South Africa’s Telkom has published its 2020 integrated annual report, which shows the group’s ownership by geographical region.

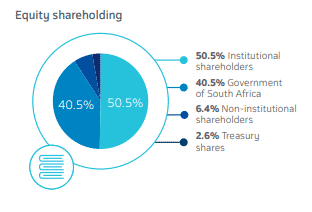

As of 31 March 2020, Telkom is 50.5% owned by institutional investors, 40.5% held by the Government of South Africa, 6.4% is owned by non-institutional investors, and the remaining 2.6% is held as treasury share.

Broken down into geographical regions, Telkom’s ownership is as follows:

-

-

- South Africa – 44%

- United States of America – 37%

- United Kingdom – 9%

- Europe – 6%

- Rest of the world – 4%

-

Despite South Africans owning 44% of the telco, foreigners seem to have an appetite for buying shares in Telkom. Foreigners continue to see value in a business that is undergoing a restructuring of its business as it deals with declining performance in fixed-line voice services and migration into mobile data, fibre networks and financial services.

Foreigners now own 56% of Telkom shares, which is a vote of confidence.

Here are Telkom’s top institutional investors

- PIC – 14.8%

- Acadian Asset Management – 2.6%

- LSV Asset Management – 2.3%

- The Vanguard Group – 2.3%

- Dimensional Fund Advisors – 2.3%

- BlackRock Institutional Trust Company – 2.1%

- Sanlam Investment Management 1.7%

- Grantham Mayo Van Otterloo & Co LLC 1.5%

- Allan Gray (Pty) Ltd 1.1%

- State Street Global Advisors (US) 1.1%

Telkom Dividend

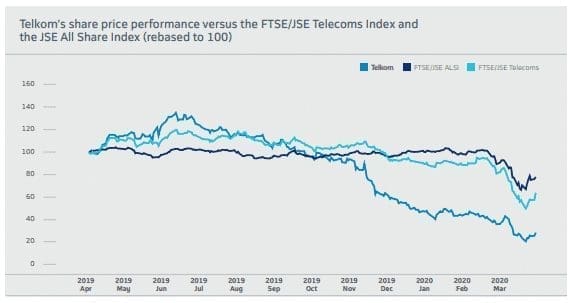

Two months ago, Telkom declared a dividend of 50.08 cents per share for the year to March 2020.

Telkom also suspended dividends for three years as part of its plans to conserve cash after a 66% drop in full-year earnings.

Telkom shares performance

2 Comments

And we the consumer suffer ..due to bad bad services

Telkom is one of the most useless companies in SA.

All they can do is to steal the customers money.

This ANC government should close down Telkom and save the tax payers money and frustration.