Transnet, which owns and operates the ports, rail freight, and pipeline network of SA, is looking for equity partner to manage and operate its fibre optic network and optical transport network.

Transnet is increasingly turning to private partners to support the expansion and improvement of its operations – a key driver for the country’s economy.

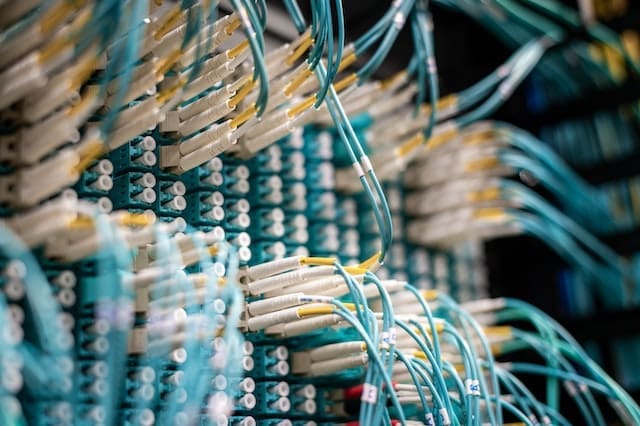

A tender document released on Tuesday specifies that the state-owned company also owns, operates, and manages fibre and optical transport networks through its Transnet Freight Rail (TFR) and Transnet Pipelines (TPL) divisions.

TFR is responsible for the installation, maintenance, and upgrade of the fibre optic infrastructure.

At TFR, the telecommunications infrastructure and facilities provide rail safety and mission-critical services.

These include communication services for train authorisation systems, radio networks, remote control of electrical substations, and trackside monitoring equipment.

In addition, the network enables the transmission of Transnet voice and data services via its service provider(s).

Transnet owns and operates through TPL a 48-core Layer 1 fibre cable of approximately 680 km.

The 48-core fibre cable is adjacent to the 24-core process control network, which is not part of the Project scope.

Transnet owns Layer 1 and Layer 2 fibre optic cables that span approximately 11,000 km across the country.

These fibre cables enable mission-critical railway and pipeline applications on TFR and TPL respectively, and Transnet has to ensure the security of the supply of telecommunication services for these applications.

The state-owned company sells free fibre capacity and managed capacity to other players in the telecommunications industry.

However, Transnet’s Layer 1 and Layer 2 capacities are far from being fully utilised.

Transnet cannot maximise revenues from these capacities.

For this reason, Transnet has put out a tender in the market to find parties interested in partnering with the company to operate its fibre network assets and optical transport network.

To facilitate the transaction, Transnet said it will establish a special-purpose vehicle to ring-fence the identified network assets to be held jointly with the equity partner.

Transnet explains that it will issue shares in the SPV to the preferred bidder at a price to be determined during the RFP phase of the award process.

Both Transnet and the equity partner will share in the profits in proportion to their respective stakes.

Transnet will retain 50% plus one share in the new company and the existing customer contracts for the provision of fibre will be transferred to NewCo.

The state-owned company will be a customer of NewCo and will enter into a service-level agreement.

In addition, Transnet is looking for an equity partner with extensive experience in managing and operating large commercial fibre networks, with financial strength and the ability to provide services at all levels of the Open Systems Interconnect (OSI) model.

The equity partner’s participation should result in revenue being generated for Transnet’s spare capacity, including fibre backhaul and last-mile connectivity.

The equity partner must also ensure the security of supply for optimal connectivity for Transnet and the communities in which it operates.

In addition, the equity partner must be able to generate sufficient funds to upgrade Transnet’s fibre infrastructure by upgrading end-of-life fibre segments, increasing the capacity of the optical transport network and introducing orchestration capabilities.

Transnet holds two ICASA licences to operate the networks.

The state-owned company is seeking legal advice on the treatment of the licences.

Further details will be provided in the RFP phase of the procurement process.