South Africa’s biggest and best digital bank, as rated in the SITEisfaction 2021 report, is changing the way South Africans do small to medium sized cash-based transactions. Capitec is expanding its digital offering with the launch of Capitec Pay Me, enabling its clients to generate a personalised QR code on the bank’s app to receive payments immediately and securely from other Capitec clients. Making and receiving payments is free, championing affordability for clients.

With over 9 million digital banking clients, Capitec’s Francois Viviers, Group Executive of Marketing, explains how the solution will advance South Africa’s digital economy.

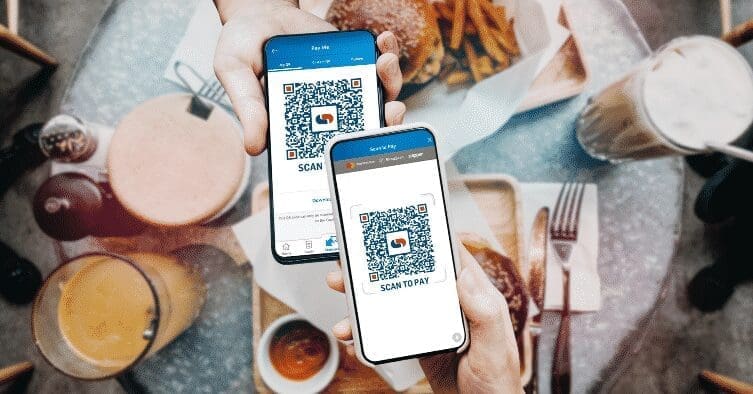

“Carrying cash is expensive and unsafe. We’re giving our clients, who are from all different walks of life, a simpler and safer way to pay. You’ll no longer need cash to pay for small purchases at informal retailers, tip car guards or pay the person selling ice creams at the beach. It’s also an easy way transfer money to family or friends and to split the bill at a restaurant.

“We’ve already seen over 2.5 million clients activate their unique QR code after quietly launching it on our app last week.”

Clients can activate and access their unique Pay Me QR code on the bank’s app or visit a branch to get a printed version supplied in a plastic pouch with a lanyard.

To pay someone the person receiving money shows their QR code, while the other person simply selects ‘scan to pay’. The payment is verified using your app pin or biometrics making it very secure. There is no need to enter account or cell phone details, saving time and preventing errors.

“We’re constantly challenging the norms of banking. A few years ago we asked why the traditional banks were charging around R50 for immediate payments. We initially lowered our fee to R10 and have managed to reduce the cost even further to R7.50. Our clients now do around 30% of all immediate payments in South Africa,” Viviers says.

“Just as we’ve made immediate payments affordable and accessible to all South Africans, we believe Pay Me is going to reduce South Africa’s need for cash.”

Pay Me provides a way for clients to track their spending. Transactions are listed on the track money feature on Capitec’s app. While smaller transactions may not feel like big spending, they quickly add up. Pay Me can show where even small amounts go each month.

“We don’t believe in innovation for innovation’s sake. Each new feature must put clients in better control of their financial lives,” Viviers concludes.

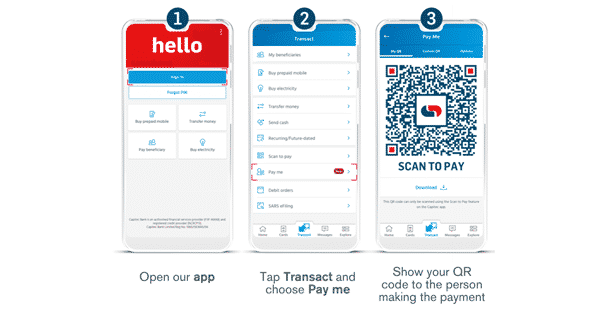

How Pay Me works in 3 simple steps:

- Open the banking app, tap Transact and choose ‘Pay Me’ (to receive a payment) or Scan to Pay (to make a payment). Both these options can also be added to your favourites on your home screen.

- When selecting ‘Pay Me’ you can choose

- ‘My QR’ which is your personal QR code. (No amount is specified, and the payment will automatically go into your main savings account) or

- ‘Custom QR’ which is created based on the amount you enter (you specify the amount to be paid by the other person and choose which account it should be paid into)

- Show your ‘Pay Me’ QR code to the other Capitec client who will tap ‘Scan to pay’ and hold the phone over the screen displaying the QR code. The transfer of funds it processed instantly.