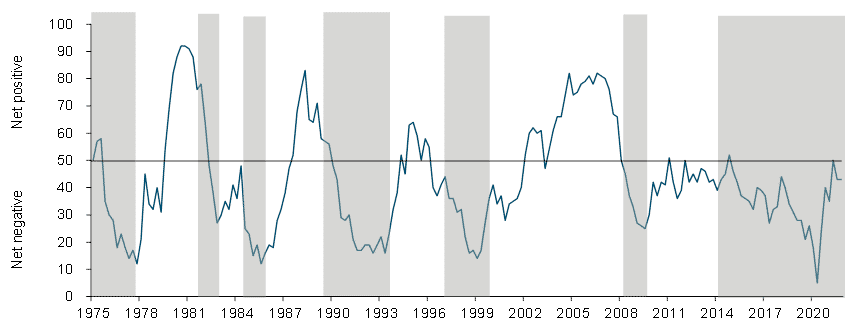

After falling from 50 to 43 in the third quarter, the RMB/BER Business Confidence Index (BCI) remained unchanged in the fourth quarter of 2021. The outcome could easily have been better were it not for a variety of special factors that kept sentiment subdued.

Figure 1: RMB/BER Business Confidence Index

Source: BER, SARB (Shaded areas represent economic downswings)

The fieldwork for the fourth quarter survey took place during the first two weeks of November (27 October to 15 November). It covered 1 300 senior executives in the building, manufacturing, retail as well as wholesale and motor trade sectors.

Details

The third wave of COVID-19 infections, the unrest in KwaZulu-Natal and Gauteng, transport delays, shortages of inputs and insufficient stocks all hit confidence hard in the third quarter. Although the impact of some of these shocks has faded, new ones like the NUMSA strike and loadshedding emerged, which prevented sentiment from recovering in the fourth quarter. On top of that, existing supply chain disruptions and stock shortages have intensified. Except for building contractors, confidence declined in all the remaining sectors.

Building confidence jumped from 18 to a still-low 30 points in the fourth quarter. After lagging the residential sector since the onset of the pandemic, confidence in the non-residential sector bounced back noticeably to surpass the BCI of the residential sector. Improved sentiment among smaller contractors in KwaZulu-Natal stood out. Yet, it’s unsure how long the improvement in overall building confidence will last; the non-residential property market continues to suffer from oversupply, while the boost from unrest-related re-building will likely prove temporary.

Retail confidence declined marginally from 56 to 52 and wholesale confidence from 55 to 53. These are the only two sectors where confidence has exceeded the neutral 50-mark and where indices are significantly above long-term averages. Sector rotation within retail trade continued; sales of non-durable goods subsided, while those of semi-durable and durable goods picked up. Black Friday and festive season sales could well amplify this trend if stock levels improve.

Manufacturing confidence declined from 41 to 38. Sales improved noticeably after the third quarter disruptions, but a string of factors dampened confidence, ranging from a struggle to source enough crucial inputs timeously, production disruptions due to the NUMSA strike and load-shedding, to escalating cost increases owing to higher prices of raw materials, increased transport costs and additional expenses related to load-shedding.

New vehicle trade confidence sagged further from 47 to 41, mainly as new vehicle dealers also suffered from insufficient stocks. This curbed the number of units sold.

Bottom line

“Thanks to a slight improvement in the composite activity indicator also derived from the survey results, confidence could easily have increased in the fourth quarter. It is a pity that various unfavourable external as well as domestic shocks prevented this from happening. Unfortunate too is the likelihood that supply chain disruptions, insufficient stocks, load-shedding and escalating cost increases will prevail for a while longer, so dimming the hopes of a further strong recovery in the RMB/BER BCI any time soon”, said Ettienne Le Roux chief economist at RMB.