Ripple just scored another award and market win, and XRP holders are celebrating. The XRP Price recently broke past a key resistance level, signaling renewed strength and confidence in its long-term outlook.

But interestingly, while XRP rides this bullish momentum, another project, Paydax Protocol (PDP), is quietly building a similar success story from the ground up. Right now, Paydax is getting attention from investors looking for the next major opportunity with its strong fundamentals and growing utility.

Ripple’s Win Reinforces Market Confidence

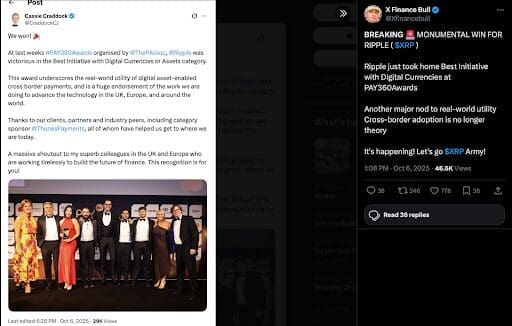

Ripple just earned another major nod from the fintech world; the Best Initiative with Digital Currencies or Assets award at the PAY360 Awards, hosted by The Payments Association. The win highlights Ripple’s continued success in proving that blockchain is a real solution for cross-border payments.

Cassie Craddock, Ripple’s Managing Director for the UK and Europe, shared the news with gratitude toward partners and clients who’ve helped the company push blockchain into mainstream finance. The award, sponsored by Thunes Payments, underscores how Ripple’s technology bridges the gap between traditional systems and modern digital assets.

The recognition also adds fresh optimism to the market, strengthening investor sentiment around Ripple’s ecosystem. This is validation for the XRP price. It reinforces the view that Ripple’s utility-driven model continues to find real adoption, giving XRP price action a stronger fundamental base than many speculative tokens in today’s market.

A New Project Reflecting the Same Momentum

Ripple’s recent success mirrors a broader trend. Investors are paying closer attention to real utility. Paydax is redefining what it means to build sustainable value in crypto. Its lending model lets users borrow stablecoins against crypto or tokenized real-world assets like BTC, ETH, luxury watches, or even real estate; without selling what they own.

Paydax offers flexible Loan-to-Value (LTV) ratios from 50%, giving borrowers full control over their risk. Lenders can earn up to 15.2% APY, while stakers, those underwriting loans through the Redemption Pool, can earn as high as 20% APY. This pool acts as decentralized insurance, stepping in when borrowers default, ensuring lenders don’t lose funds.

Beyond that, the platform features leveraged yield farming with potential returns exceeding 41% APY. It’s a DeFi ecosystem where real-world assets meet blockchain innovation. Paydax shows how decentralized systems can deliver measurable, real-world outcomes that’s also helping steady the XRP price in the broader market.

The Strength Behind Paydax’s Growing Trust

Paydax is backing its credibility with verified transparency. The project recently completed a full audit by Assure DeFi, confirming both smart contract safety and the legitimacy of its doxxed, KYC-verified team. For investors, this means added accountability, and this is the kind of structure that institutional players look for before entering early-stage markets.

The Paydax DApp also integrates leading technologies: Chainlink for live asset price feeds, Jumio for user KYC verification, MoonPay for fiat on- and off-ramps, and Prosegur for secure custody of real-world assets. While these are not yet formal partnerships, their planned use demonstrates how Paydax is aligning itself with industry-standard infrastructure.

So far, the project has raised over $900,000, signaling growing institutional confidence. If the team keeps transparency high and continues building with real-world integration in mind, that trust, much like Ripple’s growing legitimacy, could help sustain long-term value stability, even as the XRP price continues to test new resistance levels.

From Ripple’s Breakout to Paydax’s Potential

The XRP price recovery has reminded investors how fast sentiment can shift when fundamentals align with progress. Similarly, the PDP token is still in its early stage, priced at just $0.015 in presale, but its model gives it a strong case for exponential growth.

History shows new tokens with working models tend to outperform in their first cycles. If Paydax follows through on its roadmap, analysts see room for substantial upside by Q1 2026. A $1,000 investment today could be worth over $100,000 as listings, institutional demand, and lending adoption expand.

As the XRP price pushes through resistance, Paydax might just be the next project ready to follow that breakout trajectory. Early investors can even claim a 25% bonus using code PD25BONUS, setting the stage for better entry positions before later rounds.

Join the Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper