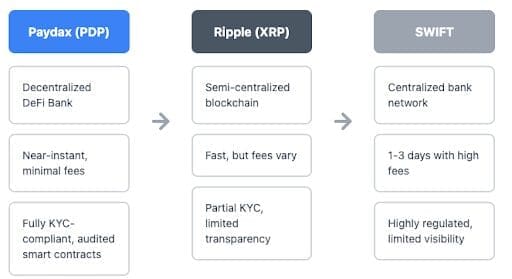

Achieving financial freedom through crypto has always been the ultimate goal for investors. However, the path to making millions of dollars isn’t so simple. While Ripple and other DeFi networks leave crypto investors exposed to market unpredictability and liquidity gaps, SWIFT is slow and costly for traditional market players. Because of this, it’s easy to feel like the real opportunity for true wealth is always out of reach—but Paydax (PDP) is here to change that.

With the launch of its new DeFi bank, Paydax aims to build a decentralized alternative to Ripple and SWIFT, putting control and profits back into the hands of everyday users. Many experts already believe that when this DeFi bank hits the market, it could be the next big step toward true crypto-powered wealth.

Paydax (PDP): The Next Revolution Beyond Ripple and SWIFT

As a DeFi bank, Paydax takes an entirely different approach from Ripple and SWIFT. Instead of a centralized messaging network like SWIFT or a single-company blockchain like Ripple, it’s launching a community-owned DeFi bank where every transaction is automated, transparent, and instant.

Through the use of crypto and Real-World Assets (RWAs), Paydax enables users to borrow against their holdings without selling them. Borrowers also get flexible LTV ratios from 50%, 75%, 90%, and 97%. Moreover, through high-tech features like Chainlink-compliant oracle systems, this DeFi bank can track price feeds, ensuring thorough accuracy.

Features That Power The Ecosystem

Unlike Ripple and SWIFT, Paydax puts its community in complete control of its ecosystem. The features integrated within this DeFi bank are designed to help it grow and potentially replace Ripple and SWIFT, which are still encumbered by limitations within the traditional banking frameworks.

Core Features

| Paydax Features | Purpose |

| Decentralized borrowing and lending | Users can lend their crypto and RWAs to earn interest or borrow against them without intermediaries, enabling Peer-to-Peer finance. |

| Multi-collateral lending | Paydax supports over 100 cryptocurrencies, allowing borrowers to utilise a range of digital assets and RWA as collateral and thereby maximise their borrowing potential. |

| KYC and Audit | Paydax’s smart contract has been thoroughly audited by Assure DeFi, earning a complete security certification. Its team is also fully doxxed, and every member has undergone a strict KYC verification process. |

| RWA tokenization | Real-World Assets are tokenized on-chain, authenticated, and stored safely, unlocking new liquidity opportunities. |

| AI risk engine | Paydax employs advanced AI engines to evaluate risk in real time, optimizing lending rates and collateral requirements. |

| Flexible loan terms | Borrowers can choose repayment schedules, LTVs, and interest types depending on their strategy. |

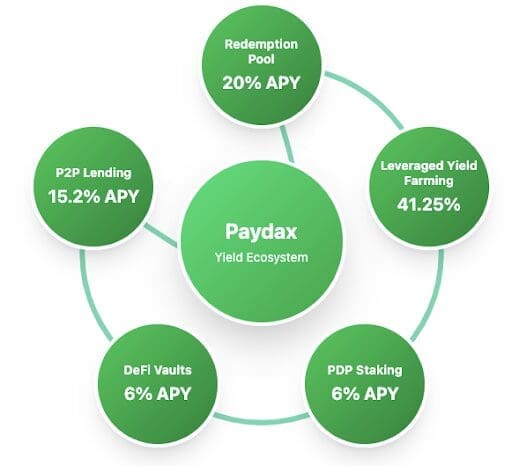

| Redemption Pool (APY 20%) | This is a dedicated insurance pool that protects lenders from borrower defaults and allows them to withdraw funds safely. |

From Zero To Crypto Millions—The Paydax Growth Blueprint

Earning with Paydax is simple. All you have to do is stake, lend, and grow. Through this DeFi bank, crypto investors and PDP holders can put their tokens to work, earning a steady income instead of letting them sit idle in exchanges or banks. By staking PDP tokens, users can earn daily APY rewards of up to 6%.

Liquidity providers also earn leveraged yield farming rewards of up to 41.25% APY, while P2P lenders gain up to 15.2% APY. With consistent, active contribution and strategic growth, Paydax users have the potential to turn modest holdings into crypto millions over time.

Meet The Partners And Team Protocols Behind The DeFi Bank

Paydax has partnered with key industry players to ensure credibility and scalability. Its technical architecture integrates security services, such as Gnosis Safe multisig wallets, to keep users safe. The DeFi bank has also partnered with Sotheby’s for RWA evaluation, Brinks for asset custody, and Onfido for identity verification and greater security.

Where Ripple and SWIFT rely on legacy institutions and centralized systems, Paydax leverages crypto-native infrastructure to stay compliant and trustworthy. The leaders behind the platform, CMO Matej Petrik, CEO Werner Van Staden, and CTO Maksim Petukhov, regularly host AMAs and podcasts to share updates and maintain complete transparency.

Why Getting In The Presale Early Could Change Everything

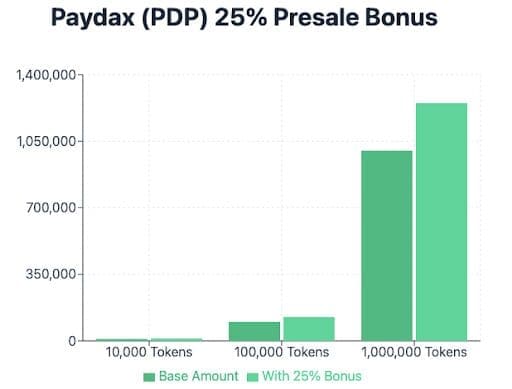

The PDP presale is where the real opportunity begins. Stage one has just kicked off at $0.015 per token, offering investors a rare early opportunity ahead of the next bull market. Early presales like this don’t come often, which is why PDP tokens are already selling out fast. Currently, more than 65 million PDP tokens, valued at almost $1 million, have been sold.

With adoption from whales and investors ramping up, it’s only a matter of time before the price of each token skyrockets to $0.017 in the next presale stage. Paydax has added a 25% bonus to help users maximize their holdings and compound potential returns. Getting in now is the best bet to position ahead for massive growth and possible financial freedom.

The Future of Financial Freedom Starts Here

For early supporters, the growth potential of the Paydax DeFi bank and its native token, PDP, is enormous—potentially outpacing even Ripple and SWIFT in the future. The PDP presale marks the beginning of what could become the most viral and successful crypto project of 2025. While the systems built by Ripple and SWIFT were revolutionary, Paydax offers a more modern and inclusive technology, enabling users to borrow against their assets and access instant liquidity.

Take the time to explore the presale today and secure your stake before prices rise and the 25% bonus expires. Use the code, PD25BONUS, to gain access to extra PDP tokens and maximize potential rewards.

Create A Potential Path To Crypto Millions With The Paydax (PDP) Presale:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper