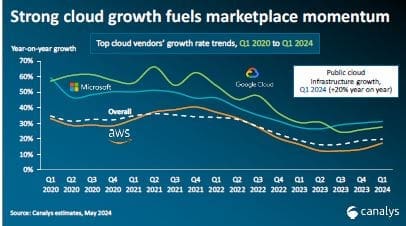

Hyperscalers AWS, Microsoft, and Google are intensifying their efforts to expand market share by leveraging artificial intelligence (AI), according to a recent report by Canalys.

As the competition in the cloud industry heats up, these tech giants are increasingly turning to AI-driven solutions to differentiate their offerings and capture a larger slice of the rapidly growing cloud services market.

Enterprise software sales through hyperscaler cloud marketplaces—led by AWS, Microsoft, and Google Cloud—are projected to reach $85 billion by 2028, up from $16 billion in 2023.

The availability of cloud credits for third-party purchases and the emergence of new digital-first buyers are reshaping enterprise procurement behavior, vendor sales strategies, and channel models.

While most sales through these marketplaces are currently direct to end customers, Canalys expects that by 2027, more than 50% of marketplace sales will flow through the channel, highlighting the growing role of channel partners.

The demand for AI is a key driver behind this growth, as more enterprises seek AI-driven solutions to enhance their operations and innovation efforts. Canalys reports that the increasing demand for AI is likely to drive substantial and sustained growth in cloud services.

“Public cloud growth has re-accelerated around the world after a brief cooling in 2023, influenced heavily by the growth in AI services,” the research firm notes. “By 2028, the public cloud market is on track to hit full-year sales of $590 billion, led by demand for compute capacity to support AI growth.”

Securing and expanding long-term commitments has become a key strategy for all three major cloud providers in their competition for enterprise market share and future customer spending. To attract these commitments, substantial discounts are being offered to customers who agree to the largest and longest-term deals.

In the first quarter of 2024 alone, Microsoft reported an 80% increase in Azure deals worth over $100 million, with the number of deals exceeding $10 million more than doubling.

Major global multinationals and Independent Software Vendors (ISVs), such as Coca-Cola and Cloud Software Group, are signing multi-year commitments worth billions of dollars. AWS and Google Cloud are following a similar trajectory.

By the end of Q1 2024, the combined total commitments for AWS, Microsoft Azure, and Google Cloud reached nearly $360 billion, including outstanding commitments over a year, remaining purchase obligations, and cloud backlog. These commitments continue to grow by tens of billions of dollars each quarter, driven particularly by quarter-on-quarter growth for Microsoft Azure and Google Cloud.

Despite this aggressive expansion, there is rising unease about the potential for overinvestment in AI, as returns are taking longer to materialize than initially anticipated. Nevertheless, hyperscalers are doubling down on their AI offerings, and enterprises continue to adopt the technology, betting on long-term benefits.

IBM, too, is expanding its presence in the cloud marketplace arena, particularly within AWS Marketplace, now offering a broad range of SaaS and software products across 92 countries. While IBM’s marketplace strategy has posed challenges in avoiding the displacement of its distributors, the company is supporting channel partners by expanding AWS DSOR (AWS’ distribution model for Marketplace) to 15 major markets, with plans to reach more than 20 by the year’s end.

In conclusion, as AWS, Microsoft, and Google continue to leverage AI to expand their cloud market share, the landscape of enterprise cloud services is being reshaped, with long-term commitments and AI-driven growth at the forefront of this evolution.