International payments have always been a challenge. Exchange rates fluctuate, transfer fees can be steep, and some services may block transactions they deem suspicious. In this landscape, virtual cards have emerged as a lifesaver. When these cards are unlimited, they unlock even more possibilities for users.

An unlimited virtual card is essentially a regular bank card without a physical form. You receive the card number, expiration date, and CVV code via email or an app, and you can use it just like a plastic card. The key difference is the absence of spending limits, making it particularly useful for freelancers, entrepreneurs, and anyone who frequently uses international services.

Where to find the best solutions?

The market is brimming with services offering unlimited virtual cards. However, choosing the right one isn’t straightforward. It’s essential to consider not only the unlimited spending feature but also:

- Ease of card top-ups

- Support for popular payment systems like Visa and Mastercard

- Usage fees

- Data security

Below, we review three top services that provide optimal solutions for international payments.

-

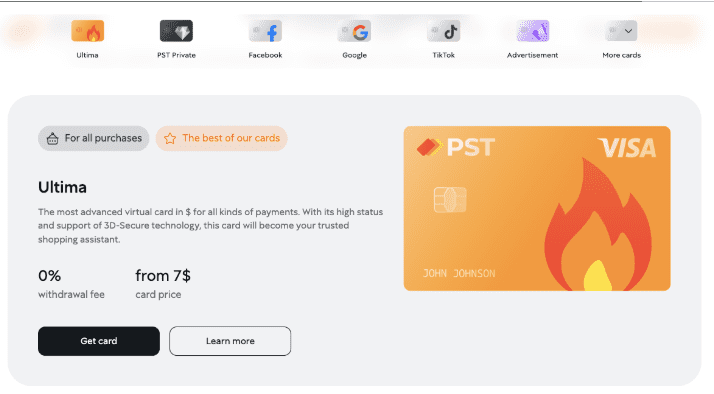

PSTNET

Ultima cards are virtual dollar cards offered by the financial provider PSTNET. These cards have no limits or restrictions — on spending, top-ups, or the number of cards you can create. Additionally, Ultima cards stand out with zero transaction fees and no charges for declined operations. The top-up fee is minimal at just 2%, and you can withdraw funds in USDT without any fees. These cards operate on Visa/Mastercard payment systems and can be used for a wide range of online payments, including hotel bookings, airline tickets, shopping, subscriptions, and digital products.

Features:

- Security: 3D Secure, Two-Factor authentication

- Telegram bot: For 3D Secure codes and service notifications

- Card top-up options: Supports 18 cryptocurrencies (Bitcoin, USDT TRC20/ ERC20), SWIFT/SEPA bank transfers, or other Visa/Mastercard cards

- Registration: Via Google, Telegram, Apple ID, or email

- Customer support: 24/7 via Telegram, WhatsApp, and website chat

2. Capitalist

Capitalist is a financial platform where users can issue virtual cards. It caters to both individual users and businesses. With Capitalist cards, you can pay for ads, services, subscriptions, make international transfers, and manage cash flows. These cards are supported by Visa/Mastercard and are well-suited for digital subscriptions or advertising expenses. The platform has a transparent fee structure: $0.50 per transaction and a 3.3% top-up fee. Spending limits are relatively high, but unlimited spending requires additional agreements as a legal entity. Individual users must negotiate limits on a case-by-case basis.

Features:

- Security: Two-Factor authentication

- Telegram bot: Tracks transactions and sends real-time operation notifications

- Card top-up options: BTC, USDT (ERC20/TRC20), ETH, USDC (ERC20), SWIFT/SEPA transfers, other Visa/Mastercard cards

- Registration: Fill out a standard form, confirm your email, and activate card issuance access

- Customer support: 24/7 via Telegram and email

3. Volet

Volet offers both virtual and physical cards supported by Visa, Mastercard, and UnionPay, making them usable for transactions worldwide. The platform’s cards are multi-currency, supporting USD, EUR, and GBP, offering a solid alternative to traditional bank cards. However, activating a Global Plus unlimited virtual card requires issuing it on a physical card first, followed by activating a digital bank through the app. For EU residents, card delivery can take up to two weeks via courier. The service features a transparent fee system: balance top-ups start at $1 + 2.95%, and purchases in the card’s currency cost $0.20 per transaction. For other currencies, the fee is $0.20 + 2% for conversion.

Features:

- Security: Two-Factor authentication

- Telegram bot: Not available

- Card top-up options: BTC, ETH, LTC, bank transfers, and other Visa/Mastercard/UnionPay cards

- Registration: Via the app

- Customer support: 24/7 via email, in-app chat, and phone

How to protect yourself and your funds with virtual cards

Security concerns are always top of mind, especially when dealing with large sums. Virtual cards provide several effective solutions to address these issues. For instance, single-use cards can be created for specific transactions and deleted immediately afterward to prevent unauthorized use. Additionally, if fraudulent activity is detected, the card can be quickly locked through the app or account dashboard, ensuring immediate protection.

While the card itself may offer unlimited spending capabilities, it’s essential to plan your expenses carefully, as your funds are not infinite. Ensuring a sufficient balance is particularly important for recurring subscriptions. Monitoring exchange rates is another crucial aspect; for example, if your card operates in USD but purchases are made in EUR, the final amount might exceed your expectations due to conversion rates. Apps designed to track exchange rates can be valuable tools in such situations.

Finally, using separate cards for different purposes — such as one for subscriptions, another for shopping, and a third for advertising expenses, can significantly improve expense management and provide better financial control.

Conclusion

Unlimited virtual cards are more than just a payment tool — they simplify life, making international purchases more convenient and secure. If you haven’t tried them yet, now is the perfect time to start!