As the holiday season approaches, businesses are gearing up to express gratitude to their employees and reward loyal clients. While the classic gift of chocolates remains a thoughtful gesture, there’s an even better way to show appreciation – by letting recipients choose their own perfect gift. Scan to Pay, powered by Ukheshe, introduces a game-changing solution known as Scan to Pay vouchers, according to Tracy-Lee Schoeman, VP of Loyalty and Rewards at South Africa’s largest QR payment ecosystem.

This innovative service was born out of a rising demand from businesses looking to distribute tailor-made loyalty or incentive rewards efficiently and cost-effectively in bulk.

Scan to Pay vouchers seamlessly merge the convenience of Scan to Pay technology with the benefits of rewards, allowing businesses to motivate both customers and employees without the traditional hassles and expenses associated with procuring and distributing physical vouchers or gift cards.

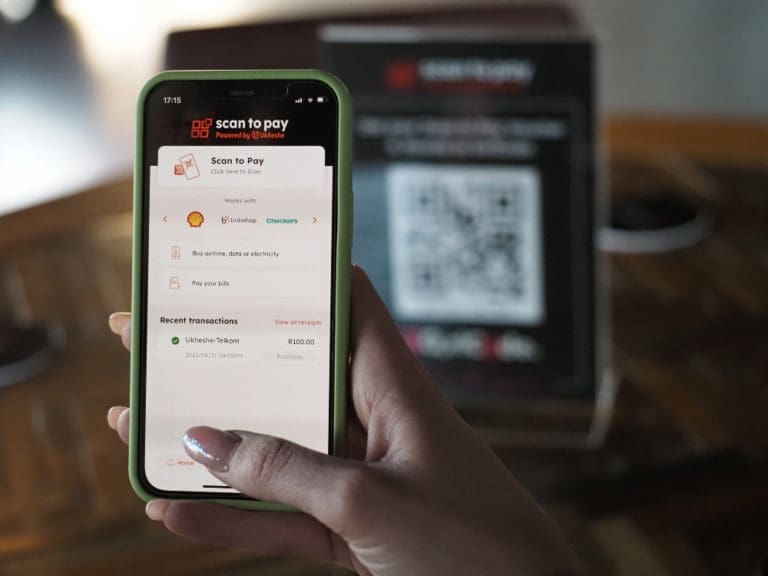

With Scan to Pay vouchers, the entire reward or gifting process becomes streamlined. Businesses simply provide the cellphone numbers of recipients, who then receive a prompt to download the app. Their vouchers are securely stored within the app, ready for use.

These versatile vouchers can be applied to a wide array of transactions, ranging from in-store purchases at retailers and online shopping payments to buying airtime and settling bills.

Scan to Pay, powered by Ukheshe, stands as South Africa’s largest QR ecosystem and boasts a proven track record, trusted by millions of merchants and consumers.

In fact, it’s the preferred QR payment platform for over 600,000 vendors, 14 banks, numerous fintech companies, 94 payment service providers, and six acquirers.

The transaction itself is entirely cashless and seamless, as users simply point their phone screens at the displayed voucher, which functions much like a barcode, while the technology takes care of the rest.

For recipients, this method is not only safer and more convenient than carrying physical cash or using cards, but it’s also instant and accessible to anyone across South Africa, regardless of whether they reside in remote areas or bustling cities.

Users can take comfort in knowing that their information is securely processed through Ukheshe’s Eclipse API, and their details remain confidential, concealed from the party or business handling the voucher during the payment process. Furthermore, any remaining balance on the voucher is preserved for future use.

Schoeman enthusiastically states: “We are excited about this next step in the Scan to Pay journey. Not only does it streamline business processes, but it also offers another avenue of financial inclusion in a country that is largely underbanked. It’s convenient, cost-effective, secure, and accessible to everyone involved in the journey – whether sender, recipient, or vendor.”