TymeBank, one of South Africa’s digital banks, has reached the 3 million customer milestone. The digital bank owned by billionaire Patrice Motsepe was launched in February 2019.

The bank has no monthly banking fees and in most cases, transaction costs are 30 to 50% lower than what customers would pay at other banks. TymeBank said this is a compelling proposition for South African consumers, with the bank consistently onboarding between 100 000 and 120 000 customers each month – between 3 000 and 5 000 new customers every day.

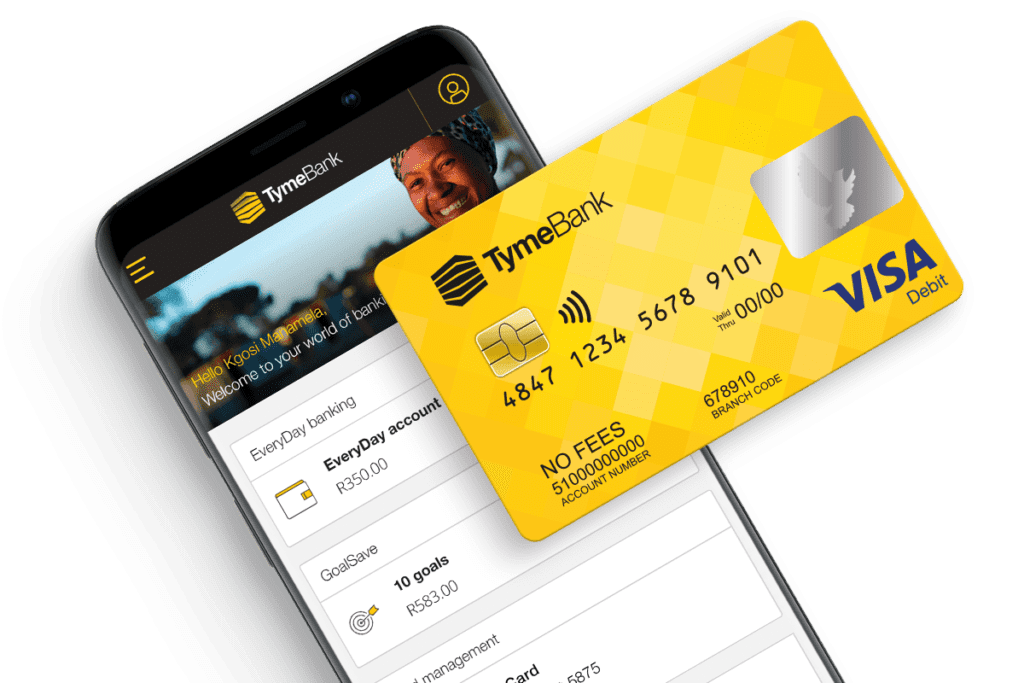

TymeBank has no branches, and its core banking technology platform is hosted securely in the Cloud.

“With our focus on lower transaction costs and giving value to our customers, we can proudly say that we have enabled 100 million free transactions to date, which is timely given the current climate. This, plus the fact that we have never asked a customer to complete any paperwork, saves our customers money and makes their banking experience quick and convenient, right from the start,” said TymeBank CEO Tauriq Keraan.

“In addition, customers earn up to 8% with our GoalSave product, which is the highest interest rate they can earn with immediate access to their savings and without any penalties.”

Keraan said TymeBank’s hybrid model of digital banking and physical service points is what sets it apart.

“In a country where banking fees and data costs are high and the levels of digital and financial literacy are low, we have re-imagined digital banking to make it accessible to all South Africans across the economic spectrum,” he said.

“While our technology allows for exponential customer growth, our priority is to broaden our offering to include innovative credit and insurance products plus a variety of value-added services. We want to continue broadening access to banking for the benefit of the country’s consumers.”

Also read: Discovery Bank Says Well-Positioned For Growth

Discovery Bank said that it is well-positioned for growth as it flirts with 300 000 customers in the six months to end-December 2020.

The bank, which is powered by the country’s largest medical aid provider Discovery Health, said value drivers are trending in the right direction and is well-positioned for growth.

The bank has 556 000 accounts held by 298 000 clients; Discovery disclosed on Tuesday in a presentation for the Domestic Medium Term Note Programme “non-deal” roadshow. The company informed investors that any forecast financial information in the presentation is unaudited and has not been reviewed or reported on by its external auditors.

2 Comments

Pingback: TymeBank Records Highest Number Of Customer Registrations In October | TechFinancials

Pingback: TymeBank Attains First Profit, Aims For Top Three In SA Retail Banking