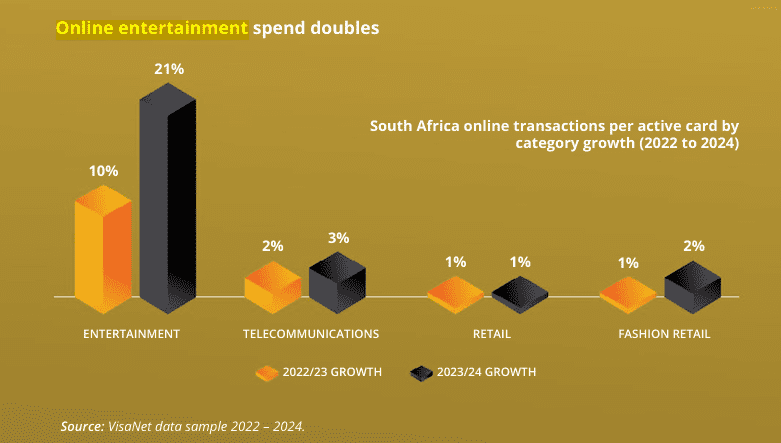

Online entertainment is now the fastest-growing category in South Africa’s digital spending, surging by 110% since 2023. Consumers are flocking to streaming services, sports betting, and event bookings, with Discovery Bank clients leading the charge.

The latest Discovery Bank and Visa SpendTrend25 report reveals key insights into South Africa’s evolving entertainment habits, analyzing credit card spending from 2019 to 2024.

Key Trends in Online Entertainment (2024)

- 110% Growth in Online Entertainment – The biggest jump in digital spending.

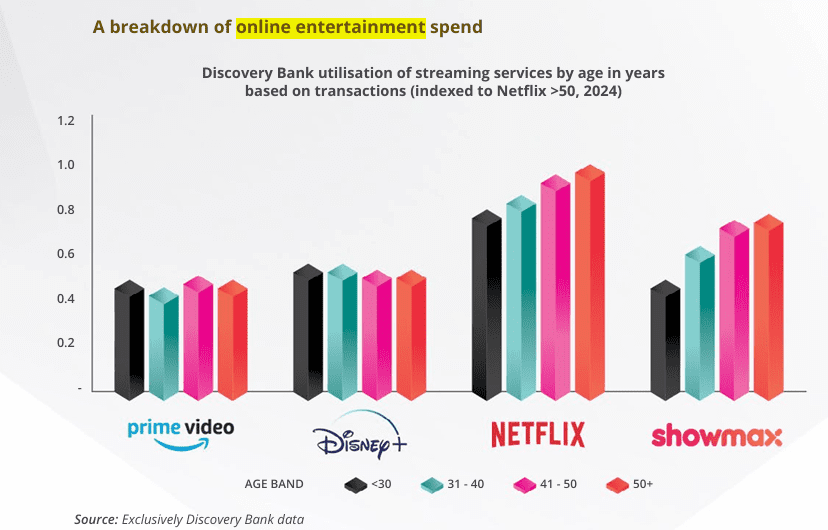

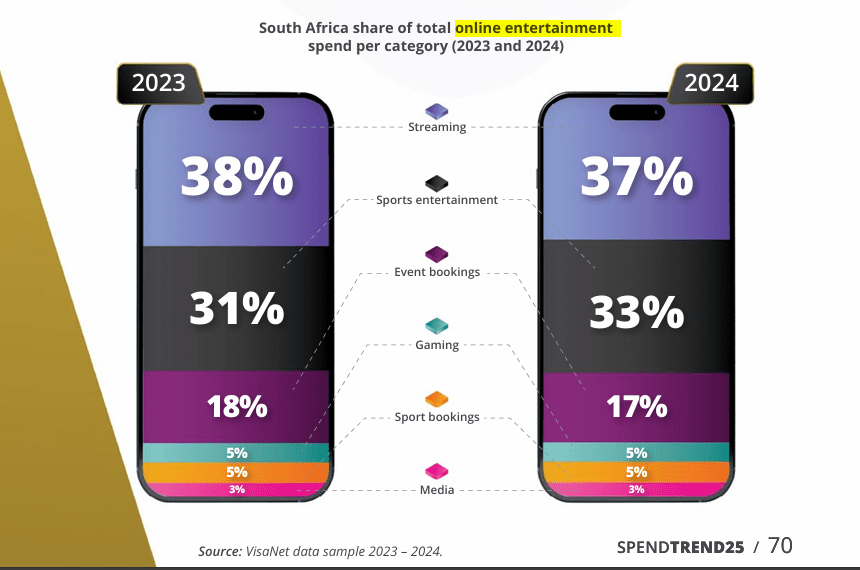

- Streaming, Sports Betting & Event Bookings dominate.

- Discovery Bank clients spend more & get early ticket access – driving a 20% increase in average transaction value.

- Sports bookings (like paddle) grew by 64% among Discovery Bank users vs. 41% nationally.

- Affordability matters – Consumers are making more transactions but spending less per purchase, prioritizing accessibility.

Why Are Discovery Bank Clients Spending More?

- Exclusive early access to concert & event tickets.

- Higher transaction frequency & value – Clients spend more on experiences.

- 93,000+ paddle games booked in 2024 – 70% on weekdays, showing a shift in leisure habits.

The Bigger Picture

South Africans are embracing digital entertainment like never before, with streaming, betting, and live events driving demand. The rise in smaller, frequent transactions suggests a focus on budget-friendly fun without sacrificing experiences.