The institutional nature of Ethereum is once again sparking optimism in the market all over the world and particularly in Asia, where ETF debates are on the rise. With the prospect of wider access to Ethereum via existing exchange-traded funds, investor demand for altcoins such as Solana (SOL), Cardano (ADA) and XRP is becoming cautiously positive. Although the most recent flash crash has taken place, traders are exploring new areas of accumulation, which hints that the correction would open up new entries for long-term investors.

One of the most talked about presales among the upcoming stars is MAGACOIN FINANCE, which has become one of the best altcoins to buy among analysts.

Ethereum ETF Demand Grows

The buzz around a potential Ethereum ETF approval in Asia mirrors the excitement seen earlier in the U.S. market. Such a move does open the path to institutional inflows, which analysts believe would allow traditional investors to gain exposure to Ethereum without directly holding tokens. The possibility of better market participation has already caused a short-term recovery, with ETH recovering above $3,800 following its flash crash to $3,510.

Meanwhile, in Hong Kong and Singapore trading desks, the Ethereum derivatives and spot exposure are on high demand. Traders believe that a regional ETF listing would not only legitimize Ethereum as a digital commodity but also boost liquidity to altcoins that traditionally trade with it. This optimism is evidenced by the increasing open interest and reduced funding spreads observed on the Asian exchanges.

In addition to this, the network elements of Ethereum are still strong. As the total staking has surpassed 27 million ETH and gas fee has become stable, investors consider the most recent dip to be an accumulation period. Provided that an ETF product is approved by Asian regulators, it may initiate a new wave of cross-border investment, which will benefit correlated assets like Solana, Cardano, and XRP, which exhibit renewed accumulation patterns.

SOL Price Presents Buying Opportunity

Solana price recent retracement to around $185 has not shaken long-term investor confidence. The blockchain continues to attract developer activity and remains among the fastest networks in the market. Analysts see the $185–$190 range as a healthy correction zone within Solana’s ongoing uptrend, with strong support aligning near the 200-day moving average.

The network’s expanding ecosystem, driven by staking growth and institutional-grade integrations, underscores its resilience. If price action holds above this support area, analysts forecast a rebound toward the $210–$230 range once market sentiment stabilizes.

Interestingly, the attention surrounding emerging presales, such as MAGACOIN FINANCE, has drawn comparisons with early Solana adoption, suggesting a similar potential for exponential growth once exchange listings occur.

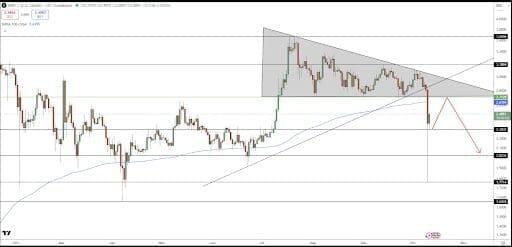

XRP Price Prediction: Can Bulls Hold the Recovery?

XRP price 42% crash to $1.77 followed heavy liquidations after U.S.–China tariff tensions rattled markets. However, the token has since rebounded toward the $2.30 zone, which now acts as a critical short-term support level. On-chain data shows renewed wallet accumulation, hinting that long-term holders are capitalizing on the discounted prices.

If XRP sustains above $2.30, a recovery toward $2.70–$3.18 remains plausible. Conversely, a close below $2.02 could signal further downside risk. Analysts suggest that a return to market calm could restore investor confidence, setting the stage for another accumulation phase.

XRPUSD 1-Day Chart | Source: X

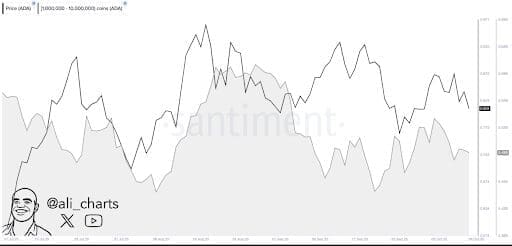

Cardano Whales on the Move

Cardano (ADA) experienced a steep 65% decline, slipping below $0.30 before recovering. The drop coincided with large-scale whale outflows, as major investors reduced holdings during the selloff. According to blockchain trackers, over 40 million ADA were moved by top wallets within a week, reflecting short-term risk aversion.

ADA Whales | Source: X

However, analysts now report that some of this capital is being allocated to promising presales, particularly MAGACOIN FINANCE, which has been gaining traction as a legitimate, audited project with over $15.5 million raised. This migration of capital suggests that large investors are diversifying into emerging projects with high upside potential.

MAGACOIN FINANCE Tops Analyst Picks

MAGACOIN FINANCE has ascended the watchlists of analysts as one of the most credible presales in 2025. Audited contracts, a transparent roadmap and robust fundraising momentum have seen the project emerge as one of the most interesting speculative tokens. Being an early opportunity altcoin, MAGACOIN FINANCE has over 18,000 investors involved and early-stage prices are still below $0.01.

However, in contrast to more common projects that are driven by hype, MAGACOIN FINANCE boasts of a well-designed framework, an expanding community foundation, and well-defined strategies for exchange listings. Its performance in unstable market environments shows increasing investor enthusiasm over approved, compliant alternatives to the big-cap altcoins.

Conclusion

The ETF momentum of Ethereum in Asia has the potential to spark the next wave of crypto bull run and positively impact related assets like SOL, ADA, and XRP. Although the price remains volatile in the short term, the accumulation trends of key networks indicate that there is a buying opportunity.

With the expansion of institutional attention and a rebound in investor trust, MAGACOIN FINANCE is one of the best altcoins. The crypto presale possesses transparency and early-stage growth opportunities making it one of the best bets in the upcoming crypto rally.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance.