JSE-listed technology group Blue Label Telecoms shares took another nosedive on Thursday as it emerged that troubled Cell C has fallen behind on payments to MTN for using its network.

Cell C has a roaming agreement with MTN.

In its half-year results, MTN announced that it is owed R393 million by Cell C and has written off a part of the amount.

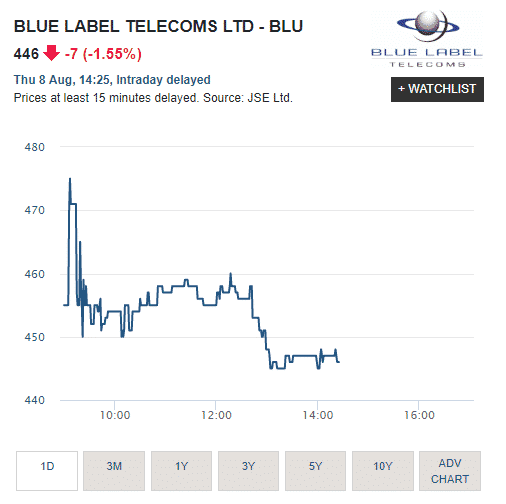

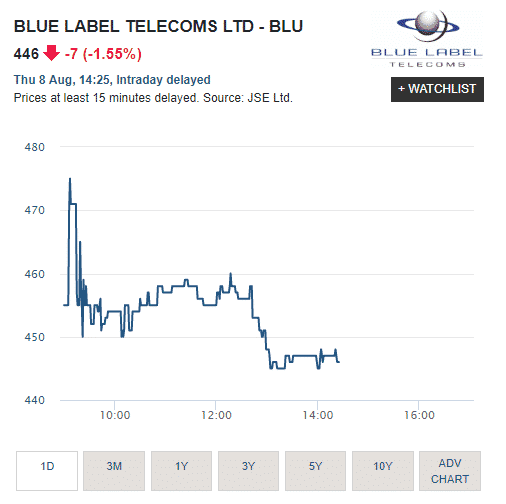

The share price of Blue Label Telecoms was trading 1.55% lower at R4.46 a share by 15h00 on Thursday, reflecting investor concern that the troubles at Cell C may be far from being resolved.

In 2017, Blue Label Telecoms through its wholly-owned subsidiary, The Prepaid Company, took control of 45% shareholding in Cell C.

While ICT group Net1 – which at the time thrown into the spotlight in 2017 in the Sassa payments debacle – own a further 15%, Cell employees 10%, and around 30% of the company will be split into three special vehicle companies. These companies are Cedar Cellular Investment (which carries 11.8% of Cell C), Magnolia Cellular Investment (16%) and Yellowwood Cellular Investment (2.2%).

However, Blue Label Telecoms’ share price and market value continue to be hammered by negative news emanating from Cell C.

Five months ago, rating agency S&P Global Ratings lowered Cell C’s issuer credit rating to CCC- from CCC+, placing it deeper in “junk” territory.

The rating agency pointed out that R8.8-billion of Cell C’s R9-billion debt would mature within the next 18 months, while the telecommunications group remains free cash flow negative under ordinary working capital and capital expenditure conditions.

To attempt to rescue the situation, Blue Label Telecoms on Wednesday ahead of MTN’s interim result announced that Cell C has concluded a detailed term sheet regarding a national roaming agreement with MTN South Africa.

“This agreement will result in substantial cost-savings for Cell C by reducing network and capex spend through an extensive roaming arrangement,” Blue Label Telecoms informed investors on Wednesday.

“This agreement is mutually beneficial to both parties.”

To calm the market, Blue Label Telecoms also announced that it has promoted Douglas Craigie Stevenson to CEO of troubled Cell C.

The JSE-listed firm, Cell C’s largest shareholder, said the appointment of Craigie Stevenson is with immediate effect.

However, it seems Craigie Stevenson is faced with a tough task ahead to stabilize the company and be able to pay MTN’s debt and service the company’s R8.8-billion of debt which is maturing soon.

Also read: Cell C’s BEE Partner May Lock Horns With Blue Label Telecoms, Net 1 and

Cell C vs CellSaf: Is It A Case Of Goliath Being Favoured By Regulators?