mitsui Financial Group earned the most investment banking fees in the region during 2020, a total of $57.3 million (R884 million) or an 11% share of the total fee pool.

Mergers & Acquisitions

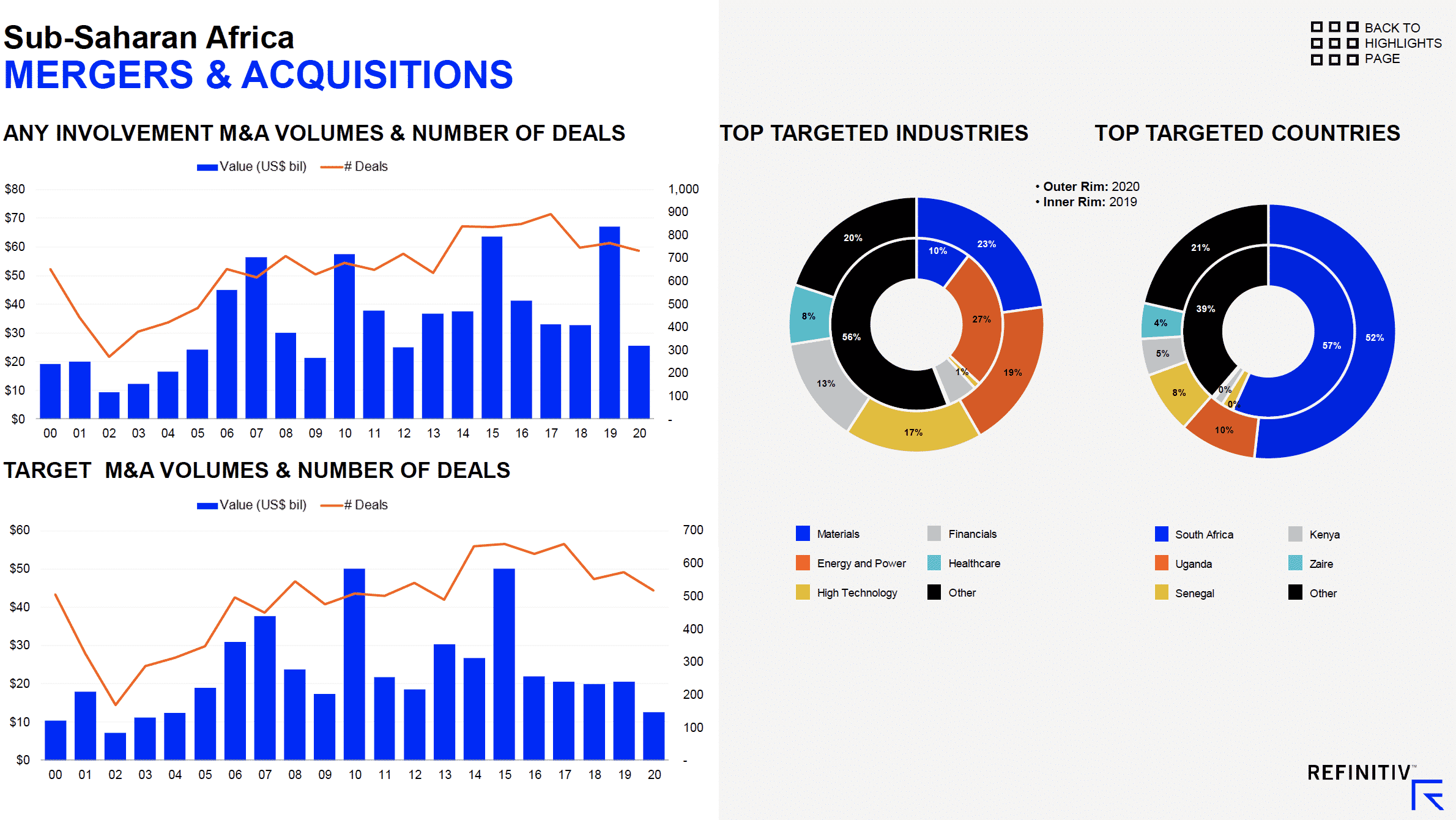

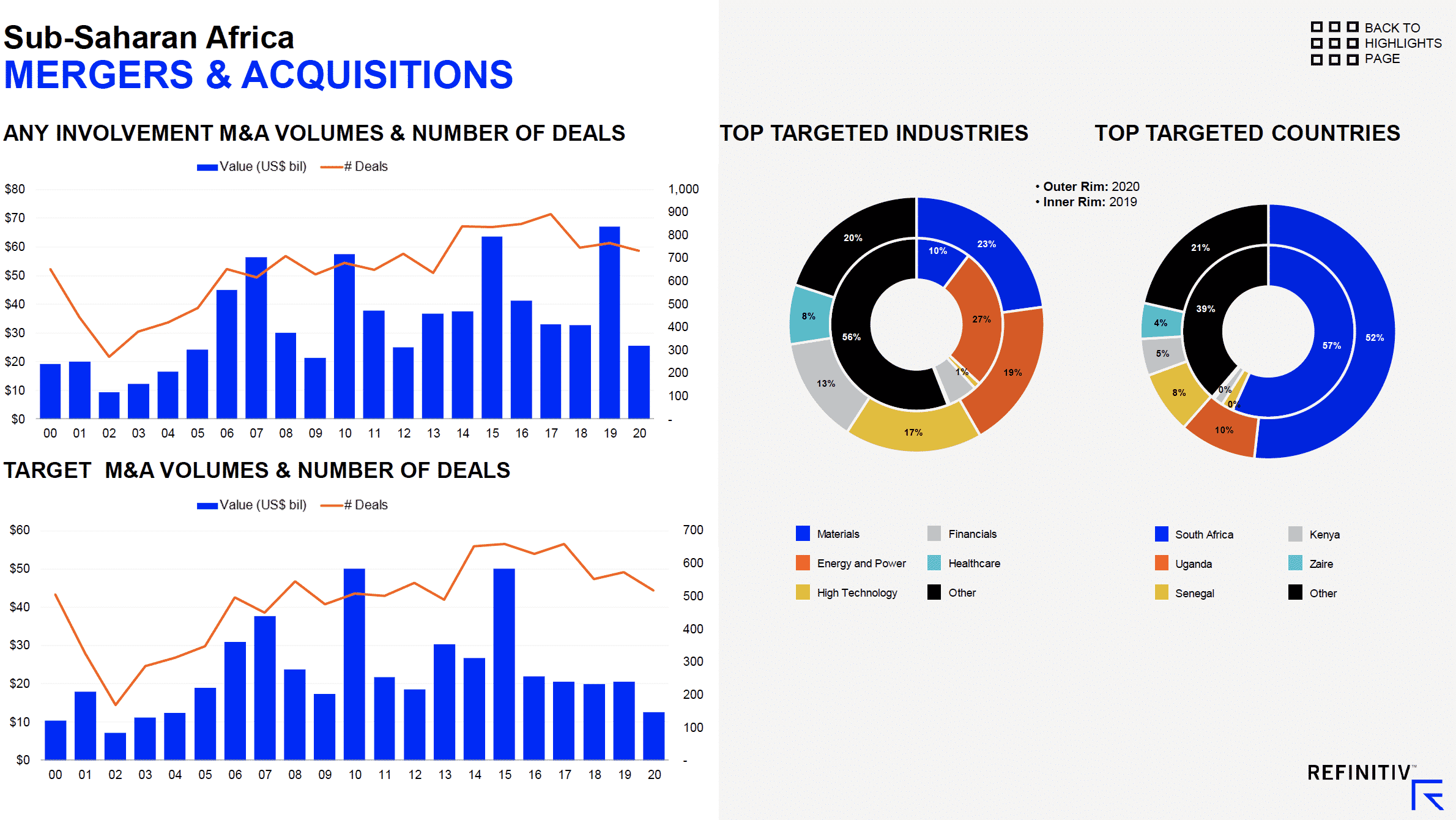

The value of announced M&A transactions with any Sub-Saharan African involvement reached $25.7 billion (R403 billion) during 2020, 62% less than the value recorded during 2019 when Naspers’ $35.9 billion (R558 billion) internet assets spin-off boosted merger activity to an all-time high.

The value of deals recorded in 2020 is the lowest annually since 2012. The number of deals declined 5% from last year to a seven-year low.

The value of deals with a Sub-Saharan African target declined 39% to a sixteen-year low of $12.5 billion (R201 billion) as domestic M&A within the region declined 44% from last year and the combined value of inbound deals reached just $7.1 billion (R108 billion), the lowest annual total since 2009.

Chemicals company Sasol agreed to sell a $2 billion (R31 billion) stake in LyondellBasell in October, the largest deal in the region during 2020. Boosted by this deal, materials was the most active sector for deal-making during 2020, accounting for 23% of Sub-Saharan African target M&A activity, followed by energy & power (19%) and technology (17%). South Africa was the most targeted nation, followed by Uganda. Outbound M&A reached a three-year high of $6 billion (R93 billion) during 2020, 13% more than the value recorded during 2019. The value was boosted by Angolan state-owned Sonangol’s purchase of PT Ventures from Africatel Holdings for $1 billion (R15 billion) and Templar Investments’ $1 billion offer for Jindal Steel’s Oman unit. With advisory work on twenty deals worth a combined $4.4 billion (R62 billion), JP Morgan holds to the top spot in the financial advisor ranking for deals with any Sub-Saharan African involvement during 2020.

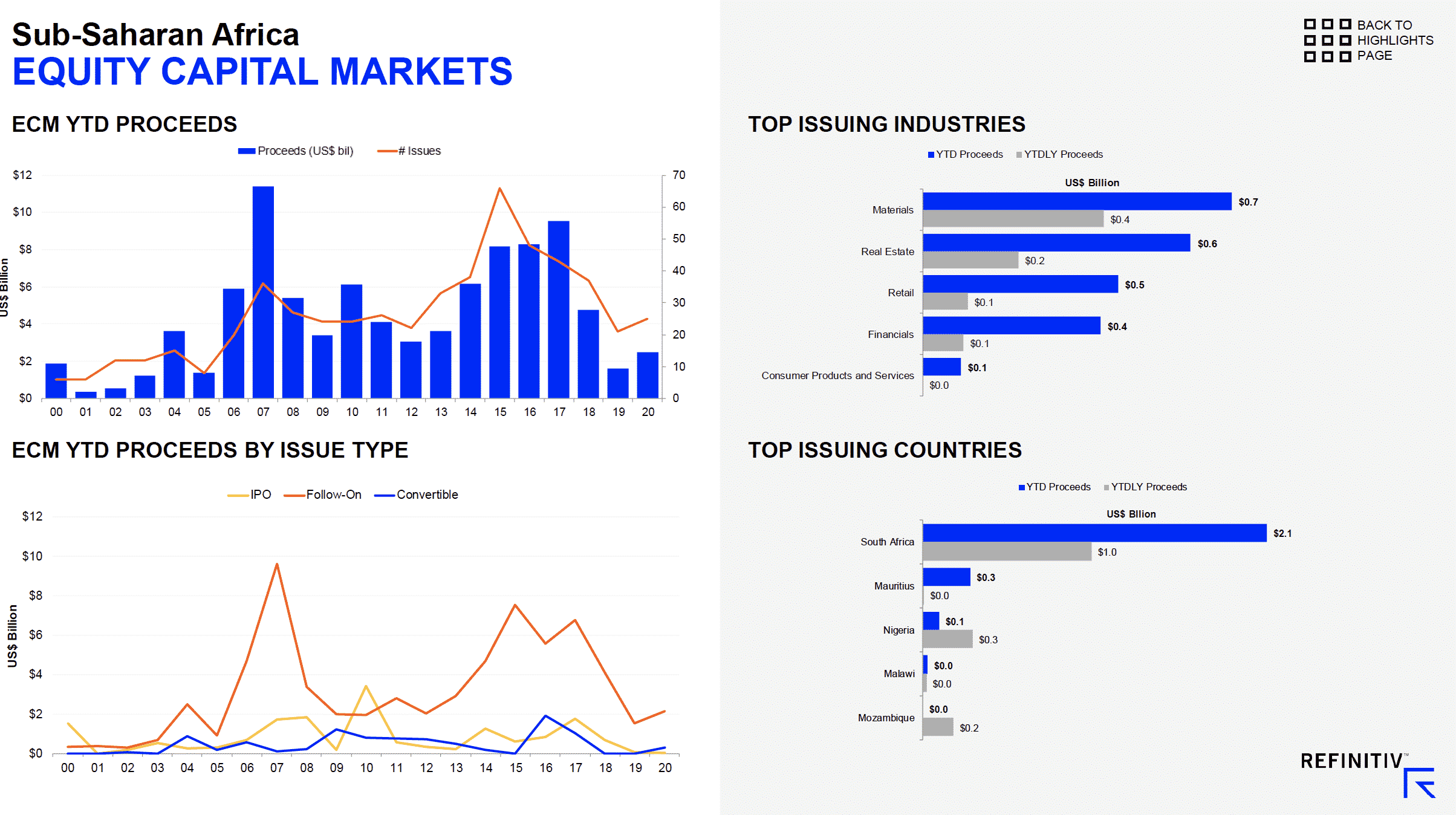

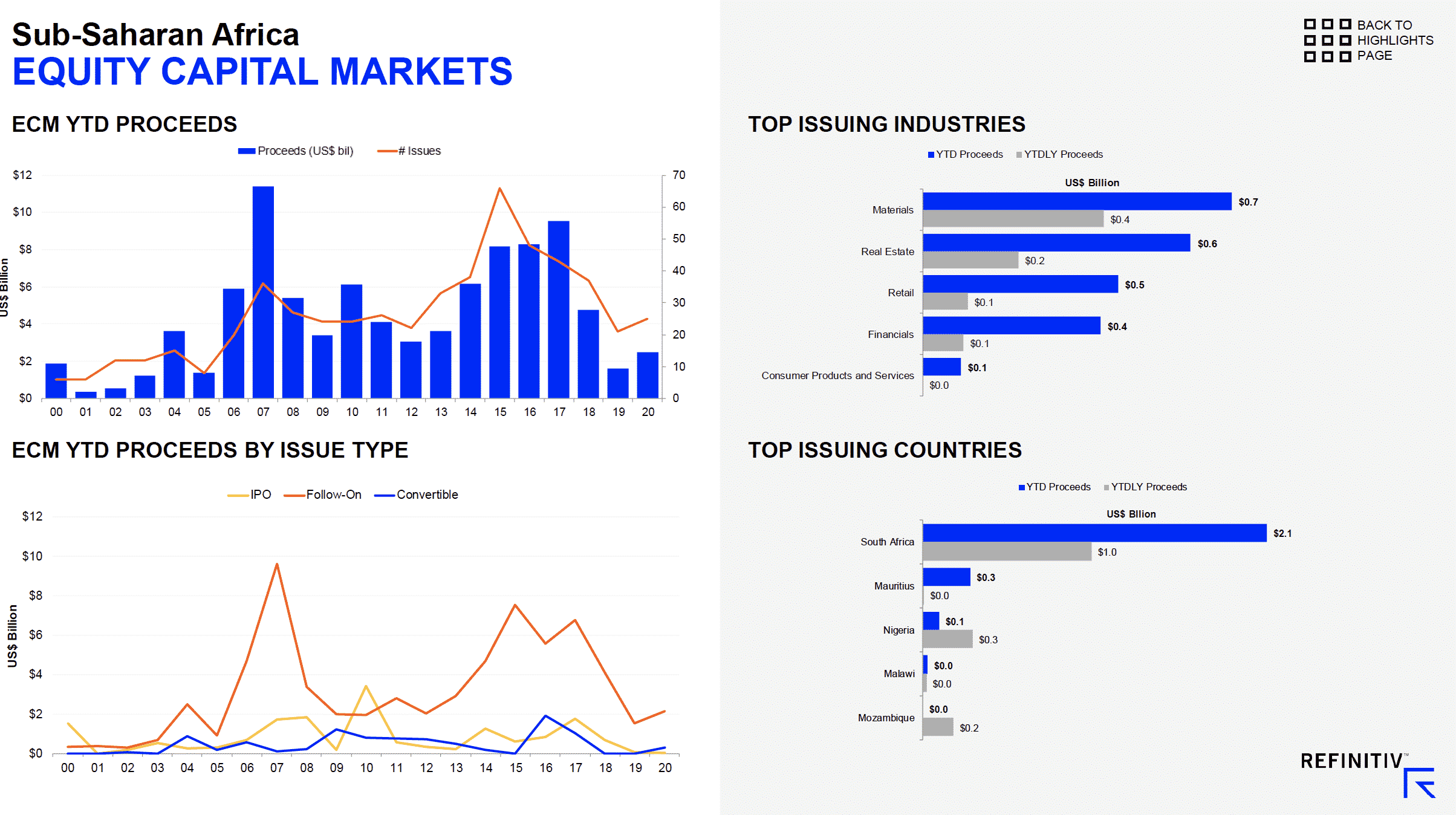

Equity Capital Markets

Sub-Saharan African equity and equity-related issuance reached $2.5 billion (R38 billion) during 2020, 54% more than the value recorded during the previous year, but lower than every other annual total since 2005. The number of deals recorded increased by 19% from 2019 but was lower than any other yearly tally since 2012. One initial public offering was recorded during 2020, compared to three in 2019. Malawian telecoms company, Airtel Malawi, raised $28.7 million (R434 million) on the Malawi Stock Exchange in February. JP Morgan took first place in the Sub-Saharan African ECM underwriting league table during 2020.

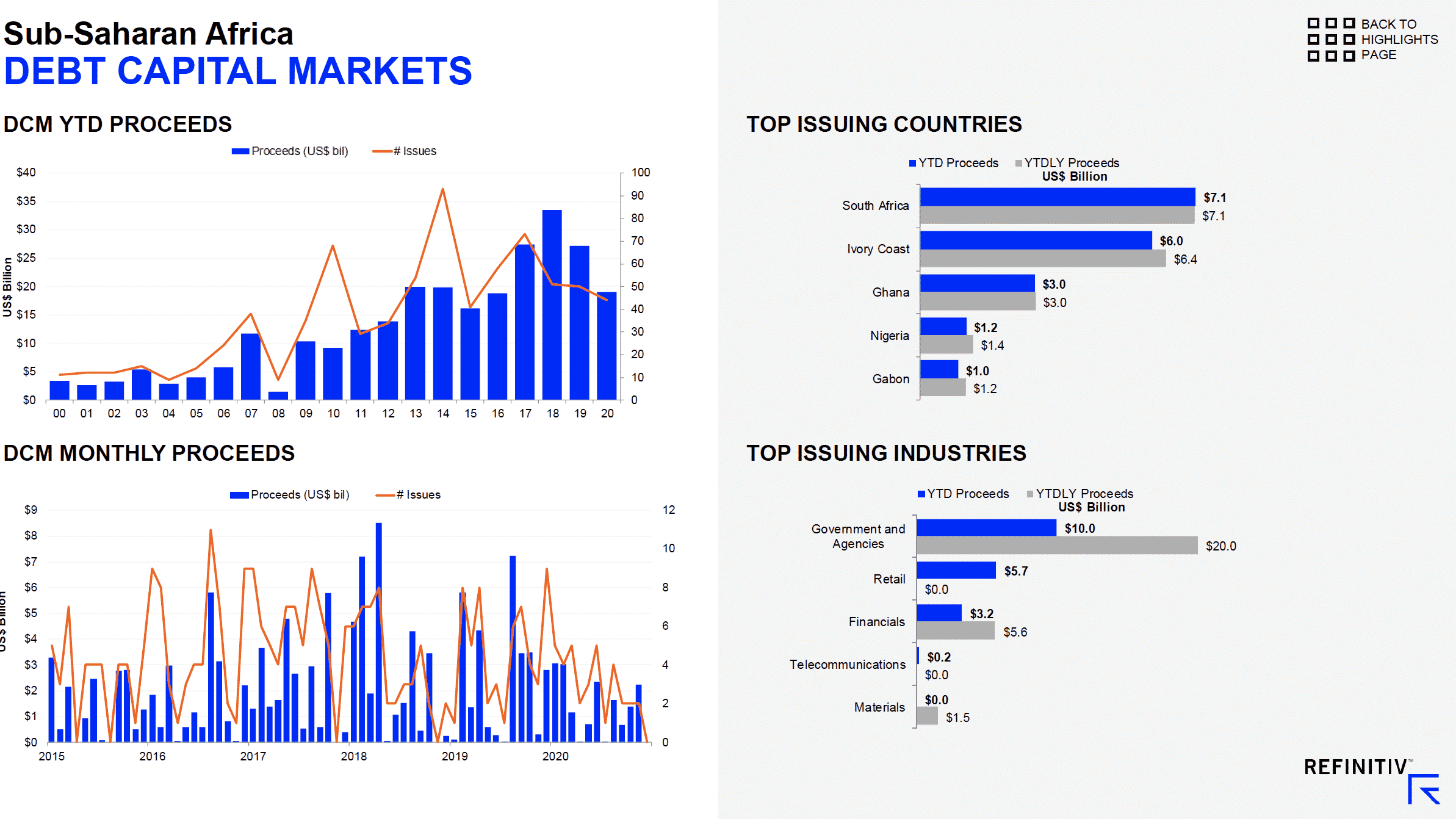

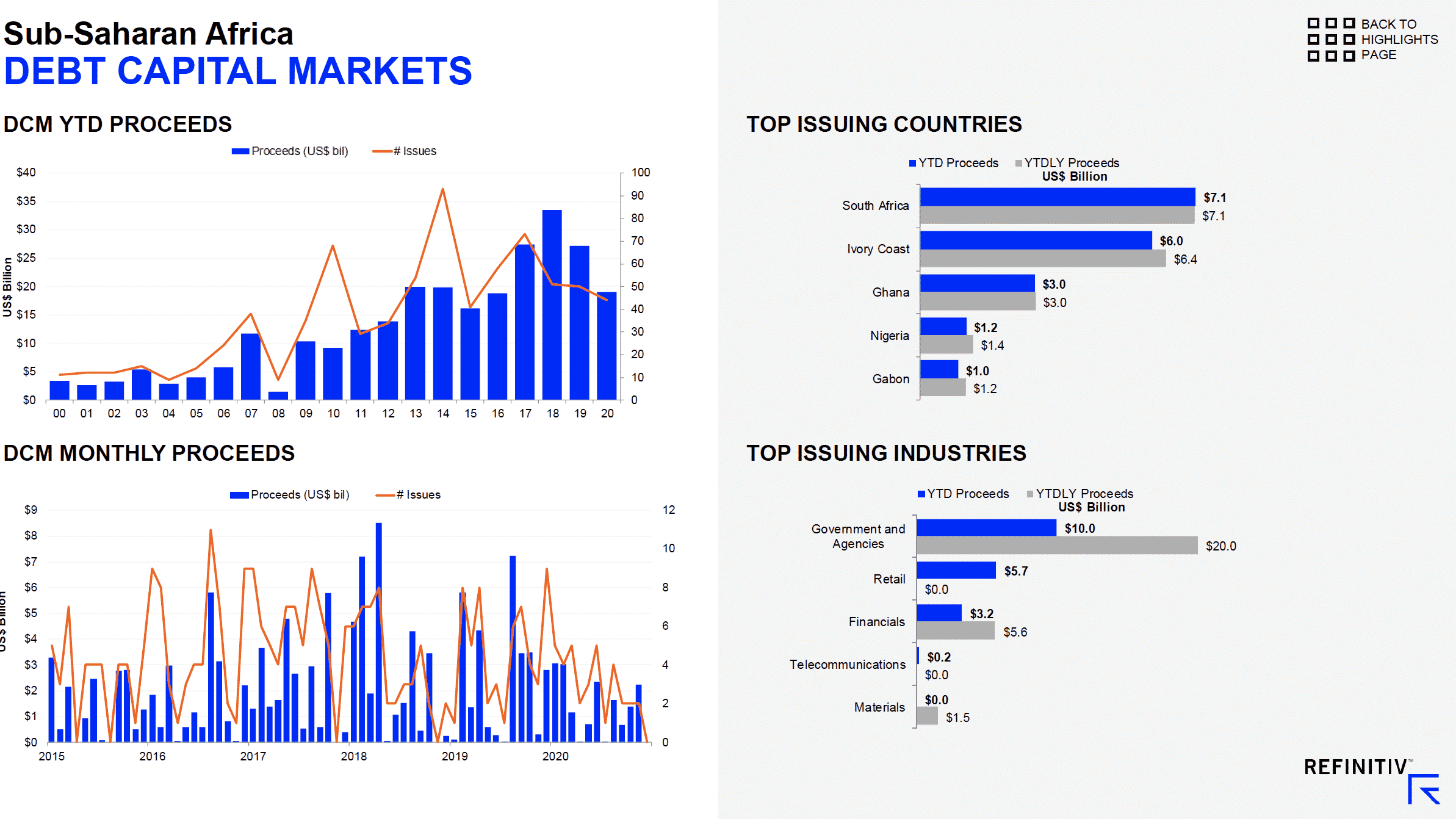

Debt Capital Markets

The African Development Bank raised $3 billion (R46 billion) in a “Fight Covid-19” social bond at the end of March to help alleviate the economic and social impact the Coronavirus pandemic will have on livelihoods and economies in the region. With this deal and Ghana’s $3 billion Eurobond in February, Sub-Saharan African debt issuance totalled $8.9 billion during the first quarter of 2020, the second-highest first quarter DCM total in the region of all-time. Only $1.9 billion was raised during the second quarter, the lowest quarterly total in eight years, followed by US$4.0 billion during the third quarter.

Prosus raised $2.2 billion in December, boosting fourth-quarter bond issuance in the region to US$4.3 billion. The total proceeds raised during 2020 is US$19.0 billion, down 30% from last year and a four-year low.

Deutsche Bank took the top spot in the Sub-Saharan African bond underwriter ranking during 2020 with US$2.6 billion of related proceeds, or a 13% market share.