Sydney, Australia – 01.10.2025 – Afterprime, a next-generation FX and CFD broker, today announced the launch of Afterprime 2.0, introducing the world’s first Pay-to-Trade model. In a historic shift for retail trading, Afterprime compensates traders for trading flow — on a platform that has been independently ranked the #1 lowest-cost broker worldwide by ForexBenchmark.

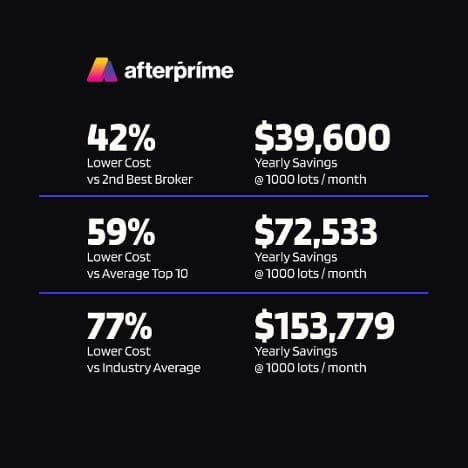

Independent data confirms Afterprime’s all-in trading costs are 40–70% lower than major competitors. For professional traders, that cost edge translates directly into measurable performance gains.

“Traders are sick of smoke and mirrors,” said Jeremy Kinstlinger, CEO & Co-Founder of Afterprime. “For decades, brokers leaned on churn, affiliates, and gimmicks to lure newbies in. With Afterprime 2.0, we’ve stripped all that away — delivering trading on the world’s independently verified lowest costs. And then we went further: paying traders for the flow they generate. It’s a reset of how brokers and traders work together.”

How it works

Instead of charging commissions on raw spreads, Afterprime credits traders for trading flow. Orders are passed directly to top-tier liquidity providers, where the firm monetizes flow at scale and shares the rewards back to clients. The result is a broker whose incentives are transparent and aligned: long-term profitable trading benefits both sides.

“Every broker says they offer the best pricing,” added Elan Bension, Co-Founder of Afterprime. “We’re the only ones who can actually prove it with third-party data. That’s why we’re challenging the industry to step up — put your costs out in the open. Traders deserve that level of transparency.”

Built for professionals, not for retail churn

To preserve execution quality, Afterprime 2.0 operates on an invite-only basis, ensuring that its liquidity ecosystem remains dedicated to disciplined, professional traders. Its Discord community plays a central role in accountability — giving members direct access to the founders, surfacing issues in real time, and shaping the product roadmap from the ground up.

The bigger picture

By combining the lowest verified costs, Pay-to-Trade rewards, institutional-grade execution, and community-led transparency, Afterprime 2.0 resets the broker–client relationship. Much like Robinhood’s leap to zero commissions, Afterprime goes further — beyond zero cost, to a model where traders are compensated for their flow.

“We see this as more than a product launch,” said Jeremy Kinstlinger. “It’s a blueprint for the future of trading. Our goal is to lead by example with a model that won’t be matched for some time, and to push the rest of the industry toward something simpler, cleaner, and more aligned with traders.”

About Afterprime

Afterprime is a next-generation FX and CFD brokerage built on the principles of transparency, alignment, and an aligned execution model. Founded by industry veterans with over a decade of experience, the firm was created to challenge legacy brokers that profit from client losses.

Independent verification from ForexBenchmark (2025) ranks Afterprime #1 globally for lowest all-in trading costs across 40+ FX pairs. By combining Pay-to-Trade rewards, verified cost leadership, institutional-grade execution, and a community-driven invite-only model, Afterprime delivers a brokerage environment fundamentally aligned with trader success.

Afterprime represents the next evolution of retail trading — where trust is earned through data, incentives are transparent, and traders finally operate on the same terms as institutions.