Stash, an investment app created by Liberty, now reaches 45 000 users.

The tax-free investment app has been downloaded 50, 000 times with 175,000 investment transactions per month, and more than R70 million in investments so far.

Liberty said on Monday this is a great reason for anyone to start stashing their spare change today.

Stash is an app that simply rounds up transactions when you swipe your bank card and invests the digital spare change in South Africa’s Top 40 companies, tax-free.

Stash is classified as a tax-free investment account, which means you don’t pay any tax on your Stash investment. You can contribute up to R33,000 per year and up to R500,000 over your lifetime into this tax-free investment. All the capital growth and investment returns, no matter how big, is tax-free, further maximising the value of your investment over time.

When Stash was first launched, it was a Minimum Viable Product (MVP).

“Our aim was to launch an investment App with just enough features to satisfy early customers in order to gather their feedback,” Glenn Grimley, Chief Specialist: Ecosystem Products at Liberty says.

“This feedback drives new development, functionality and usability of Stash and Liberty is able to co-create a better proposition with our customers.”

The initial value proposition used your bank’s transactional SMSs to detect every swipe of your debit, credit or cheque card. It used this data to then round up the purchase value to the nearest R10 and collected the spare change, which was invested in a tax-free savings account.

However, changes to Google’s global privacy policy have prevented the App from being able to detect SMSs, which resulted in changes being made to the way the app determines how much money customers choose to invest.

“In addition to adhering to South African legislative privacy rules and Google’s new privacy policies, we also paid close attention to feedback from Stash customers. People wanted to see how much they were investing and how their investment performed over time,” Grimley explains.

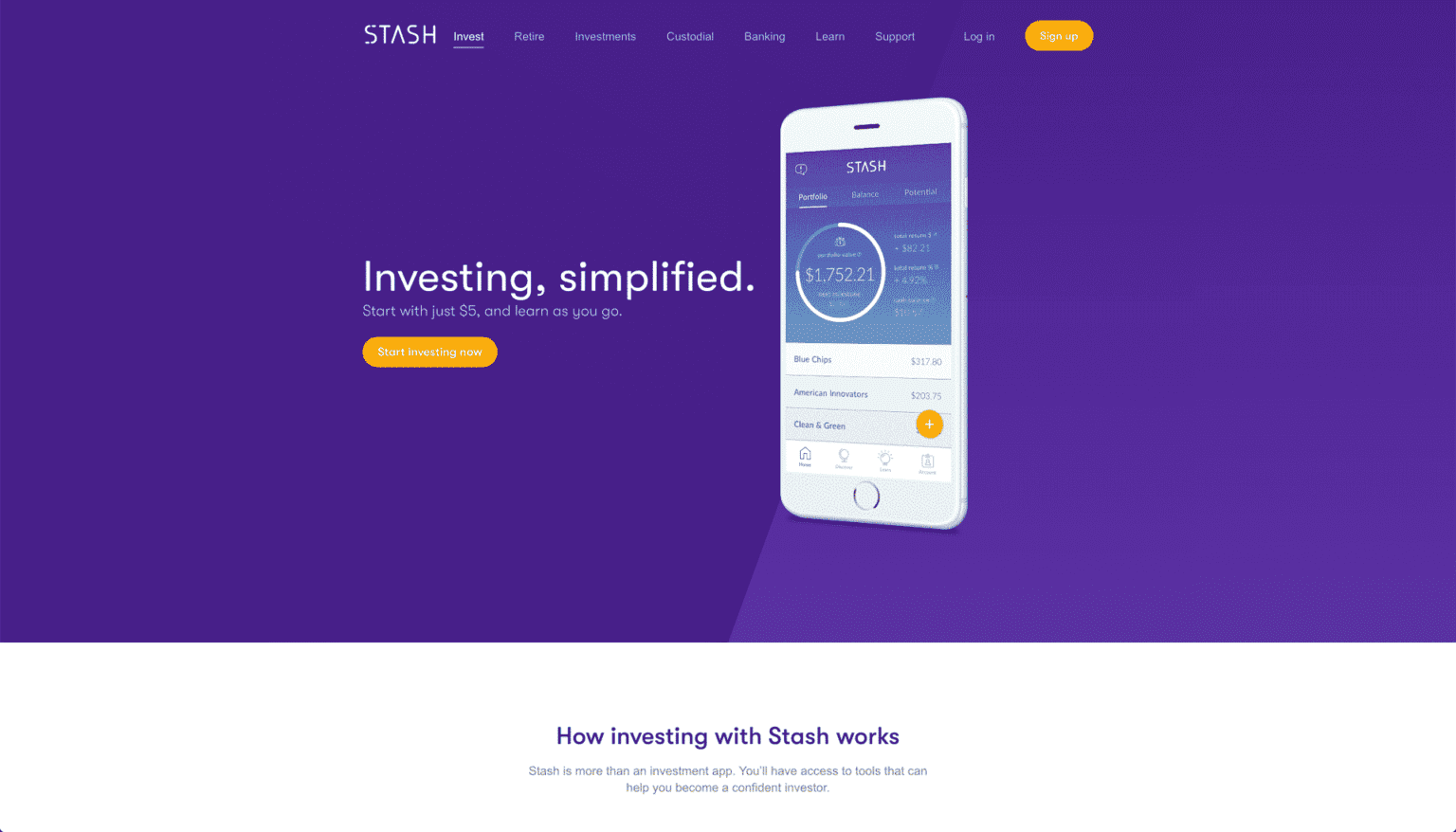

“Our customers also wanted new ways to determine when to invest while having full control over how much they stashed each month. We’ve listened to our customers’ feedback, building new functionality off the back of it and reskinned the App to provide a user-friendly and effective User Interface (UI).”