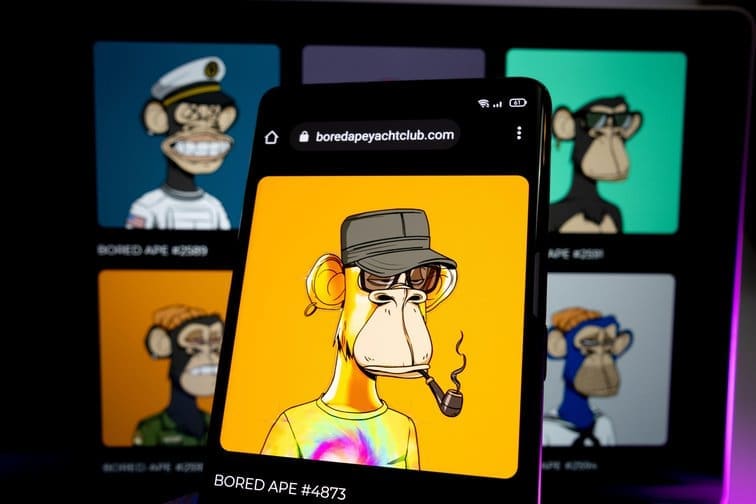

Crypto assets have revolutionised the FinTech market due to the cryptography technology of blockchain. Cryptocurrencies are becoming more mainstream and a word known by many financial buffs. However, the new buzzword in recent months is NFTs. NFTs – Non-fungible tokens – can be bought and sold using cryptocurrencies such as Ethereum or Bitcoin. The most that a digital art piece has been auctioned for is a record-breaking $91 800 000.

Is it not mind-boggling, that digital art, which is mere pixels on a screen, can be a millionaire-making investment asset? Further, in what way should the legal market take note of this new technology?

What exactly are NFTs?

NFTs have three key characteristics. Firstly, an NFT has a similar composition to cryptocurrency, in that they are units of data recorded on a blockchain, which is a public ledger that utilises cryptography technology to record these transactions and is secure due to the nature of cryptography.

NFTs are “non-fungible” in that they are defined by their uniqueness and exclusivity which inhibits them from being easily substitutable or transmutable for their equal value, as is the practice, with traditional currency. Put differently, NFTs are cryptographic tokens with a distinct digital signature consisting of metadata that makes each NFT unique.

Secondly, NFTs are digital archives or tokens which represent a worldly object. In simpler terms, an NFT will be the digital file of the owner. The owner of the NFT will possess the exclusive rights of ownership over the digital asset and they will have a unique digital certificate of ownership (an NFT is a digital receipt which guarantees the ownership to the purchaser that the contents of the link contained in the NFT.

Thirdly, the price of NFTs is influenced and determined by their demand (making such prices susceptible to volatility). The economy and the financial market do not directly influence the value of the NFT, rather it is the value that an individual is willing to pay for it.

An NFT can be one of two things, digital art or a digital token which is bought and sold on known blockchains such as Ethereum. Any digital art/work, including physical goods, which can be represented in digital forms, such as a photo, video or scan, can be turned into an NFT.

Why should the legal market take note of NFTs?

Much like cryptocurrencies, NFTs are largely unregulated. While there may be smart contracts on the blockchain governing the terms of the NFT and most importantly who owns the NFT, other terms will also need to be present. Terms such as – how the NFRT can be transferred if the owner gets a percentage of any resale value and what the NFT represents (due to the fact that its unique metadata) — making sure no two NFTs are exactly alike.

From an intellectual property law perspective, it needs to be understood that when purchasing NFTs the work itself is not owned by the purchaser but rather the creator of such and only the metadata purchased is owned. The creator of the NFT retains the copyright over the NFT. Copyright is a bundle of rights conferred to the holder of the copyright or an individual authorised by the holder, which entitles them to exclusive control over the work. On the other hand, it is confusing to fathom that purchasers of NFTs are spending exorbitant amounts of money to gain ownership rights to the contents of a website link.

In addition, while NFTs remain popular, there is an increased risk for misuse of intellectual property rights as physical artwork can be digitised and sold as an NFT. One would need to understand NNFTs in order to advise anyone of a potential claim against any misuse of intellectual property rights and any other rights that may be applicable. This brings us to our legislative lay of the land applicable to NFTs in South Africa.

Much like cryptocurrencies, our legislation will need to be adapted to understand whether an NFT is a security as defined in the Financial Markets Act, 2012 and to address the risks associated with owning an NFT (some of these risks also relate to the location of the NFTs and whether the cloud server or website of the seller correctly reflects the NFT purchased and remains unaltered). The Crypto Assets Regulatory Working Group established by the South African government published the Intergovernmental Fintech Working Group Crypto Assets Regulatory Working Group Position Paper (“IFWG Position Paper”), which explains that crypto assets are not recognised as ‘money’, as a legal definition. By excluding it from the legal definition of money, it excludes the application of existing legislation to cryptocurrencies. Crypto assets have similar characteristics to money, currencies and securities. It is understandable that legislators are reluctant to regulate the crypto sphere due to its enigmatic nature. However, it is important to note the concomitant risk of not accommodating crypto assets in the regulatory space is that it remains unregulated and open to misuse. The unregulated space of crypto assets has the potential to create a form of parallel payment and banking system.

This can easily enable several forms of illegitimate cross-border financial flows and tax evasion. The IFWG Position Paper contains a number of recommendations on how to regulate crypto assets in the South African legal framework including the implementation of an anti-money laundering and counter-terrorism financing framework, a framework to monitor cross-border financial flows and financial sector laws and, amongst other things, the recommendation to declare crypto assets as financial product bringing it into the ambit of the Financial Advisory and Intermediary Services Act, 2002.

This can also be seen relating to our tax applicable laws as SARS does not recognise crypto assets as a form of legal tender, but it does regulate crypto assets. Normal income tax rules are applicable, this means that taxpayers must declare the gains or losses associated with the crypto asset as part of their taxable income.

Purchaser beware – key takeaways

The recommendations contained in the IFWG Position Paper remain as recommendations and no formal amendments to the legislation have been made to date. Further, the IFWG Position Paper speaks to crypto-assets and their viability as a widely used means of payment in an investment class and as a cross-border remittance instrument but does not necessarily refer to NFTs specifically. NFTs have been around for some time but in 2021 NFTs boomed and became mainstream. Accordingly, there may be a further need for further thought regarding legislative development and such legislative development, to the extent that NFTs raise consistent concern.

Nevertheless, we wonder whether the NFT bubble will burst and whether it is a technology that is here to stay. To the extent that NFTs remain an attractive investment option to you, it is important to be aware of the lack of regulation and risks involved in NFTs being misused or not resulting in what you initially purchased.

- Ildiko Gyarmati, Senior Associate and Pooja Pundit, Candidate Attorney at CMS South Africa