The latest data released today by MTN shows that the number of active Mobile Money (MoMo) users increased by 7,5 million to a total of 35 million, generating a monthly ARPU of $1,15 in the year to end-December 2019.

“The value of MoMo transactions in the year was $96,1 billion ()R1.54 trillion), with 9 200 transactions processed per minute (up from 6 800 per minute in 2018),” the company said.

The launch of MoMo in South Africa and Afghanistan brings to 16 the number of markets in which we are currently live.

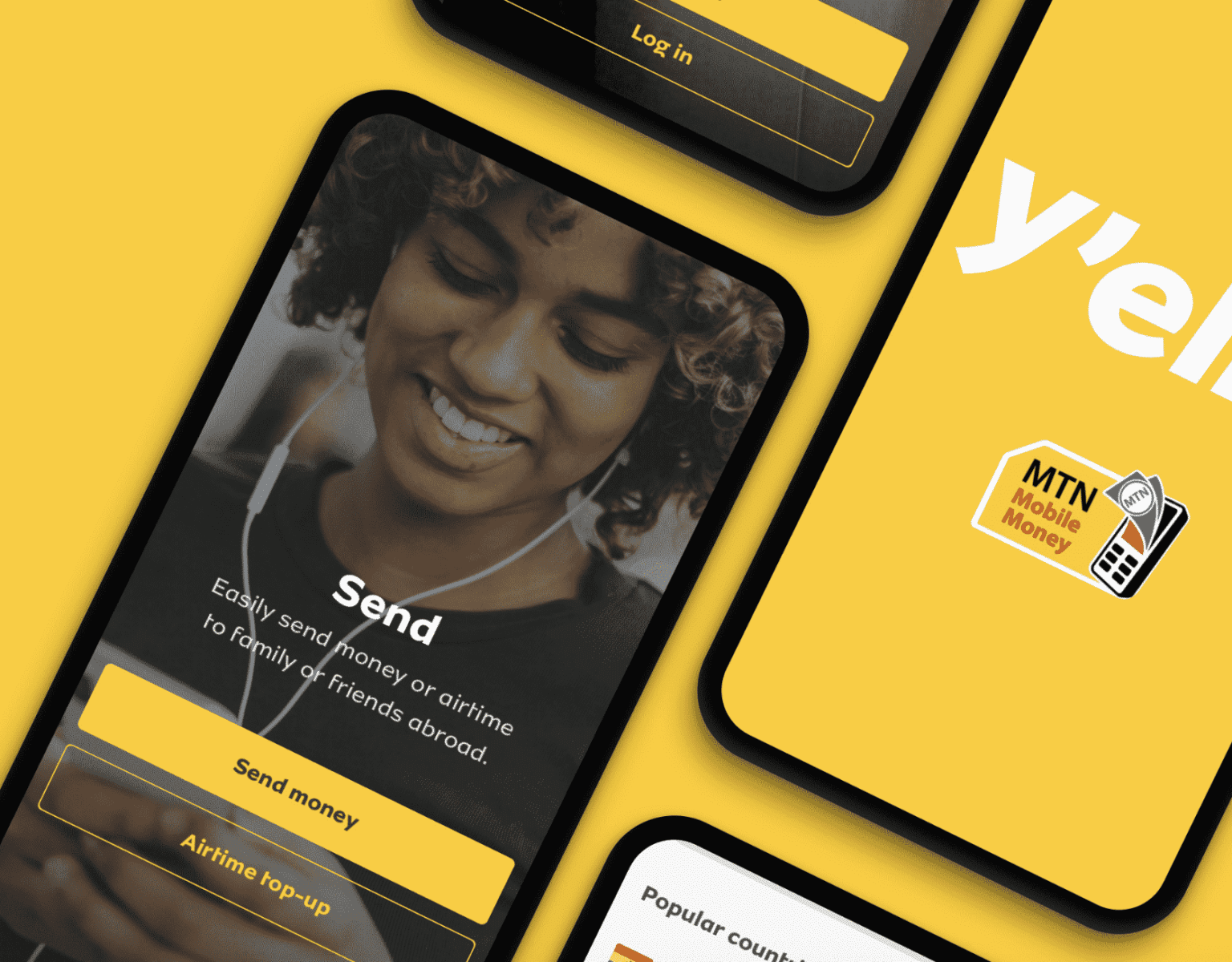

“In November we launched MTN Homeland, a mobile remittance application to facilitate money and airtime transfers from Europe to Africa and parts of the Middle East.”

The MTN Homeland service is powered by Johannesburg–based FinTech startup MFS Africa, the largest digital payments hub on the continent. It connects over 180 million mobile wallets on the continent. Through a single API, MFS Africa connects mobile wallet systems, banks, money transfer operators, and merchants to enable real-time, cross-border and cross-network transactions.

With MTN Homeland, remittances can be made from Europe to Cameroon, Congo Brazzaville, Ghana, Guinea Conakry, Rwanda and Uganda, while airtime can be sent to Afghanistan, Benin, Botswana, Cameroon, Congo Brazzaville, Ivory Coast, Ghana, Guinea Bissau, Guinea Conakry, Liberia, Nigeria, Rwanda, South Africa, Swaziland, Uganda, Yemen and Zambia.

Through MTN Homeland, MTN is ramping up its efforts to enhance access to digital and financial services for its customers.

By year-end, MTN said its lending marketplace MoMoKash had facilitated $787 million in loans on behalf of banking partners.

“We are focused on building our base of merchants utilising MoMoPay, which is live in 10 markets with 200 000 active merchants.”