The performance of the share price of Welkom Yizani, the black economic empowerment (BEE) shares of Media24, continues to disappoint investors.

Investors paid in a subscription of R10.00 per share at the establishment of the scheme in 2006.

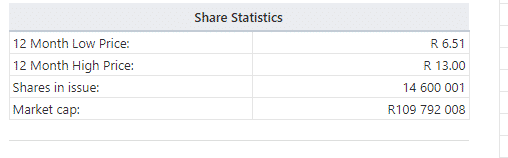

In the past 12 months, the share price has reached a low of R6.51 per share and at the same time shot up to a high of R13.00 per share.

The stock on Tuesday was trading at R7.52 per share and yesterday was at R7.50 per share. This is way below the subscription price of R10.00 per share.

Investors of Welkom Yizani are losing money on this stock.

There are 14.6 million shares on issue valued at R109 million.

The more the share price is trapped below the R7.00 level it means Welkom Yizani investors who want to sell will make a big loss.

As a result, multitudes of initial investors in the empowerment scheme had already lost patience and exited the investment at a loss.

But Welkom Yizani shares had been trapped close to R7.00 per share for more than a year which caused much consternation from initial investors.

These investors paid in a subscription of R10.00 per share at the establishment of the scheme in 2006. Then the scheme’s shares were listed for trading on an over the counter platform on the 9th of December 2013. The shares were stuck at R10.00 for more than a year and at one point sunk to R3.50.

This meant that thousands of initial investors in Welkom Yizani were losing money. Many did sell at R10 and below out of frustration.

Welkom Yizani holds a 15% stake in Media24, a print media dominated operation within the Naspers stable.

Media24 has not had the best of times in the past few years as profitability suffered. This was largely a result of dwindling advertising revenue.

Media24 is one of the largest media companies in the country with huge exposure to the struggling print media. Its assets include well-known titles like City Press, Daily Sun, Beeld, Rapport and a host of knock and drops and magazines and printing assets.

The company also owns 51% of eCommerce fashion platform, Superbalist.

In its latest financial results, Media24 reported excellent results for the six months to end-September 2019, boosted by strong growth in eCommerce revenue, higher school textbook orders and stringent cost management throughout the company

Media24’s revenue increased by 6% year-on-year to R2.4 billion, while the trading loss decreased by 84% to R28 million. Core headline results improved from a loss of R111 million to a profit of R63 million over the period.

Explaining this performance, the group said “Our growth portfolio (detailed below) performed especially well by more than halving its trading loss year on year as our investment in eCommerce (online retail) and streamlining our digital media operations started to deliver results. We continue our strategic journey to build a sustainable future for Media24 in an increasingly digital landscape.”

But the performance of Welkom Yizani has failed to track the financial recovery being experienced by Media24.

When the Welkom Yizani shares were listed in 2013, investment analysts assigned a to the BEE shares a met asset value (NAV) of about R25 per share. That NAV should have advanced further after dilution of debt in the past years. – [email protected]

6 Comments

Ek het Welkom yizani bee andele in 2006 gekoop

. Ons is nou in jaar 2020 . Volgens bee andele skema wet ,is die tydperk 10 jaar termyn. Ek weet andele pryse gaan op en af. Daarvan is ek 100% bewis. My vraag is die 14 jaar tyd perk .

I bought 50 share from Welkom yizani in 2006. It’s almost 14 years now and I tried on several occasions to sell my shares because this company is working at a loss and it doesn’t promise anything better soon. Which is the fastest procedure can i use to sell my shares because with that change i can buy meat for my children.

I bought the shears in 2006 i still have hope

I bought 130 shares in 2006 and I would love to sell my shares !

I bought 200 share 2006, i called and wanted to sell my shares because trully i dnt see improvent, i called 2017 to sell them ,they took me from pillar to post,im no longer working and i want to do something with the money. Please help.

Contact Phuthuma Nathi call centre on 086 011 6226