South African banks will fully transition to digital banking within five years as consumers embrace digitisation.

A new report on the future of retail banking drafted by Boston Consulting Group (BCG) on behalf of Discovery Bank found that more than two-thirds of South Africans (69%) believe that the country’s banks will transition to a fully digital banking system within five years.

The Discovery Bank-BCG survey also found that most South Africans (60%) believe that in just five years, there may be no need for banks to have physical branches.

The survey was based on responses from 1,000 consumers from all walks of life and income levels, 400 local businesses and several international banking experts.

Covid-19 accelerated the adoption of digital banking channels

The pandemic may have been the tipping point in making digital banking age-agnostic, as people of all generations adopted digital channels to do their shopping, banking, and other activities.

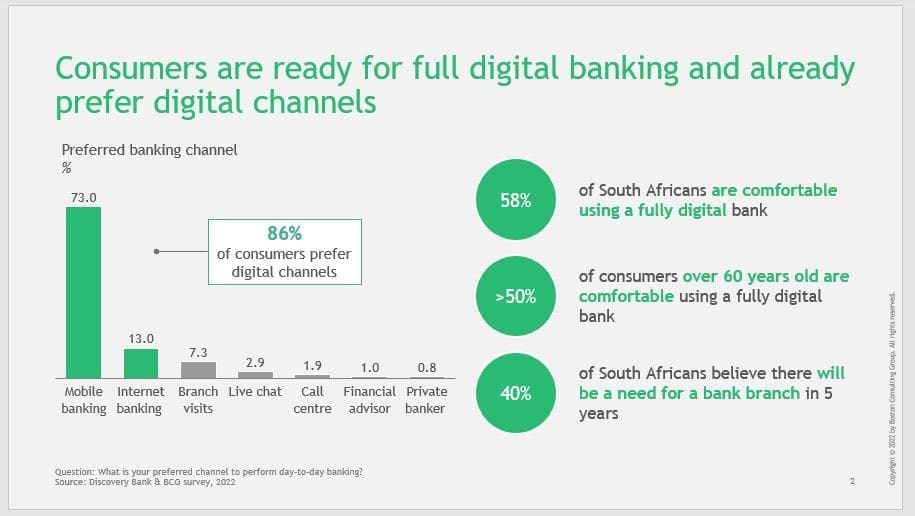

The survey discovered that the vast majority of South Africans (86%), across income bands have preferred to conduct their day-to-day banking digitally.

The data suggests a willingness, if not a preference, among most consumers to use digital channels for all services, even services for which they would typically use a branch. Considering that most banks have not yet made a full-service transition to digital, the findings suggest the potential for a bionic approach.

Almost 60% of South Africa’s consumers say they would be comfortable with a digital full spectrum banking offering, allowing them to complete such transactions as securing a mortgage or car loan online.

On the one hand, age may be less of a barrier to a fully digital transition than before the pandemic.

Historically, people over 60 years old have been seen as unlikely to use digital channels. Yet the survey finds that more than half of consumers over 60 years old (56%) say they are comfortable with digital banking.

The pandemic may have been the tipping point in making digital banking age-agnostic, as people of all generations adopted digital channels to do their shopping, banking, and other activities.

The survey also found that many South African consumers are ready to do more of their banking through digital channels, or even prefer to bank that way.

In preparing for a digital future, banks and FinTechs must determine how they will lead the way in rethinking retail banking.

“We envisage a progression of digital banking into super-app platforms for some archetypes, for example ecosystems and neobanks. These platforms will extend the role of banks to offer far more than banking alone. They will create virtual environments in which clients can seamlessly manage a vast spectrum of their day-to-day and long-term investing needs and tasks.”

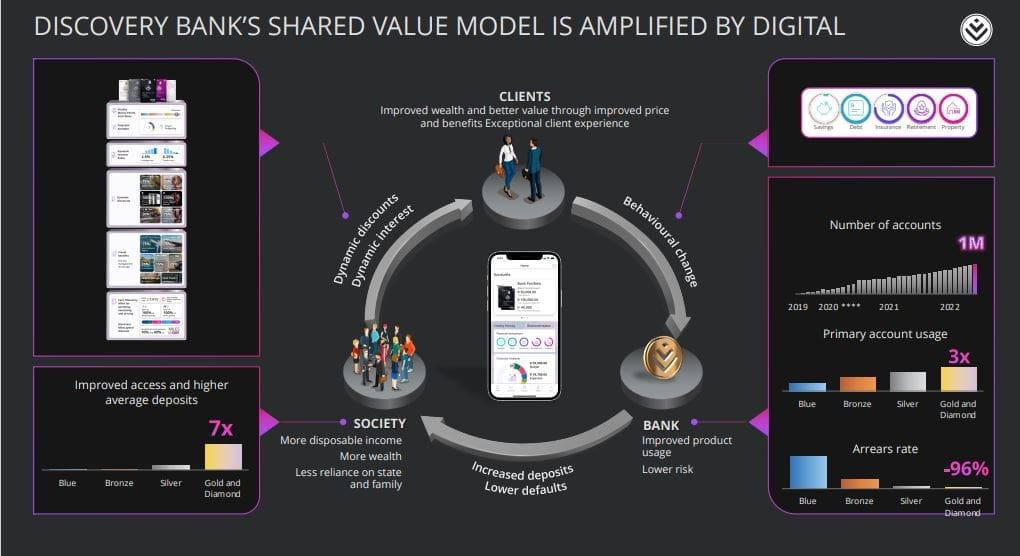

While a bank may choose a dominant archetype, it does not need to be exclusive. For example, Discovery Bank is a new entrant but has focused on building a full-service retail bank and creating travel and health ecosystems with an emphasis on monetising shared value.

On the other hand, Standard Bank is a large incumbent that is digitising its primary retail bank, scaling Looksee (an ecosystem for home ownership) and offering Shyft (an online forex product).

“Industry winners will be those that see ahead to how they might best add value to their clients’ lives.”