Allegations have surfaced suggesting that a select group of current and former Cell C executives may have secretly apportioned to themselves parts of the struggling business.

Insiders, who are making the allegations, however, said Cell C CEO Douglas Craigie Stevenson and chief financial officer Zafar Mohammed were not part of the select group.

The insiders point to what they said was the “opaque” new shareholding for Cell C as described in filings at ICASA.

“Some former and current executives ‘hijacked’ a part of the business for themselves,” claimed an insider who spoke on condition of anonymity.

“Some former and current executives of Cell C have allocated chunks of the business to themselves.”

TechFinancials pressed for more evidence of the alleged hijack, but one of the insider said: “You are dealing with cruel people.”

Earlier this week Mybroadband reported on Cell C’s recent filing with ICASA (Independent Communications Authority of South Africa). The report revealed that Cell C now has a strange shareholding structure.

Late last year, on 22 December, Cell C responded to ICASA’s Invitation to Apply (ITA) for IMT spectrum. As part of its application, Cell C provided a comprehensive document with a breakdown of its current shareholding.

Cell C has seven shareholders, with Blue Label Telecoms holding a large chunk of the issued share capital.

-

-

- The Prepaid Company (Blue Label Telecoms) – 45%

- Magnolia Cellular Investment – 16%

- Net1 Applied Technologies South Africa – 15%

- Cedar Cellular Investment – 11.8%

- Albanta Trading 109 – 5%

- M5 – 5%

- Yellowwood Cellular Investment – 2.2%

-

Mybroadband reported that “M5”, is owned by a group of former Cell C executives.

Another insider pointed fingers at Albanta Trading 109 saying together with M5: “They own a large chunk of Cell C”.

He said the development meant Blue Label Telecoms (one of the biggest shareholders) was unable “to move forward without the blessing of Albanta Trading 109 and M5.”

Directors of M5 as revealed in the 2018 filing made to the London Stock Exchange:

-

-

- Jose Dos Santos (Ex-Cell C CEO) owns 1.875%

- Robert Pasley (former Cell C Chief Strategy Officer) 1.25%

- Graham MacKinnon (Cell C Group general counsel) held 1.25%

- and Hilton Coverley, Cell C’s executive of Informal Channel owns 0,625%.

-

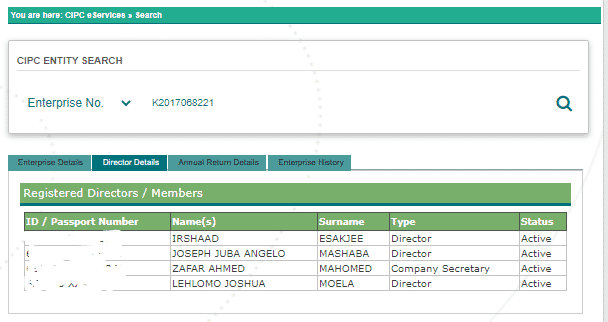

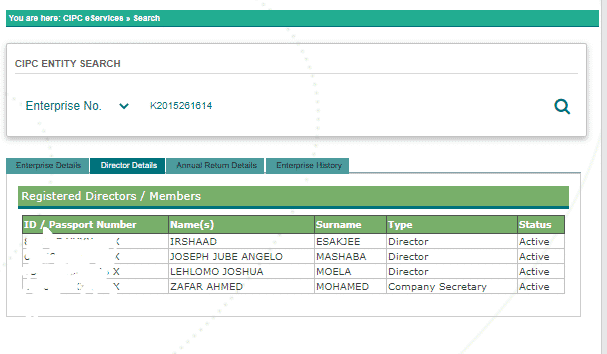

The CIPC website details current and previous directors of Albanta Trading 109, Cedar Cellular Investment, Yellowwood Cellular Investment, and Magnolia Cellular Investment.

The CIPC is the Companies Intellectual Property Commission, previously known as CIPRO, an organisation that oversees all registered entities in South Africa.

The CIPC website indicates that directors of Albanta Trading 109, were also directors of Cedar Cellular Investment, Yellowwood Cellular Investment, and Magnolia Cellular Investment.

M5 directors are former directors of Albanta Trading 109, Cedar Cellular Investment, Yellowwood Cellular Investment, and Magnolia Cellular Investment.

Directors of Albanta Trading 109 are:

-

-

- Irshaad Esakjee (Cell C’s executive head: operational finance and reporting),

- Juba Mashaba (chief human resource officer at Cell C),

- Lehlomo Moela (managing executive: government relations at Cell C), and

- Zafar Ahmed (company secretary of Albanta Trading 109).

-

CIPC records show the following Cell C former executives resigned from Albanta Trading 109, Cedar Cellular Investment, Yellowwood Cellular Investment, and Magnolia Cellular Investment.

-

-

- Graham MacKinnon (Cell C Group general counsel),

- Jose Dos Santos (Ex-Cell C CEO),

- Robert Pasley (former Cell C Chief Strategy Officer), and

- Daniel Strachan (a director of law firm Adams & Adams)

-

The combined Cell C shareholding of Albanta Trading 109 (5%), Cedar Cellular Investment (11.8%), Yellowwood Cellular Investment (2.2), Magnolia Cellular Investment (16 %), and M5 (5%) comes up to 40%.

Blue Label Telecoms owns 45% of Cell C shares and the remaining 15% is owned by Net1 Applied Technologies South Africa.

Asked to comment Cell C said: “The Cell C ITA submission to ICASA is confidential and ICASA have not made any filing public.”

How was Albanta Trading 109 created?

In August 2018, TechFinancials reported that shares had been allocated to Albanta Trading 109.

At the time, Cell C was planning to list the business on 1 July 2019 according to the London Stock Exchange filings.

But that listing did not occur as Cell C failed to perform but awarded millions to its executives.

For more read: R219 Million Paid to Three Top Execs at Cell C in 2017

The company established a share option scheme entitling staff and key management to participate in the equity of the company’s recapitalisation transaction.

The scheme provided participants with 10% of Cell C’s shares for consideration.

Key management was given 5% of the issued shares at nominal value as part of the recapitalisation.

Furthermore, 25 million ordinary shares were issued to Albanta Trading 109 Proprietary Limited (classified as MS15), a wholly-owned subsidiary of the Believe Trust.

Cell C employees were supposed to be its beneficiaries.

But this structure seems like a front for the few executives at Cell C, empowerment consortium CellSaf alleged at the time in a complaint lodged with the Competition Commission, seen by TechFinancials.co.za.

CellSaf alleged that: “There are reasons to believe that MS15 or the Employee Believe Trust (EBT) were conceived of as fronts that were designed by Cell C’s white executives without input from black employees”.

In December 2015 MS15 was to pay R1,5 billion for a 15% stake in Cell C. The purchase price was then increased in October 2016 to R2 billion without explanation, according to CellSaf.

CellSaf said this was even though MS15 had failed to raise R1,5 billion for almost a year.

“Cell C would fund the transaction by taking loans of R2 billion from Investec and Rand Merchant Bank,” said CellSaf in its complaint.

“If MS15 failed to pay the R2 billion in 12 months (or raise its own funding for the shares) Cell C would pay R100 for the shares. In a later version of the transaction, EBT would pay R2500 for a 5% stake in Cell C.

“It would also pay R10 for another 8.82% stake in the company. At the same time, four white executives would pay a nominal fee for a 5% stake in Cell C.”

There has been no information made public about what transpired since then.

Albanta Trading 109 – a secret entity with all the answers for Cell C BBBEE Shares

It looks like Albanta Trading 109 is supposed to be an empowerment vehicle for Cell C workers.

In short, this company is an equivalent of a YeboYethu – a Vodacom empowerment scheme, or a Zakhele Futhi – a black economic empowerment vehicle for MTN workers but owning 35% of Cell C if CIPC filings are correct.

The opaque company should be handling all the issues related to shareholding awarded to Cell C’s workers.

Yet Cell C workers, represented by the Information Communication Technology Union (ICTU), have been unsuccessfully seeking answers about their “Believe Phantom Option Shares Scheme (popularly known as Believe Share Scheme)”.

Four years ago, on 1 September 2017, Cell C awarded its workers shares in the Believe Share Scheme, based on its audited financial results for 2016.

At the time, the share price was R31.06.

Cell C had set the first vesting date for 1 September 2020 for the Believe Share Scheme.

However, the company in 2020 did not pay out any dividends to workers because it said the business did not meet the EBITDA threshold.

Unable to get answers from Cell C, ICTU last year approached Investec – the Believe Share Scheme fund administrator – for answers. The workers came empty-handed as Investec referred ICTU back to Cell C.

For more read: Workers at Cell C Want Investec to Explain ‘Sudden Devaluing’ of their Share Scheme

Retrenched workers did not get a cent of their promised dividends from the Believe Share Scheme.

But some Cell C executives, such as Mashaba the HR boss, who should be answering questions about the Believe Share Scheme are quiet. Workers continue to be retrenched.

The Albanta Trading 109 is controlled by former and current Cell C executives, who failed to provide answers to the workers and ICTU (see above).

NOTE: TechFinancials is waiting for Cell C comment.