Indices are a collection of multiple stocks used to gauge the overall outlook of the market or an economy. A good example would be the S&P500 which combines fortune 500 companies in the United States. The Dow Jones industrial average is also significant, showing the hypothetical performance of the top 30 companies.

Indices trading involves buying or selling a whole group of securities but in a single combined form. The value of the respective index will rise or fall when the price of one of the companies increases or decrease.

Traders can trade on indices in the form of CFDs or futures contracts. In the latter, there is an expiry date at which the speculation expires in the future.

How do you calculate the value of an Indice?

Market capitalization is one of the common methods in measuring the value of an Indice. The formula is given as:

Market capitalization = current market price per share x total number of shares

This form of calculation will give more weightage to companies with a higher stock value. A single big move in any big security will have a much more significant effect.

Trading Strategies in Indices

The basic components of trade indices are the same as other financial instruments. We have summarized them as follows:

- Beginner traders are recommended to paper trade in the initial stages of their trading to avoid risk. Professionals recommend not to exceed more than 1% risk per trade on a live account.

- Trading psychology is vital to execute your strategy properly. With a poor mindset of greed or fear, your trades won’t be effective even with a proper methodology.

Technical and fundamental analysis hold their ground in trading Indices. Traders can focus on any big incoming news regarding top security present in the indices. This can include cash flow, debt-equity, earning reports, CEO change, etc.

While fundamental factors are pretty successful, they only help trade long-term. For scalping or day trading, it is possible to trade using technical such as support and resistance, trend lines, market structure, etc. Indicators are also common in this regard, with moving averages, RSI, MACD, Bollinger bands, etc., used for identifying momentum and divergences.

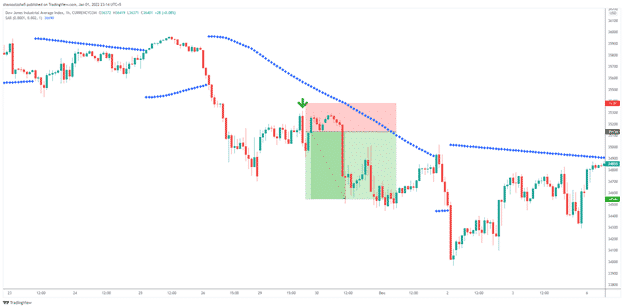

Image 1. A trader uses Parabolic SAR and candlestick patterns to trade the US 30 index. As soon as they witness a bearish engulfing on the chart with negative SAR, they take a short trade with a risk-reward of more than 1:2.

Hedging strategies are also famous for mitigating the risk. Let us consider an example of a trader going long on Microsoft as the incoming earning reports are likely to be positive at a considerable margin to understand this better. However, you are uncertain as some market conditions are non-convincing. To save yourself from the downside, it is possible to short the S&P500.

Time zone strategy is also applicable here where traders can use incoming news from Asia sessions to prepare for short on London. Similarly, economic disturbance in the European zones can be good for selling the market on US open.

A Few Things to Note

There are some vital points traders should grab before they invest in Indices.

- Classification. While there is no general rule to classify indices, traders can place them amongst market cap, sectoral, and benchmark headings.

- Trading hours. The indices are available to trade simultaneously as the standard stocks. It is also possible to trade after the market hours but it is mainly limited to professionals.

- Trading choices. There are multiple choices for trading indices. This can include CFD brokers, ETFs, mutual funds, options, and futures contracts.