South African insurtech pioneer Naked has raised $38 million or R700 million in its latest funding round, marking the largest insurtech investment in Africa to date.

The Series B2 round, joined by global impact investment firm BlueOrchard, alongside continued support from existing investors Hollard,, Yellowwoods, International Finance Corporation (IFC), and Germany’s DEG, will accelerate Naked’s mission to transform insurance through technology-driven convenience, transparency, and cost-effectiveness.

Founded in 2018 by actuaries Alex Thomson, Sumarié Greybe, and Ernest North, Naked has redefined insurance with its fully digital platform powered by artificial intelligence (AI) and automation.

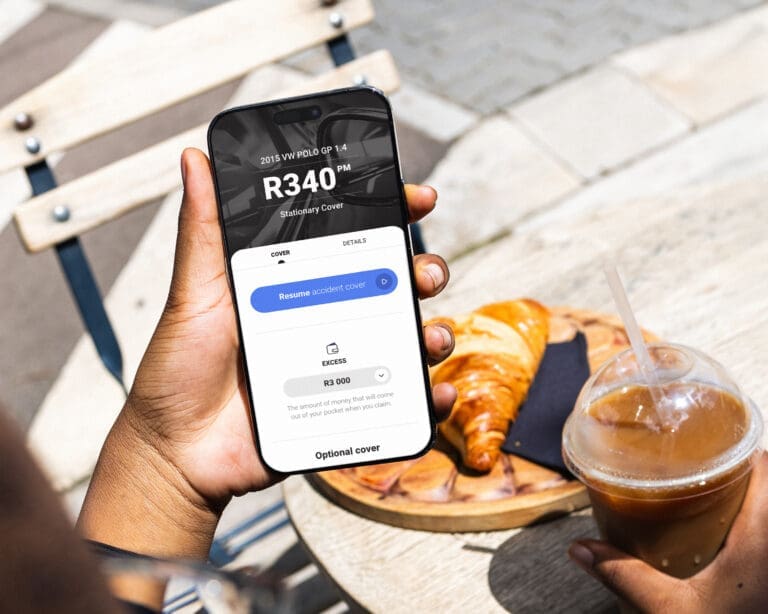

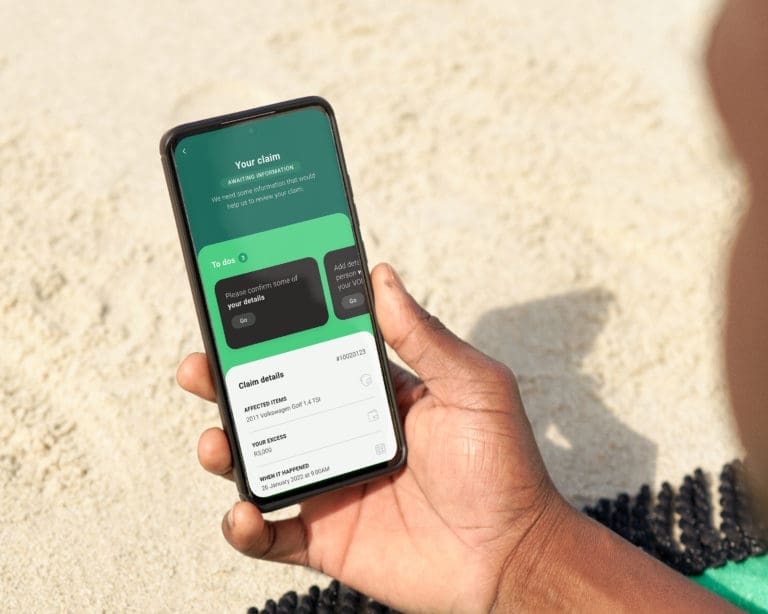

The app allows customers to obtain final insurance quotes in under 90 seconds, purchase coverage, submit claims, or pause accident coverage – all without the need for phone calls.

As the only platform in South Africa selling 100% of its car, home, and single-item insurance policies online without human intervention, Naked has demonstrated remarkable scalability and profitability.

Naked’s unique business model, the “Naked Difference,” further distinguishes it from traditional insurers.

The company takes a fixed percentage of premiums and donates any surplus from unclaimed funds to causes chosen by its customers. This approach eliminates conflicts of interest in claims processing, ensuring valid claims are handled fairly and promptly. This innovative model has helped Naked build trust and establish itself as a modern, purpose-driven alternative in an industry often seen as rigid and transactional.

The new funding will enable Naked to deepen its investment in automation and AI, expand its product offerings and market reach, and enhance advertising efforts to grow its customer base. Additionally, the funds will help meet regulatory capital requirements tied to the company’s rapid growth and evolution.

“This investment marks an exciting milestone as we continue to define a new category of insurance,” says Alex Thomson, co-founder of Naked.

“It’s a strong vote of confidence from both our existing shareholders and our new investor, BlueOrchard. Their support validates the success of our business model and highlights the significant progress we’ve made in making insurance more accessible and convenient. Building off the base of a loyal community and unique technology platform, we are positioned for strong growth in the years ahead. We’re deeply grateful to South African consumers for embracing this new generation of insurance and to our investors for their trust in our vision.”

BlueOrchard’s investment aligns with its mission to leverage digital innovation for financial inclusion. “Naked’s focus on using technology to expand access to insurance fits perfectly with our InsuResilience Investment Fund strategy,” says Richard Hardy, Private Equity Investment Director for Africa at BlueOrchard. “This funding will help Naked broaden its reach and develop new products that strengthen the financial resilience of its customers.”

With this record-breaking funding round, Naked is poised to further disrupt the insurance industry, delivering innovative solutions that prioritize customer needs and redefine what insurance can be.

In today’s hectic world, convenience is key. That’s where the Naked app comes in – revolutionising the way you handle insurance with technology. Let’s explore what makes our app unique and why it’s your go-to companion for managing insurance.

Get a final quote in 90 seconds and get insured in under three minutes

Forget the lengthy phone calls with insurance agents. With the Naked app, you can get a comprehensive car insurance quote in just 90 seconds. Whether you’re at home or on the go, insuring your car is as simple as tapping your screen.

Customise your coverage and excess

The app allows you to personalise your policy to fit your needs and budget. You can choose your excess, adjust your cover levels, and add options like car hire, coverage for additional accessories, and credit shortfall protection with ease.