Discovery Bank today released a special report which shows South Africans take up to 29 years to change their bank accounts – that’s roughly 70% longer than the British and double the time of Americans.

Titled “The application of shared value banking: A focus on interest rates and the potential benefits for South Africans,” the report showed that younger clients, and those who are digitally engaged, are 20% more likely to change their banks than the average banking client in South Africa.

The bank’s research highlighted the impact of three major financial trends which are having a positive effect to increase the frequency at which clients reconsider their banking relationships:

- Nature of risk: Where banks have traditionally used socio-economic factors to determine an individual’s risk of default, Discovery Bank analysis indicates that while socio-economic factors are relevant, an individual’s behaviour has a much higher impact on their financial risk.

“Clients who manage their money well are often mispriced due to their socio-economic standing. Conventional banks are unable to segment based on behaviour. With Dynamic Interest Rates, Discovery clients can reduce their interest on borrowings by as much as 6.75% for managing their money well,” Hylton Kallner, Discovery Bank CEO said.

- Technology: The banking industry has evolved towards digital banking and payment solutions. In an always-on world, the need for bank branches is decreasing rapidly. The onset of COVID-19 has also added pressure on banks that have been slow to innovate and digitise their servicing solutions.

“There has been a rapid preference for and move towards digital banking and contactless payment solutions, technically making it unnecessary for clients to visit bank branches,” Kallner noted.

“The availability of online and digital servicing channels, therefore, reduces the barriers of entry, like long waiting times or administration, resulting in more choice for banking clients and making it easier to move between service providers.”

- Social responsibility: Studies show that South Africans have poor financial habits. Almost 78% of South Africans’ household income is spent on debt1, and the country has one of the lowest rates of saving in the world. These high rates of debt and low rates of saving have contributed to a breakdown of trust between banks and society illustrated by the fact that only one third of millennials trust the banks they are with2. As millions of people face hardship due to COVID-19, a social purpose is now a must-have rather than a nice-to-have for all businesses.

“Reducing major debt and creating a savings culture in South Africa are major socio-economic challenges facing both individuals and society and these are both aspects that banks can help with,” said Kallner.

These trends are transforming banking and highlight the case for a shared-value bank

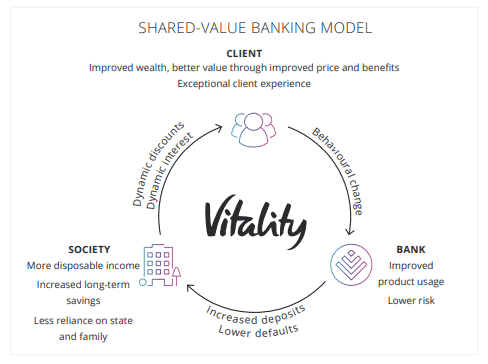

Discovery Bank’s shared-value banking model considers individual financial behaviours to understand how financially healthy clients are. In turn, through the Vitality Money programme, clients get rewards for managing their money well as measured through the five controllable behaviours: spend less than household earnings, save regularly, pay off property, invest for the long term, and to have essential insurance in place.

This programme gives Discovery Bank a powerful tool to segment clients based on their behaviour so as to reward them with lower interest rates on borrowings when they manage their money well. Likewise, clients who manage their money well typically save for longer, therefore they benefit from higher interest rates on savings.

“We estimate that if 5% of the balances in demand savings accounts in South Africa were to move to Discovery Bank, it would earn clients an additional R1 billion in interest a year. Discovery Bank offers one of the best risk-adjusted savings interest rates in the world among countries that are considered to have the lowest banking risk,” Kallner said.

For instance, a Diamond Vitality Money client with a 24-hour notice account earns more than double the average South African demand savings account interest rate, and at a higher rate than any other country with a low banking risk.

Regardless of their income levels, by improving the behaviours that impact most on financial health, Discovery Bank clients with a higher Vitality Money status have a lower chance of defaulting on debt repayments, and they also save more and for longer.

“Clients with a higher Vitality Money status are displaying strong signs of financial resilience. Clients on Gold and Diamond Vitality Money status are 99% less likely to be in arrears, have deposits more than 17 times the average, and spend over 4.5 times more than clients that are unengaged, regardless of income level,” Kallner said.

“Furthermore, Gold and Diamond Vitality Money status clients keep their funds on average 50% longer than clients on Blue Vitality Money status and save at three times the rate of clients on Blue Vitality Money status.”

With unrivalled rewards and an intuitive digital banking experience, Discovery Bank has taken on more than 300 000 clients and has seen growth to over 500 000 accounts with over R6.5 billion in deposits, therefore becoming the fastest growing bank in South Africa, and among the leaders globally.